Gold Bull Swings and Round Abouts

Commodities / Gold and Silver 2011 May 23, 2011 - 12:42 PM GMTBy: Neil_Charnock

It has not been a comfortable May for a Gold Bull however we have stood our ground in a most constructive manner here at GoldOz. It is all about how much you understand and how you handle the swings and roundabouts. Your actions alone can either lower your wealth or increase it by providing added leverage when the market turns back in your favour. What I am saying is that these pull backs can be used to increase your grip on this market sector or you can squander the opportunity by doing nothing, or even worse you can sell on the dip and exit at the wrong time.

It has not been a comfortable May for a Gold Bull however we have stood our ground in a most constructive manner here at GoldOz. It is all about how much you understand and how you handle the swings and roundabouts. Your actions alone can either lower your wealth or increase it by providing added leverage when the market turns back in your favour. What I am saying is that these pull backs can be used to increase your grip on this market sector or you can squander the opportunity by doing nothing, or even worse you can sell on the dip and exit at the wrong time.

The first thing to understand is gold itself as an asset class and why everybody needs at minimum some of it at this point in history. You need to own gold is not the subject of this article however. I am not a perma-bull however I will not let go of a trend until it is over. Even a brief study of the last 100 years of monetary history reveals that the underlying root cause that caused the GFC event has not been solved and that pouring gasoline on a fire will not put it out either.

The developed nations have found themselves in a hole and they are still digging. Some are digging at the sides trying to create a ramp out and others are still going deeper. A lot of good work is being done yet the imbalance is still there. The developing world is facing challenges associated with rapid growth, structural reform and the effects caused by hot money seeking yield, seeking investment return and safety. Investors face renewed educational challenges so that they can understand the risks, structure their portfolios for change and spot valuation misalignments.

This article offers some notes on constructive steps we have taken in recent months and which we have been teaching our subscribers behind the scenes. We run a newsletter service and an educational portfolio in our Gold Membership area of the site to teach investors how to select, balance and evaluate their own investment decisions as markets evolve in real time. The situation is fluid meaning that topical news flows push waves of capital in and out of various markets based on risk off or risk on.

The influential factors (e.g. European debt, inflation, economic disequilibrium, commodity shortages or US deficits) lie there smouldering until fresh events ignite renewed interest in the media and in turn influence the importance weightings put on these same factors in the multitude of computer programs that control vast sums of money around the world. Plug the new event or numbers into the algorithm and push the button. Some of the factors that dictate future financial events are set in stone yet they are ignored when the numbers or spin dictate alternate sentiment on the day. This creates opportunity but only if you understand the big picture. How you structure and manoeuvre your investments will dictate how well you exploit these swings and roundabouts which are the greatest show on earth.

We study the simmering disequilibrium in the global financial system and distil the news events as they unfold in relation to the Australian gold stocks specifically. However there is certainly relevance to gold investment on a global scale and different asset classes as we dissect the big picture. Gold and mining stock investing is difficult however it is our belief that education is the key to success. With all due respect investment in this sector without it is just gambling and a recipe for disaster.

A deep conceptual understanding of money, gold, mining and macroeconomics cannot be learned overnight yet it is essential for success. We try to keep adding layers of data and the important aspects to build this education over time for clients at all levels of experience. The flow of ideas and sharing can mean that clients teach me at times and this is exciting. There are many good hearted people in this world despite what the media projects. There are those of us trying to pull as many people into the life boat of financial safety as we can at this extremely difficult and dangerous period in history.

That is enough philosophy; it is shared by many of my colleagues in the precious metals business. The key is to move with the markets and there are certainly ways to do this once you understand these markets, including fundamental and technical analysis to a high degree. Back in March there were emerging concerns again about Europe, major upheaval in the Middle East and then the Japanese were hit with a tragic disaster which caused a market panic at the time.

Here was my commentary at the time (March 16th issue GoldOz newsletter GM27 - next four paragraphs):

"I mention this as "best information" availability to me at this time because the world seems to think things are worse than they are with contagion of panic throughout finance markets today 15th March 2011. This is not an event like Lehman Brothers either, which was the 4th largest bank in the USA before it imploded. This is not a 2008 GFC at this stage as the global credit market has not frozen - the trouble is less general. This is a Black Swan or Fat Tail event or whatever you want to call it however we have to wonder at the true magnitude and duration. A level head and cool analytical viewpoint are needed here to avoid potentially expensive and unnecessary decisions.

Japan is the 3rd largest economy and is partially compromised at present. The whole economy has not shut down. These people are incredibly resilient do not underestimate them. The short to medium term damage to the Japanese economy is immense and they cannot really afford it. There are global supply chain issues as well, as many parts destined for manufacture come from Japan.

We have covered their debt and other issues before so I will not go over it again. They are stimulating, nevertheless it comes with the trouble in the Middle East. This is not going away any time soon and it is likely to escalate pushing up gold even more.

Even Europe is now being noticed among the mix. Blood in the streets - thank you Mr. Market I have been waiting for the perfect time to move more heavily into these gold stocks. The Educational Portfolios start to grow more now with different stocks that are reaching attractive levels."

Gold went up from just under US$1400 to $1560 in the following 7 weeks and the Australian gold sector went up 20% in the same period. Now two months later the news is that the Japanese economy shrank at an annual rate of 3.7% in this first quarter and, remember, their disaster occurred on the 11th March 10 weeks into that quarter. I did not get every point exactly correct in a complex situation however the sentiment effect, the overall assessment and conclusion was correct and that is what counts.

