Disappointing Trend of U.S. Home Sales Leaves Housing Sector at Top of Fed’s Watch List

Housing-Market / US Housing Jun 24, 2011 - 05:33 AM GMTBy: Asha_Bangalore

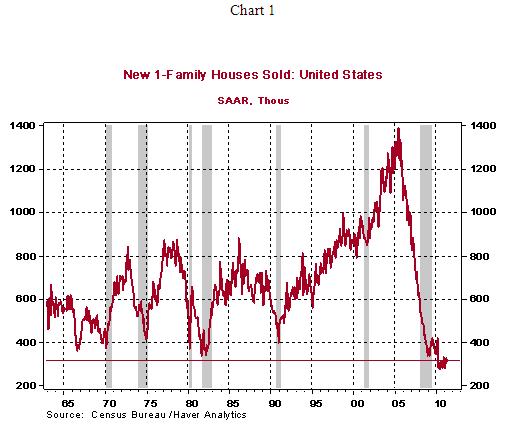

Sales of new homes fell 2.1% in May to an annual rate of 319,000. The level of home sales is still close to the recession/record low of 278,000 registered in August 2010. Sales of new homes plunged nearly 27% in the Northeast, held steady in the Midwest, fell in the West (-3.5%) and rose in the South (+2.4%).

Sales of new homes fell 2.1% in May to an annual rate of 319,000. The level of home sales is still close to the recession/record low of 278,000 registered in August 2010. Sales of new homes plunged nearly 27% in the Northeast, held steady in the Midwest, fell in the West (-3.5%) and rose in the South (+2.4%).

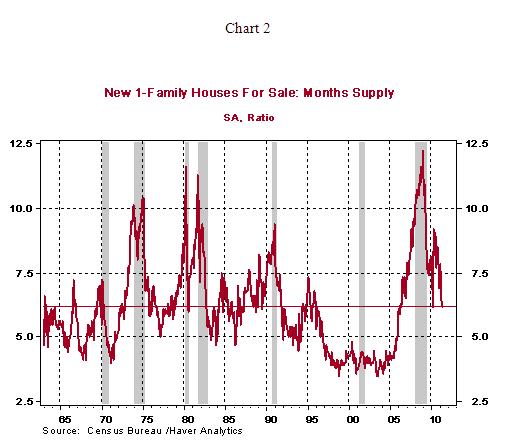

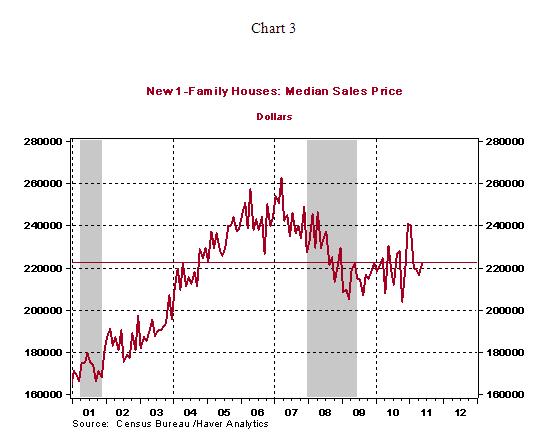

The inventory of unsold homes edged down one notch to a 6.2-month mark and it is noteworthy because it matches the long-term average. It has taken a little over two years for inventories to shrink from the peak in January 2009 (12.2 month supply). As a result of the low inventory of new homes, the median price of a new single-family home rose 2.6% to $222,600 on a month-to-month basis. However, from a year ago, the median price of new single-family home declined 3.4%. The median price of a new single-family home is holding at levels seen in 2008.

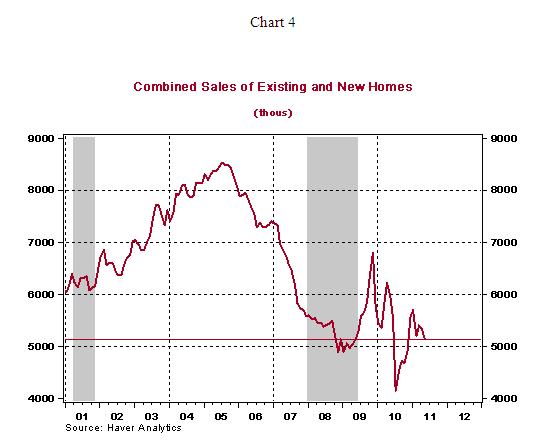

The combined sales of existing and new homes continue to hover around the recession low (see Chart 4). The failure of home sales to post gains after two years of economic recovery, in an environment when homes are affordable, remains a significant challenge. The spikes in home sales represent the impact of the first-time homebuyer credit program which expired in April 2010.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.