U.S. Dollar, Gold and Stock Market Trend Analysis

Stock-Markets / Financial Markets 2011 Jul 18, 2011 - 03:16 AM GMTBy: Chris_Vermeulen

The dollar is and has been in a strong down trend for many years and I feel as though it’s getting close to another major land slide. It could take place any time in the next month or so according to my weekly chart analysis.

The dollar is and has been in a strong down trend for many years and I feel as though it’s getting close to another major land slide. It could take place any time in the next month or so according to my weekly chart analysis.

The general rule is if the dollar falls in value then we tend to see both stocks and commodities rise. The inverse relationship at times can be tick for tick meaning if the dollar ticks down one increment then we see the broad market or specific commodities move in the opposite direction at the same time.

Since 2009 the relationship between the dollar and investments has been so close that if you were to just focus on what the dollar was doing then you could almost trade equities and commodities without reading their charts. The dollar index chart is one of those trading tools everyone should be analyzing. At $80 a month for getting the dollar index data feed it’s not a cheap trading tool…

Dollar Index 4 Hour Candle Stick Chart:

This chart clearly shows this month’s price action for the dollar which is pointing to lower prices if things play out according to the charts. This short term chart shows that in the next day or so we should see the US dollar start to sell back down.

SP500 Daily Chart (Stock Market):

The SP500 index is a great barometer of what the overall stock market is doing. The chart below shows the 5 and 14 day simple moving averages and their recent crossovers.

Last Friday we had a bearish crossover and if the market does not rally early in the week then I am anticipating further weakness in stocks. While I am still bullish on stocks as of this moment the coming week will quickly tell us what stocks are going to do. If we get a bounce which turns into a strong follow through rally then we should see a sizable rally around the corner and also a falling dollar.

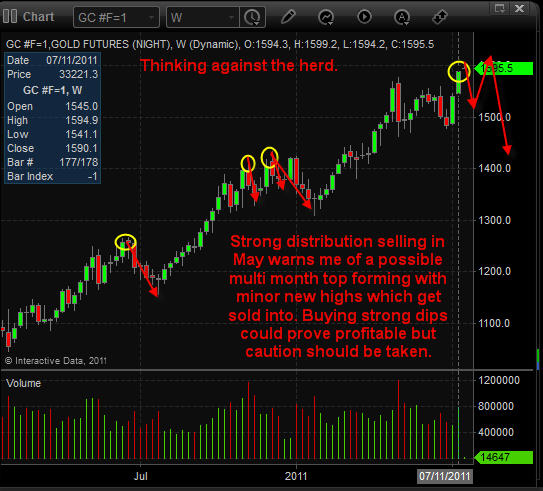

Gold Weekly Chart:

Back in May when gold was hit with strong distribution selling I posted my thoughts on how gold could be forming a 6-12 month topping pattern and how price could get choppy. Well, we are now entering that period which could prove to be interesting…

Keep in mind this is a weekly chart and from the looks of things this top could play out for another 5-6 months from here. Silver is in much of the same predicament but trading way below its May high. I’m thinking more of a double top in silver over the next few months.

Weekend Trend Trading Conclusion:

In short, I am bearish on the dollar for a week or so which should help boost stocks and commodities. After that we could see all investments make some big trend changes if buyers don’t step up to the plate to buy. If we any major headline news about the sky is falling then it could trigger a sharp correction. Unfortunately, at this time head line news is running wild spooking investors from buying much of anything other than gold. Any resolution to foreign economic issues will put pressure on both gold and silver and likely help boost stocks.

The past month I have been very cautious because the market is wound up and ready to explode in either direction. During times like this I prefer to stay mostly in cash until I get low risk setups and a clear trend.

That’s all for now, but if you would like to get my pre-market video analysis of the dollar index, each morning and intraday updates along with my trade alerts be sure to join my premium service at $59 a month which is less than the cost for the dollar index charting data feed!

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.