Gold Accelerates as U.S. Equities Enter Cyclical Stocks Bear Market

Commodities / Gold and Silver 2011 Aug 03, 2011 - 06:34 AM GMTBy: Jordan_Roy_Byrne

In recent weeks I’ve read a few missives from mainstream advisors and pundits on the merits of stocks. These people despise Gold and are quick to point out that since March 2009, stocks have outperformed Gold. This means very little as it is an arbitrary date. Gold will continue to outperform stocks and then stocks will outperform into the next decade. Trends and markets are cyclical and not permanent.

In recent weeks I’ve read a few missives from mainstream advisors and pundits on the merits of stocks. These people despise Gold and are quick to point out that since March 2009, stocks have outperformed Gold. This means very little as it is an arbitrary date. Gold will continue to outperform stocks and then stocks will outperform into the next decade. Trends and markets are cyclical and not permanent.

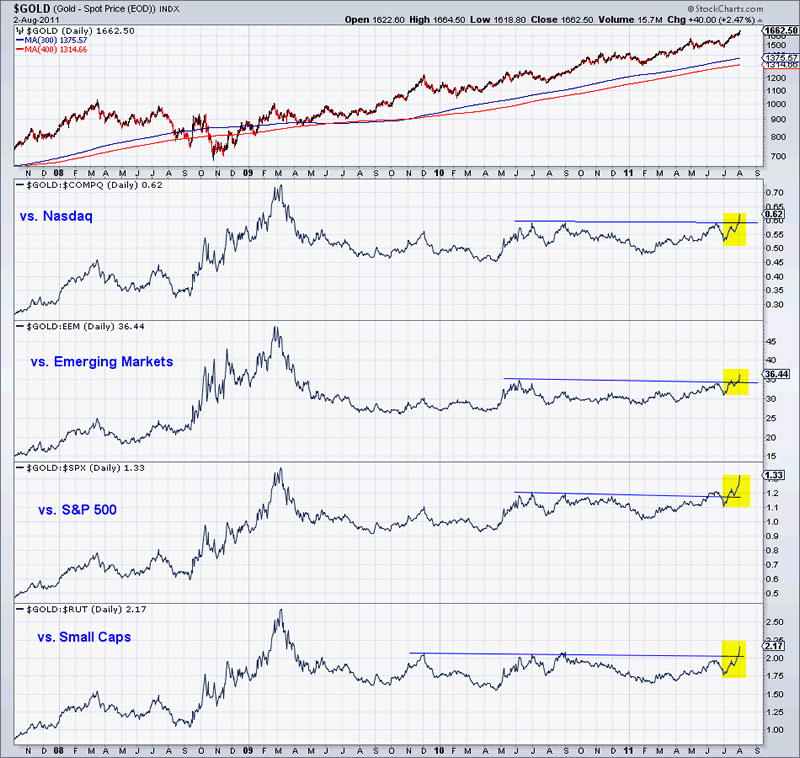

Conventional equities have had a great run but their time is ending as Gold is reasserting itself in relative terms and flying high in nominal terms. In the chart below we graph Gold against the Nasdaq, Emerging Markets, S&P 500 and the Russell 2000. All of those markets, with the exception of the S&P 500 have rallied back to their 2007-2008 highs but have failed at that resistance. Gold against these markets has broken to a 2-year high and is well on its way to retesting the peak from March 2009.

Essentially, money is moving out of equities and into Gold. We’ve said all along that before Gold begins a bubble, equities must peak and begin a mild bear market. That is now happening. The final piece will be money begins to flee Bonds. We are already seeing this globally but not universally as Bond markets such as Germany and the US remain strong. However, recent weeks should tell you that a peak in equities is providing Gold with plenty of firepower. Those who thought it was time to forget Gold and concentrate on conventional stocks couldn’t have had a more costly idea.

Nevertheless, one could and should consider the Gold and Silver stocks which are set for big gains in the next few years. These equities have lagged the metals but this is what has happened in the current and in previous bull markets. Gold just closed at a two-year high against Oil and a 10-month high against Commodities. This means that margins remain and will be robust in the future. Finally, note that the mining equities are one of the few groups to have made a new all time high. Keep an eye on GDX and GDXJ as the next move to new highs will be a major buy signal and will usher in a very strong run over the next few years.If you’d like to learn more about how to profit, manage risk and have a professional guide you, then you can learn more about our service here.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.