The ‘International Cities’ of the Developed World – Hotspots of Social Discontent for the West, Playgrounds for the East

Politics / Social Issues Aug 09, 2011 - 12:44 PM GMTBy: Aftab_Singh

The ongoing chaos in London has been widely covered by the press over the past few days. Unfortunately, the lenses with which the consensus views the world have muddled the reality of the situation. Rather than considering this to be another development in a long story of souring social mood, commentators have reported it as random violence — to be likened to a strike of lightening… To be sure, we don’t think that the specifics of the last few days could have been predicted with any precision, but we scarcely consider the ordeal to be a ‘surprise’ as such! Here, I consider the decline in social mood in the developed world and outline the implications for its great ‘international’ cities.

The ongoing chaos in London has been widely covered by the press over the past few days. Unfortunately, the lenses with which the consensus views the world have muddled the reality of the situation. Rather than considering this to be another development in a long story of souring social mood, commentators have reported it as random violence — to be likened to a strike of lightening… To be sure, we don’t think that the specifics of the last few days could have been predicted with any precision, but we scarcely consider the ordeal to be a ‘surprise’ as such! Here, I consider the decline in social mood in the developed world and outline the implications for its great ‘international’ cities.

A double decker bus burns in Tottenham, London

A Review:

Well, after years (no, decades!) of having bad names but a sanguine realities, the likes of the East End of London and Birmingham are reverting back to their former derogatory perceptions. This story evolves every half hour, so the following will probably be old soon enough. However — at the time of writing — the BBC reports:

Rioting has spread across London on a third night of violence, with unrest flaring up in other English cities. An extra 1,700 police officers were deployed in London, where shops were looted and buildings were set alight. Birmingham, Liverpool, Manchester, Nottingham and Bristol saw violence. The prime minister has returned early from his holiday to discuss the unrest, which first flared on Saturday after a peaceful protest in Tottenham over the fatal shooting of a man by police. At least 334 people have been arrested and 69 charged following the riots across London over the past three days, Scotland Yard has said. Three people were arrested on Tuesday on suspicion of attempted murder after a police officer was injured by a car in Brent, north west London, while trying to stop suspected looters.

Confusing Human Phenomena with Natural Phenomena:

Generally speaking, the ‘consequentialist’ viewpoint has prevailed in the reporting of these unfortunate developments. A shooting — it is said — ‘caused‘ the gathering, and then an incident ‘caused‘ the rioting, and then such rioting ‘caused‘ the looting and so on. The very possibility that the rioting is just the tip of a deeply sour Britain is hardly considered — instead, these occurrences have been regarded as senseless acts of random violence that were ‘just’ the unfortunate consequences of a series of events. In short, these developments have been thought of as natural phenomena. One event is deemed to have mechanically caused the other and so on. Our view is slightly different; whether it was to happen this way or another, it was going to happen! We cannot get away from the fact that man acts, and that he always and everywhere encounters choice. So, the question is not; ‘what event caused such and such event?’, but rather; ‘why was the human/crowd reaction to such and such event, this and that?’. In this matter, we’re inclined to side with the socionomic take expounded by Robert Prechter at Elliott Wave International (incidentally, in spite of the abuse that is so liberally thrown upon him, he demonstrated his talent as a trader by anticipating the current financial crash).

The Democratic Way of Dealing with Crises: Monetary Debasement

I know we always write about this here on greshams-law.com, but it remains incredibly important. The issuance of ‘IOU claims upon central bank notes‘ reached a peak in 2008/2009, and ever since, the West has been struggling through the process of their extinguishment (i.e. of de-leveraging).

This is no trivial matter in the modern credit-addicted & state-obsessed economies of the West. The dependence upon leverage has become so large that the status quo of the majority of people’s lives has to change dramatically without it. Thus, the attempts to compartmentalize financial matters away from other walks of life is becoming increasingly futile. So, as the economy reached a maximum capacity for leverage just a few years ago, the status quo of the majority of people’s lives is being rudely challenged. People are starting to realize that the premises of their pasts were misguided.

