U.S. Dollar Faces Resistance, Stocks Stall

Stock-Markets / Financial Markets 2011 Jul 15, 2011 - 03:42 AM GMTBy: Chris_Ciovacco

Before we take a look at the S&P 500 (SPY) and U.S. Dollar (UUP), let’s put the analysis in the context of the biggest news from July 13:

Before we take a look at the S&P 500 (SPY) and U.S. Dollar (UUP), let’s put the analysis in the context of the biggest news from July 13:

From Bloomberg:

Moody’s Investors Service raised the pressure on U.S. lawmakers to increase the government’s $14.3 trillion debt limit by placing the nation’s credit rating under review for a downgrade.

From the Associated Press:

NEW YORK (AP) — Comments from Fed Chairman Ben Bernanke set off a stock market rally early Wednesday, but it wasn’t long before another Fed official helped cut it short…Most of those gains evaporated later in the day after Federal Reserve Bank of Dallas President Richard Fisher said in a speech that the Fed had already “pressed the limits of monetary policy.”

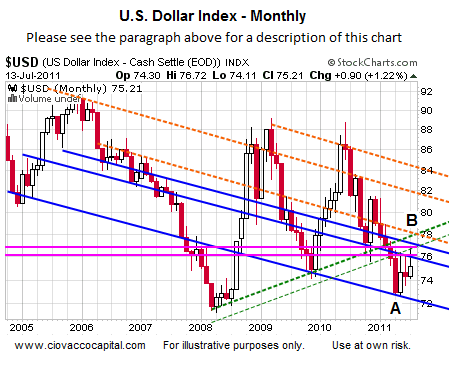

Both of these stories tend to be negative for the dollar and positive for precious metals. As we showed in May, the U.S. dollar held at a logical level near point A. The greenback now faces seven forms of possible overhead resistance below point B (see orange, green, pink, and blue lines). A break into the white space near point B, would be negative for stocks, commodities (DBC), and precious metals (especially silver - SLV). A move back toward point A, would be good for stocks, commodities, and precious metals.

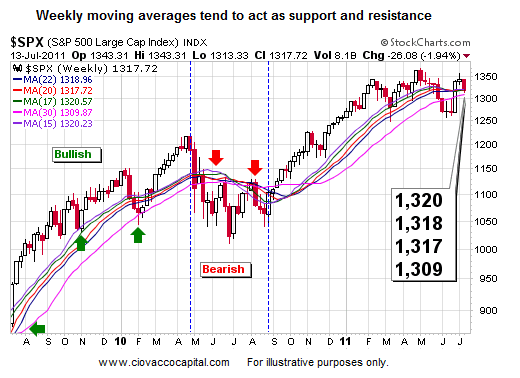

The chart below is an updated version of one we presented on July 1. Since that time, the S&P 500 has moved above the band of moving averages (thin colored lines). However, the candlestick from the trading week ending July 8 shows hesitation. The market’s performance on July 14 and 15 could go a long way in helping determine short-term outcomes for stocks (next few weeks). All things being equal, it is good for the bulls if the S&P 500 can remain above the moving averages shown below (see box below for levels to watch).

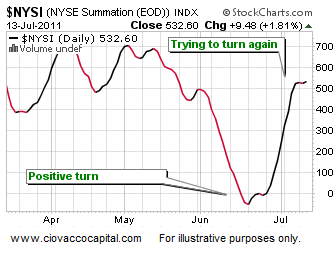

Stock market internals weakened during the recent sharp two day sell-off, but are trying to stabilize. The Summation Index, an intermediate-term measure of market breadth (advancers/decliners), ticked up again on July 13, which gives some hope to the bulls that stocks may avoid another sharp sell-off.

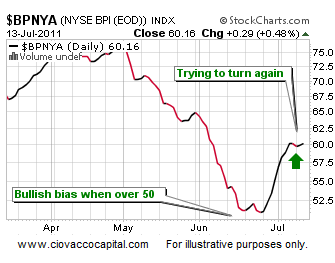

The NYSE Bullish Percent Index (BPNYA) is based on price, which is more important than any technical indicator. The Bullish Percent Index (below) for the Big Board is trying to find its legs.

As we mentioned yesterday, we are interested in gold and silver. We may exchange some of our exposure to U.S. stocks for some additional exposure to precious metals in the coming days. These markets have a lot of moving parts (U.S., Europe, Asia, earnings, Fed, etc.), which is why we tend to use the term “may” instead of “will”. We will pay close attention with an open mind and make adjustments if needed.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.