Stock Market Sure Looks Like 2008

Stock-Markets / Stocks Bear Market Aug 19, 2011 - 01:22 AM GMTBy: Tony_Pallotta

"He observed that human emotions collectively had major impacts on the on stock prices and the patterns seen in the Stock Markets in general." ~ From a book on the teachings of Jesse Livermore

When you think of it in the short term markets are nothing more than a group of people trying to process data and understand what others are doing all under the stress of losing personal wealth. They are trying to solve a problem that in may ways is not solvable unless one can adapt. Similar to a group of Navy SEALs on a mission. They are successful only if they can adjust to the changing situation. There's a reason few are SEALs and few are successful in this business.

At times like these markets are more about human psychology and less about technical and or macro data. That is why I wrote about the 2007 topping pattern as compared to the market in June and July. The macro data in both instances was deteriorating yet equity markets refused to listen to falling bond yields, falling commodity prices and countless credit products. Then the recession hit, the data deteriorated fast and ill prepared markets were forced to catch up.

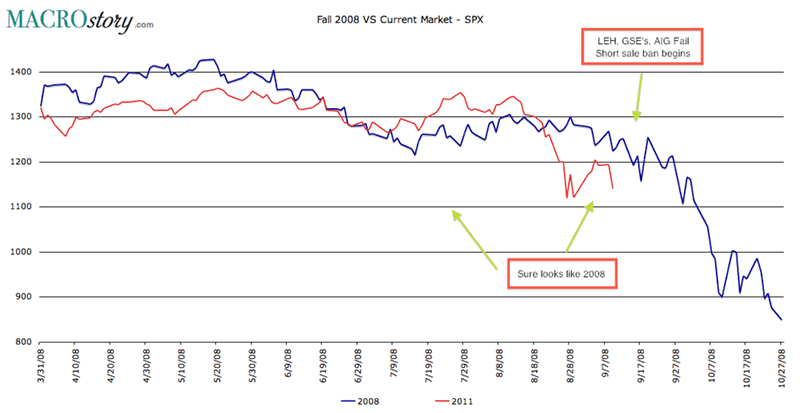

Now I believe it is time to fast forward to the fall of 2008. Once again the 2008 market is a road map of how human emotion reacts when credit events happen. When economic data deteriorates at an exponential pace. When the unthinkable becomes reality.

The volatility skew relative to the vix captures market sentiment very well. Overlay any such chart with the SPX and the similarities are without question. So for all those pundits who say this is not 2008 I present the following chart. Once again markets are pricing in the unthinkable. In 2008 history witnessed the failure of Lehman, AIG and the GSEs. Today history is bearing witness to sovereign nations on the brink of failure. In 2008 there was the threat of bank runs. Today there is the threat of currency runs. In 2008 there were government bailouts. Today there are central bank bailouts.

Through it all market participants have not changed. They are still a group of individuals trying to process data and understand what others are doing all while real money is on the line. As history has proven once again they will get it wrong. Once again leverage will destroy balance sheets. Denial will get in the way of rational thought. History truly does repeat and the patterns are present in the charts.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.