Gold Top Soon Could Fool Bulls

Commodities / Gold and Silver 2011 Jun 10, 2011 - 08:40 AM GMTBy: David_Banister

First let me start by clarifying I've been a Gold Bull since November 2001 based on Elliott Wave patterns and currency concerns as well. Since that period nearly ten years ago, I have followed and forecasted the patterns in gold and have been amazed at the clearly definable trends both for large moves to the upside as well as corrective patterns.

First let me start by clarifying I've been a Gold Bull since November 2001 based on Elliott Wave patterns and currency concerns as well. Since that period nearly ten years ago, I have followed and forecasted the patterns in gold and have been amazed at the clearly definable trends both for large moves to the upside as well as corrective patterns.

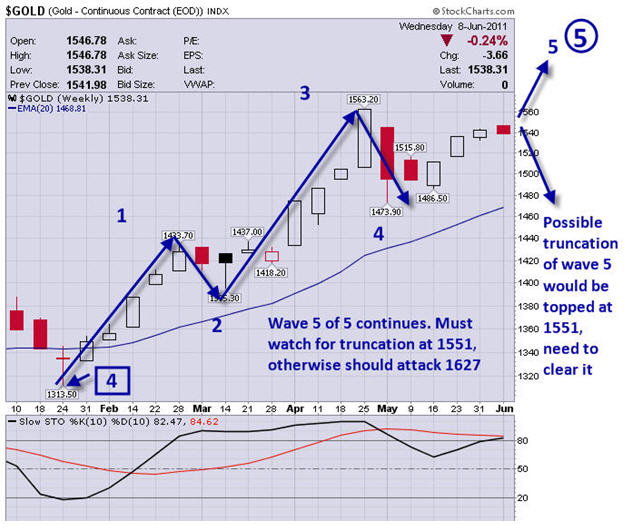

Most recently we had the last pivot bottom in January at 1310 areas, which I labeled as a "Wave 4 bottom' with regards to the most recent 5 wave pattern to the upside. In the longer term view, Gold has been in a long uptrend since the October 2008 crash lows of $681 an ounce, and I have it now in the final 5th wave up of a larger degree 5 wave move since that time. Nearly 32 months of general uptrend with the occasional corrective pattern to the downside to kick the bulls off.

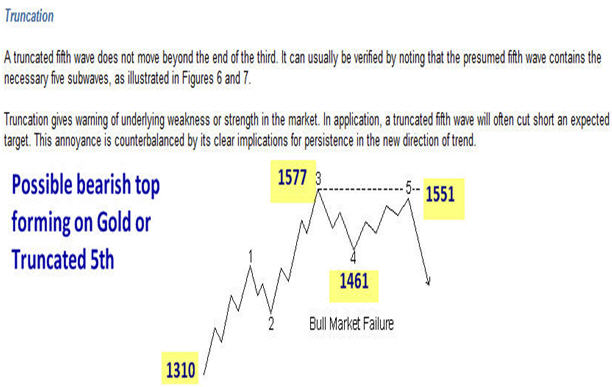

The issue now though, is that 5th waves in a final 5th wave pattern are very difficult to predict and they can extend and run higher than usual, or they can "truncate', which means they are shortened much more than usual. In the near term, gold investors want to see Gold break out over $1551 in order to avoid what looks like a potential "truncated' top in Gold at that level. What happens is the Bulls run out of gas, and the final 5th wave up gets tired and stops short of the normal destination, catching both bulls and bears off guard at the same time.

Below is a graphic of what this would look like in the current Gold Bull Market with the recent top at 1577 as wave 3, and the 1551 area as a truncated wave 5 top:

I recently wrote about this for my paying subscribers at TMTF in order to make sure they are "prepared like a Boy Scout' for a possible large correction. The other view I have had for a while is that we would surpass the 1577 highs and run up to a minimum of 1627 for the top of this 5th wave, with potential to run another $40-$70 higher in a throw over top pattern. The bottom line though is you need to be prepared for a coming top in Gold, which will be followed by a multi-month correction that most will not see coming. As it stands now, I can't find too many Bears on Gold anywhere on the planet...and that is typical of 5 wave tops.

If you would like to be kept abreast of intermediate Gold pattern forecasts, (As well as SP 500 and Silver) take a look at www.markettrendforecast.com today and get a 33% coupon discount to subscribe good for 24 hours. Or, you can sign up for the occasional free reports as well.

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (MarketOracle.co.uk, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2010 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.