Stock Index Futures Surge on Pathetic U.S. Debt Ceiling Deal

Politics / US Debt Aug 01, 2011 - 06:01 AM GMTBy: Mike_Shedlock

After spending a day in the garden weeding and transplanting I arrive at my computer to see S&P futures up 20 points, 1.5% on news a compromise was reached. Quite frankly this is ludicrous given that anyone not brain dead knew a deal would be reached.

After spending a day in the garden weeding and transplanting I arrive at my computer to see S&P futures up 20 points, 1.5% on news a compromise was reached. Quite frankly this is ludicrous given that anyone not brain dead knew a deal would be reached.

Let's pick up the action starting with U.S. Stock Futures Advance as Obama, Lawmakers Agree to Raise Debt Limit

U.S. stock futures rose, indicating the Standard & Poor’s 500 Index may rebound from its worst weekly loss in a year, as President Barack Obama announced an agreement to raise the federal debt limit and avoid a default.

Obama said in remarks at the White House that both parties in the U.S. House and Senate had reached an agreement to raise the nation’s borrowing limit and cut the federal deficit.

“A lot of people were short the dollar and U.S. equities into the weekend, betting that we wouldn’t have a deal,” Frederic Dickson, who helps oversee $28 billion as chief market strategist at D.A. Davidson & Co. in Lake Oswego, Oregon, said in a telephone interview. “Now investors will be reversing those positions as things are looking better than they did on Friday, even though there are still some hurdles to climb in the next 48 hours.”Let's stop right there and point out genuine BullSweet starting with a US dollar intraday chart.

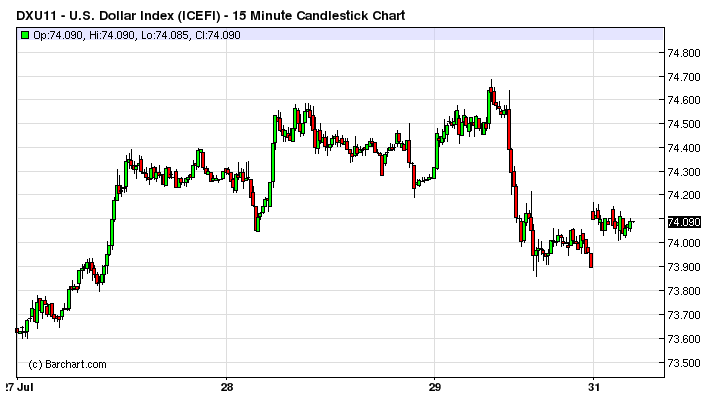

US$ 15-Mimute Chart

Does anyone see a short covering rally in the dollar? I sure don't.

Had there been an agreement to reduce the deficit by $4 trillion we might have seem one, but this deal changes nothing. Bear in mind this is coming from someone who is currently bullish on the US dollar.

Let's ask another question: Who did not expect a deal?

I accuse Frederic Dickson of genuine BullSweet.

The article continues ...

The framework of the debt agreement would raise the $14.3 trillion debt ceiling through 2012, cut spending by about $1 trillion and call for enactment of a law shaving another $1.5 trillion from long-term debt by 2021 -- or institute punishing reductions across all government areas, including Medicare and defense programs, according to congressional officials.

Senate Majority Leader Harry Reid, a Democrat, endorsed the emerging accord among Republican leaders and the Obama administration even as negotiators were working out the final details. Senate Minority Leader Mitch McConnell told senators tonight that the U.S. will not default on its obligations.

Both S&P and Moody’s Investors Service are weighing a reduction of the U.S. credit rating. The impasse boosted to 50 percent the chance S&P will cut the grade from AAA within three months, the ratings company said last month.Pathetic Deal

This is a pathetic deal. It's no wonder futures are rallying. My dead grandmother could find more cuts than this. The S&P, Moody's, and Fitch should all downgrade US debt on this deal.

$1 trillion up front and promises to cut another $1.5 trillion is the wimpiest of wimpy deals. The deficit is 1.4 Trillion. The immediate cut is a back loaded $100 billion. Then there is a possibility of another $150 billion back loaded cuts.

Anyone voting for this monstrosity should be ashamed.

Is Boehner Balking?

Here is something I picked up from Zero Hedge.

The Wall Street Journal "Washington Wire" comments on the The U.S. Debt Battle

5:24 pm: House Speaker John Boehner (R., Ohio) appears to be balking at the debt ceiling deal that Senate Democratic Majority Leader Harry Reid of Nevada has signed. Mr. Boehner is concerned about provisions in the deal that could lead to sharp cuts in military spending, say people familiar with the situation. House aides have warned that just because Mr. Reid has signed off on the deal doesn’t mean the deal is done.

Ludicrous Deal Solves Nothing

This deal is ludicrous because it does not cut enough. Congress should be ashamed.

If Boehner is concerned about excessive cuts to military spending in this deal he has truly lost his marbles.

If it was up to me, I would pull all our troops out of Iraq, Afghanistan, Japan, Europe, and 140 countries where we have troops. If we did that, we could concentrate on protecting our borders instead of being the world's policeman. The savings would be enormous.

By the way, it would be fitting if this futures ramp was the mother of all gap-and-craps. This deal solves nothing.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.