UN Warns of U.S. Dollar Collapse, Brutal Month for Silver Ends

Commodities / Gold and Silver 2011 May 31, 2011 - 12:17 PM GMTBy: GoldCore

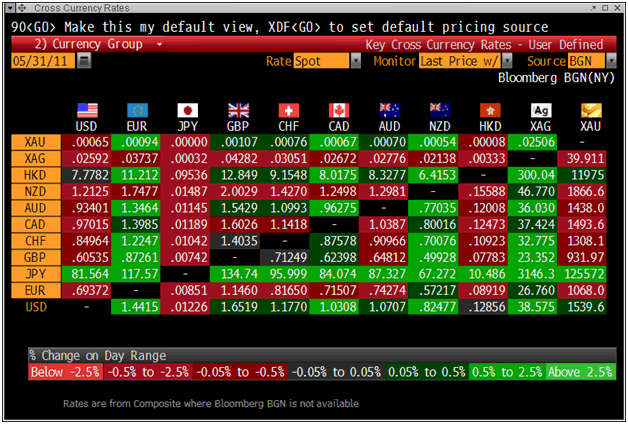

Gold has fallen against the euro and most currencies but is 0.2% higher in U.S. dollars and nearly 1% higher in yen terms as the American and Japanese currencies have come under selling pressure. Gold remains near record nominal highs in all major currencies which shows that markets are concerned about inflation and concerns about the future of major currencies.

Gold has fallen against the euro and most currencies but is 0.2% higher in U.S. dollars and nearly 1% higher in yen terms as the American and Japanese currencies have come under selling pressure. Gold remains near record nominal highs in all major currencies which shows that markets are concerned about inflation and concerns about the future of major currencies.

Cross Currency Rates

The euro climbed to a three-week high versus the dollar on speculation Germany and other European nations may pledge more funds to bankrupt Greece and favourable German economic data. This is more a reflection of dollar weakness rather than any great confidence in the euro. The euro at €1,068/oz remains under pressure versus gold and is less than 2% from record nominal highs at €1,088/oz.

While the focus, has of late, been on the increasingly ‘unsingle’ single currency, news overnight shows how there are also substantial risks posed to the yen. Moody’s have warned that they may have to downgrade Japan and have warned of a “tipping point” which may lead to a government funding crisis for heavily indebted Japan.

Moody’s caveat that the risk is long term in nature is likely underestimating the risk which is at least medium term and may even be short term given the deepening economic crisis in Japan today and the sovereign debt risks seen in the Eurozone and in the U.S.

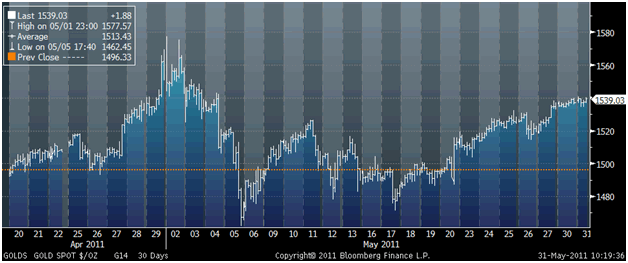

Gold in Euros – May (Tick)

The United Nations warned on Wednesday of a possible crisis of confidence in, and even a "collapse" of, the U.S. dollar if its value against other currencies continued to decline. The UN’s mid-year review of the world economy did not get covered widely.

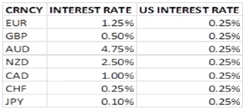

The UN economic division said that a crisis of confidence in the dollar, stemming from the falling value of foreign dollar holdings, would imperil the global financial system. This trend, it said, had recently been driven in part by interest rate differentials between the U.S. and other major economies (see table above) and growing concern about the sustainability of the U.S. public debt, half of which is held by foreigners including the Chinese government.

Gold in US Dollars – May (Tick)

A reminder, if ever one was needed, of the importance of having a diversification into gold and silver bullion.

Cost averaging remains a sensible strategy for those concerned that there may be further short term weakness in bullion markets.

On the 100th anniversary of the launch of the Titanic, governments internationally appear to be engaged in an exercise of “rearranging the deckchairs” prior to the ship sinking.

In the same way that there was a popular perception that the Titanic was “unsinkable” so today the real risk posed to the euro, dollar, yen, pound and other fiat currencies is largely unacknowledged.

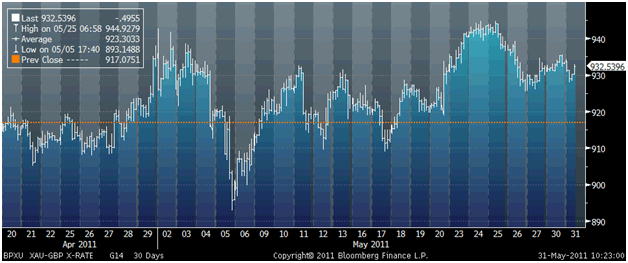

Gold in British Pounds – May (Tick)

There is a real sense of both desperation and denial about the debt crisis and indeed the global nature of the debt crisis.

Many insolvent western governments continue to simply “kick the can down the road”. This may buy time but ultimately the misguided solution of creating more public debt to cure a private debt crisis will be seen as a blunder and will likely lead to even greater financial and economic challenges.

Geopolitical Risk in the Middle East

Geopolitical risk in the Middle East and North Africa remain high and will support gold.

Risks include sectarian tensions between oil rich Saudi Arabia and Iran and instability in strategically important Yemen where a combination of pro democracy protesters and Islamic militants clash with an unpopular, corrupt and undemocratic government.

SILVER

Sell in May?

It was a brutal month for silver investors with silver down by 19.5% in dollar terms. Gold fared much better and is only down 1.6% in dollar terms and 0.36% in sterling terms. Gold was actually higher in euro terms rising by 1.07% and this and the charts above are hardly indicative of a bubble rather of a further period of correction and consolidation.

We have long warned regarding the short term volatility of silver and hence danger of attempting to trade or time the silver market.

If ever there was a market to “buy and hold” it is the silver bullion market. Those who continue to buy silver bullion coins and bars and store in safe depositories will be rewarded in the coming years.

Absolutely nothing has changed regarding the fundamentals of the silver market and this sell off was due to the massive concentrated shorts being involved in a short squeeze, unprecedented margin increases and increasing investment and industrial demand for silver.

This demand is particularly strong in China and Asia and among a minority but increasingly vocal and influential band of silver advocates who believe that silver is money and will help protect people from developing problems in the western and global financial and monetary system.

Gold

Gold is trading at $1,538.57/oz, €1,068.01/oz and £932.525oz.

Silver

Silver is trading at $38.64/oz, €26.82/oz and £23.42 /oz.

Platinum Group Metals

Platinum is trading at $1,828.50oz, palladium at $774/oz and rhodium at $2275/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.