Gold Bugs Have Won!

Commodities / Gold and Silver 2011 Aug 10, 2011 - 01:31 AM GMTBy: Ned_W_Schmidt

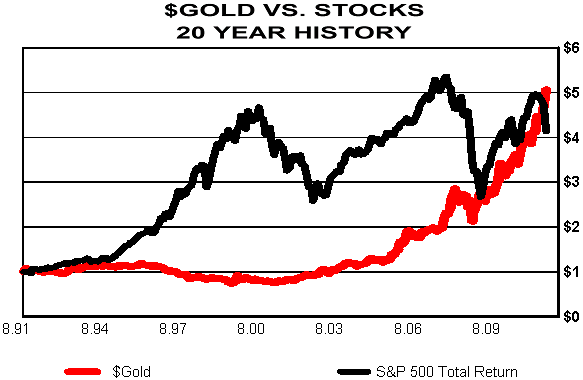

One of the problems faced by economic policy makers is that an impartial referee, the markets, does exist. That referee now holds up a red card. Ultimately, reality and the numbers will dominate ideology. Economic philosophy is fine, if it works. Well, the numbers are in. In the graph below are the results:

One of the problems faced by economic policy makers is that an impartial referee, the markets, does exist. That referee now holds up a red card. Ultimately, reality and the numbers will dominate ideology. Economic philosophy is fine, if it works. Well, the numbers are in. In the graph below are the results:

Gold 1 Keynesian Economics 0

In the graph above are plotted two wealth indices covering the past twenty years. Red line is that for $Gold. Black line is for the total return, price change and dividends, for the S&P 500. The conclusion is obvious. $Gold trumped paper equities.

For the past 20 years, an investment in $Gold was superior to investing in U.S. equities!

When results such as those develop, the implications are clear. Economic policy in the U.S. has been a complete failure over the past twenty years. We can now turn in the report card for the U.S. Federal Reserve. It is portrayed to the right

When an investment in the productive assets of a nation does not provide a return over a twenty-year period better than that of a "relic of the past" some important implications must be acknowledged. First, the U.S. government is financially dysfunctional. Everyone, including deaf hermits in Tibet, knows that. Standard & Poor's simply stated the obvious. Those in the U.S. House of Representatives that called for an end to this mismanagement should be awarded medals, not condemned.

Second, that Keynesian economic ideology has been, and is, a complete failure must be admitted. Keynesian idealists in the U.S. government should be purged. Keynesian economics being taught in universities should carry a warning label as required on cigarettes: This product is dangerous to your financial health. Finally, academic economists should be removed from the Board of Directors of the U.S. Federal Reserve. A majority of pragmatists that understand that the value of a nation's money is the only meaningful rating of a nation's economy should be appointed.

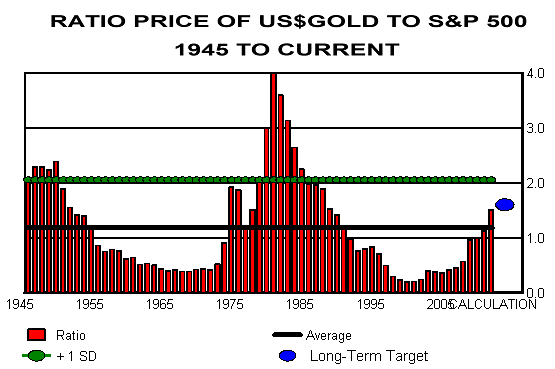

However, along with celebrating victory, Gold Bugs need to acknowledge some of the implications of the new level of asset values. In the graph above is plotted the ratio of $Gold to the S&P 500 back to 1945. Solid black line is the average. As can be readily observed, the current ratio is the highest in more than a decade. Probability of ratio above the green line is about 1 of 6.

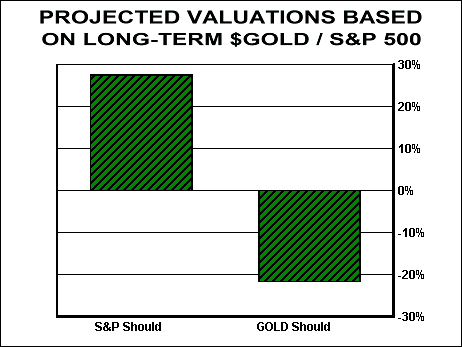

Implications of the plot in that graph probably should not be ignored. We can use that average ratio to imply asset values for both $Gold and the S&P 500. To do so, for example, we can take the current value for the S&P 500 and calculate what $Gold's price should be based on that mean ratio. The same can be done for the S&P 500 using today's price of $Gold. We can then compare those values to actual values in the market. Results from doing so are portrayed in the graph below.

What that graph portrays are the extremes. Actually results will be within those pictured as values change in the marketplace. However, the implications should not be ignored.

Gold Bugs have won. However, the reason victory was achieved was because of a strict value discipline. Gold is an investment asset, not a religious icon. Twenty years ago, $Gold was clearly undervalued and the price did not reflect the ongoing management of the U.S. economy. Valuation and pragmatism were the keys to victory by the Gold Bugs.

Let us not become mindless momentum players simply because $Gold has risen. Price of Gold rose because it was undervalued, not because you owned it. And remember, the margin clerk is yet to speak. He will!

Valuation table follows below.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.