Unfortunately, the natural reaction in the UK is to go crying to the state. The state is supposed to keep an eye on the status quo! As Felix Zulauf said in an interview the other day; (paraphrasing) ‘The Austrian way is not possible, so they print money’. As we have mentioned previously, this reaction has the unfortunate consequence of exacerbating problems; after all, isn’t absurd that the state is sought to fix the very problems that it created?

Economic Depression, Currency Style…

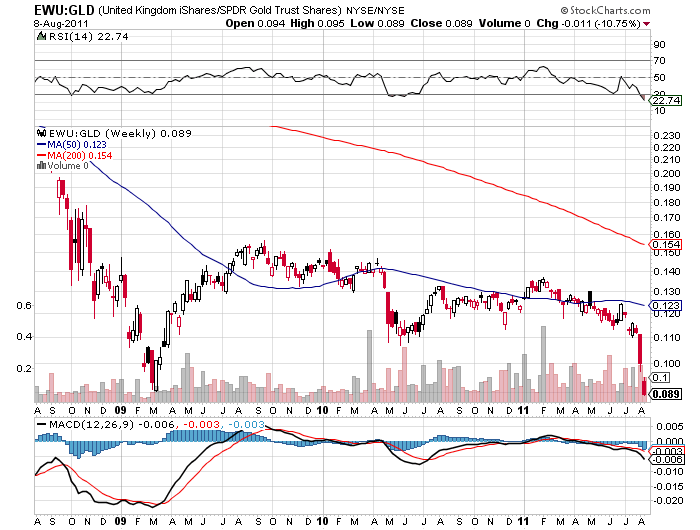

As much as we hate to consider it; the United Kingdom has been going through an economic depression for the past few years. Only the path hasn’t been the traditional one of obviously massive and onerous debt deflation. As a result of modern statist leanings, the United Kingdom has taken the hit through the currency. The people’s pension accounts had regained a significant proportion of their values in pounds not-so-sterling, but what the hell kind of measure is the pound no-so-sterling!? In gold terms, UK stocks only bounced for a few months following the March 2009 low!

Source: Stockcharts.com

Playgrounds of the East:

So, since the UK (along with the rest of the developed world) has opted to take the hit through the currency, we see ‘dream come true’ scenarios in the great ‘international cities’ of the West (such as London). People who’s parents couldn’t have dreamed to live in a prime London location are finding that they’ve got the medicine to combat the local market: things other than pounds not-so-sterling!

So, in this way, we find that London is – of course – full of foreign people having the times of their lives! As we reported a few months back, a symptom had emerged with the news that Rinat Akhmetov purchased the penthouse suite at No. 1 Hyde Park for a record amount (a story that we regard as more ‘news worthy’ than the daily ramblings on Bloomberg TV!). And yet, the local market, who are accustomed to attempting to have their cakes and eat them too are left saying: ‘What did I do wrong? This wasn’t supposed to happen to me!’. Whereas the local market are undergoing the stress that comes along with a historically large legacy of debt, the levering East (partially due to the dollar reserve standard), have found their new playgounds.

Till yet this has been a golden scenario for people with appreciating currencies (& commodities); it is only now that the frustration of the crowd is emerging in a physical way. And, since the riots are spreading uncomfortably westwards towards the West End of London, the catch is starting to become evident to such wealthy foreign communities in London. [See here for a map of the riots in London.]

Conclusions:

The recent developments in London are just one effect of a nation (nay, a hemisphere!) in disgust. Regardless of consensual interpretations of this turmoil, this should not be regarded as an isolated instance of insanity. As the democratic way of monetary debasement persists, it is likely that these trends will continue. The likes of the pound sterling are tending towards the limit of confetti-money, so we’re likely to see increasing frustrations as local communities in the great ‘international cities’ struggle to compete against their rising, international counterparts.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2011 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.