Gold, the Internet and Creating Imaginary Money

Commodities / Gold and Silver 2011 Jun 28, 2011 - 12:05 PM GMTBy: Ned_W_Schmidt

One has to love today's technology. Where else can we get so much mail from people whom we do not want to get mail? Never has porn been delivered in such high quality. But, the good news does not stop there. While creating social networks for people with lives in which no one is interested and providing the capability for old people to twitter among themselves, the internet is now providing an important government function, imaginary money.

One has to love today's technology. Where else can we get so much mail from people whom we do not want to get mail? Never has porn been delivered in such high quality. But, the good news does not stop there. While creating social networks for people with lives in which no one is interested and providing the capability for old people to twitter among themselves, the internet is now providing an important government function, imaginary money.

Source: bitcoinchartscom

Chart above is of the value of an imaginary money that trades on the internet, bitcoins. (See Coins of the Geeks, Businessweek, 20 June) Bitcoins may be the perfect modern money, and will no doubt be recommended by intellectually inbred Keynesians academics as a replacement for Greece's use of the Euro. This money has no intrinsic value, exists only in the electronic imagination of a server, and can be created in unlimited quantity. Is this not every government's dream come true?

In the above chart note the distinctive parabolic formation that occurred in the value of this imaginary money, and the ensuing collapse out of that formation. As the price of bitcoins has no reality, it traded on fantasy and emotions. Such is what technical analysis attempts to gauge, in part. That chart pattern was totally imaginary. And no, we have heard no claims yet of a banking cabal manipulating the price of bitcoins, but am sure it will develop.

Similarity of that chart pattern to that of Silver should be considered. Both traded into that pattern based on fantasies of future price. Real value was essentially ignored. With Silver having broken the critical US$34 level, attention should be on the intraday cash low of ~$32.25. A move through that prices raises the potential for the completion of the parabolic chart pattern failure.

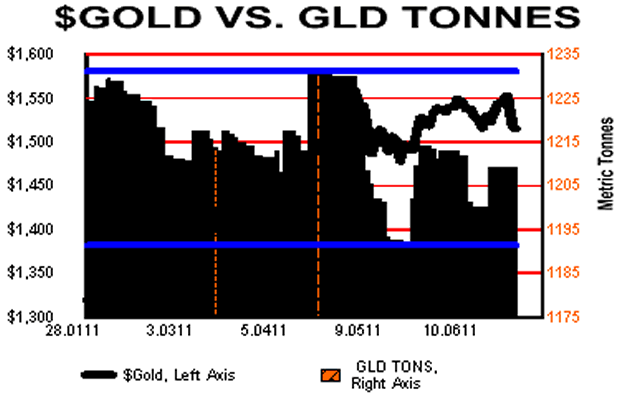

At the same time the value of an imaginary money was rising, world's demand for real money was faltering. In the chart below is plotted the Gold holdings of GLD, the Gold ETF. That chart seems to show a slightly negative bias for Gold demand. Since June of last year, the Gold holdings of GLD have declined by approximately 110 tonnes.

Peak holdings: June 2010, 1320 tonnes, Down 110 tonnes.

What should Gold investors being doing in this period of faltering demand for Gold and weakening prices? To answer that question, let us think of something else. Suppose one owned the stock of a company that was to release a patented cure for the common cold in "5 years." Price of that stock is faltering because investors would at this time rather invest in really important concepts, social networking sites. Would you sell the stock?

Same is true for Gold. Investors should retain their Gold as "5 years" from now somewhere in the world politicians and Keynesians will again be making muck of something. Rather, investors should consider building on their Gold foundation. Adding Rhodium and Chinese Renminbi to those holdings would make good sense at this time.

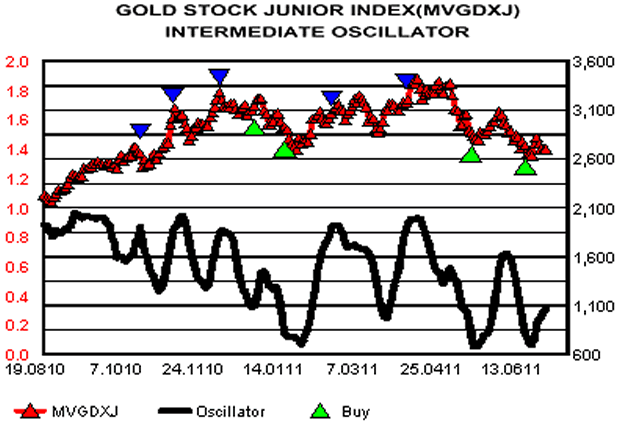

From where might the money come with which to purchase these additional investments? Chart below may help answer that question.

In that chart is plotted MVGDXJ, index used for ETF of junior mining stocks. Recent action in that index has taken out the previous short-term low. It is developing a negative trend. That development, combined with the faltering of markets for precious metals, may suggest that substantially lowering prices for an extended period of time for junior mining stocks is likely. All of which is a nice way of saying that with no support evident in that chart, the junior mining stock appear on the verge of collapsing into a significant bear market.

In that chart is also plotted a stochastic oscillator. That measure is useful during bull markets in selecting entry points as it attempts to gauge when price is at the lower edge of a presumably positive channel. In bear markets, however, the interpretation of the stochastic becomes more difficult. As it attempts to proxy the trading channel, an over sold reading on a stochastic at the time price is moving to new lows may be an indication of a breaking down of the previous channel. It might be signally that a new channel, with a negative trend, is developing. If that is the case, then we may need to modify our interpretation of the stochastic oscillator. Over sold, a normal buy signal, would become a Do Not Sell signal. An over bought condition, stochastic more than 80%, would then be interpreted as a Good Time to Sell signal.

| US$GOLD & US$SILVER VALUATION Source: www.valueviewgoldreport.com | ||||||

| US$ GOLD | US$ GOLD % | US$ / CHINESE YUAN | CHINESE YUAN % | US$ SILVER | US$ SILVER % | |

| CURRENT | $1,500 | $0.1544 | $34.00 | |||

| SELL TARGET | $1,970 | 31% | $0.5000 | 224% | $35.50 | 4% |

| LONG-TERM TARGET | $1,827 | 22% | $0.3330 | 116% | $33.00 | -3% |

| FAIR VALUE | $860 | -43% | $15.60 | -54% | ||

| ACTION | Gold preferred to Silver. | Buy Chinese Yuan | Sell Silver | |||

¹These estimates are subject to change.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.