Gold Cries "BullSheet" to Manipulated Stock Market Rally

Stock-Markets / Stock Markets 2011 Aug 08, 2011 - 06:40 AM GMTBy: Mike_Shedlock

In an extreme act of extreme hubris over common sense, a "forced rally" has begun. S&P futures that were down as much as 37 points are now down 14 points. It is 2:30 AM Central. I do not know what the actual stock market open will look like. However, I do know "sheet" when I see it.

In an extreme act of extreme hubris over common sense, a "forced rally" has begun. S&P futures that were down as much as 37 points are now down 14 points. It is 2:30 AM Central. I do not know what the actual stock market open will look like. However, I do know "sheet" when I see it.

A few times recently I used the word "BullSweet". One reader objected saying I was too polite. He proposed the word "BullShill".

I like the word "BullShill" actually, when someone is shilling something. However, the appropriate word is not sweet or shill but (well you know what it is).

At any rate here are some charts at 2:45 AM central US.

S&P 500 Futures Night Session Action

S&P 500 Futures Last Two Days

Those charts were captured perhaps 5 minutes apart so they are not perfectly in sync.

Do not be confused by the volume spike in the first chart. It is relative to the illiquid night session.

Both the initial selloff (perhaps manipulated) and the rally (definitely manipulated) are on light volume. Let's also take a look at action in Asia. Here are a couple of snapshots.

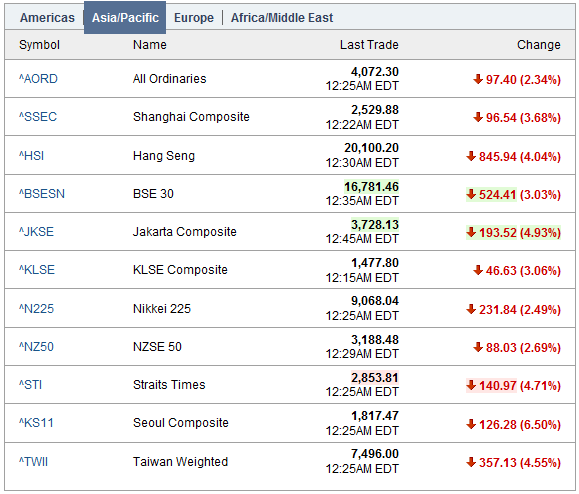

Asia-Pacific as of 12:30 AM

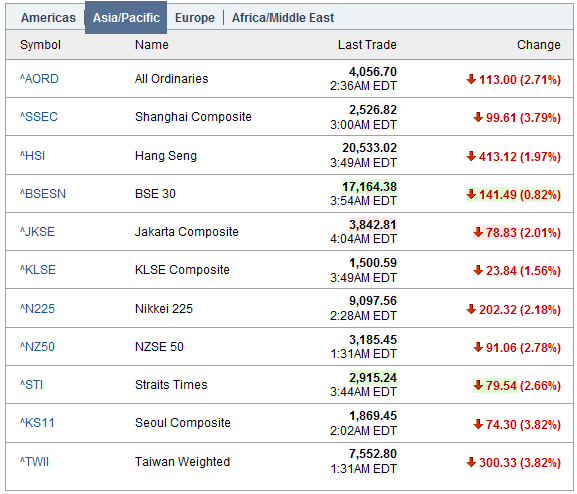

Asia-Pacific as of 3:00 AM

Taiwan which was down 4.55% is now down "only" 3.82%.

South Korea which was down a whopping 6.5% is now down a mere 3.82%.

China was down 3.68% and is now mysteriously down even more at 3.79%

European Bonds Rally (or Sink) "As Expected"

In the wake of announced intervention, one might expect the bonds of Italy and Spain to rally and the bonds of Germany to sink. That is what happened.

The Bloomberg charts are hopelessly out of date (as usual) but the quotes are accurate. (Can someone at Bloomberg please fix this!) Anyway, here are some snapshots of bond action.

Italy 10-Year Government Bonds

Spain 10-Year Government Bonds

Germany 10-Year Government Bonds

Intervention Cannot Possibly Work

Does anyone seriously think this intervention will work?

Short of the ECB buying all Italian bonds, all French bonds, and all Spanish bonds how can it? Even then, by what rationale can anyone other than an idiot purport "the system is working".

For more on idiots and how they think, please consider Do These Idiots Realize How Stupid They Sound?

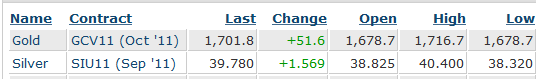

Here is one more chart to consider.

Gold Futures

Gold has spoken. It was a one word sentence regarding G-7 coordinated intervention: BullSheet

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.