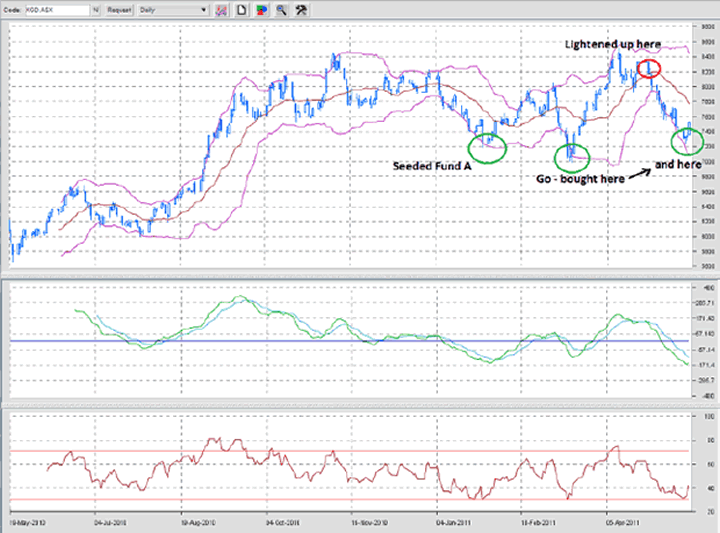

So here is the point; understand the significances of events and how it all fits together and you can then apply this to micro aspects on the markets you are invested in. We bought aggressively but within sensible money management techniques on the 15th March. Here are the last three major buy, lighten up and buy back points on the 12 month daily chart of the XGD (Australian gold sector) in the past two months as covered by our service.

The green ellipses show the start point of this education (within our service) on the left and the two recent buy points. The red ellipse shows the "lighten up" point on the 28th April and there was ample technical coverage of important influences at the time. Those charts are not within the scope of this article but I can say we use different time frames and market indicators showing how they interact.

As sentiment falls you get a drop in traffic to the large gold focused web sites and I even notice a drop in subscription activity. Investors are either waiting for some positive action before they come back or they have lost some measure of interest in the sector. I tend to do the opposite unless I believe the trend is either mature or finished. I get more intensely interested on dips and corrections because this is where you initiate investments and trades that set up your next opportunity. This is how I have increased the value of the GoldOz Educational Portfolio in a flat market over the last few months. The leverage will also be improved when the market does launch into the next up-leg which is approaching.

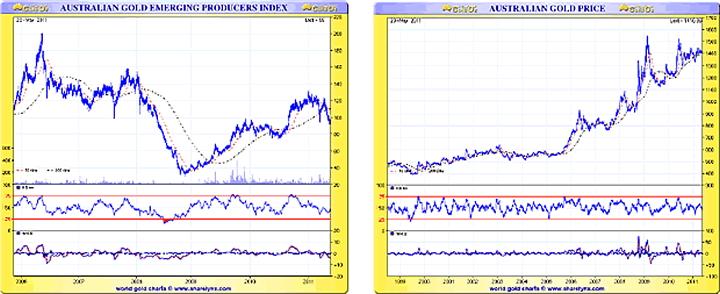

This is the time to be doing fresh due diligence on the sector to assess which stocks might move the fastest during the next up-leg. It may be time to trim the underperformers and companies that have made decisions you are not so happy with. It is time to rebalance and adjust, to tighten your grip on some stocks or adjust your risk weightings on the sector by moving towards the higher or lower risk stocks. Your behaviour on the way up and ability to recognise and lighten up or sell at the tops will determine how profitable you are. Here is the reason I believe the Australian gold sector will rally in the near future, a picture is worth a thousand words.

As you can see above the Emerging Producers index was flat coming into the start of 2008, partly as a result of rising costs; wages and drilling to name two pressures. The sell off into and through the GFC was extreme even though AUD gold soared higher, boosting profit margins for producers. We approached pre-2008 levels on this index into the end of 2010 before correcting even as gold holds high levels. Cost pressures have eased and margins remain very high. The trend is up for AUD gold and this sector and the best news is that the gold stocks need to play catch up. This is a blatant valuation misalignment and that spells e-n-t-r-y p-o-i-n-t.

Right now we face one of the most heavily flagged economic events in recent years, the end of QE2. We face another round of debt ceiling issues in the US and this is not good short term. The US has to raise the ceiling and they have to reduce the deficit so urgent work and big decisions are necessary. Italy, European banks and bond hold holders have just been put on renewed alert with Standard and Poor's posting a debt downgrade warning. No wonder gold is holding up the challenges out there and chances of a mistake are significant. For now the XGD and bellwether stock NCM have rising 200 dma's. NCM shows a strong money flow indicator and major supports have not been broken. So we have stayed the course. We have strict discipline and levels for support on this Australian gold index, if this goes we lighten back up and look to the next level down.

We have been warning about one problematic and dangerous bubble in Australia since our newsletter began and it now turns out that this sector of the economy has now contracted for the last 10 months. We have explained the dangers of exposures and how the banks work in this market sector and its interaction with the general economy. However gold, silver and selected miners have a great future as appreciating asset classes. One problem is that many investors want it now and get disappointed if it doesn't happen right away. They turn away and look elsewhere before later finding out that if they had just stayed the course they could have been right all along.

I am still just as excited about the prospects for the metals and the companies that mine them as I have been all year. Our methods have been successful this year so far in an oscillating, difficult, challenging market. Our methods are now being described and conveyed in the newsletter and portfolio like never before. The incredible oversold levels seen in late 2008 are not coming back until a few years after the gold bull finally fizzles out. That is many years away.

Our research is telling us that there is a lot of money to be made in the next few years and a nice run later this year for those who stick with the program. We can already see the entry point timetable and also the dangers for many investors in this difficult period of history. Wealth is set to transfer, change hands, is it leaving you or coming your way? I hope it is the latter. If you want to buy gold with minimal cost we have a buy gold link now at GoldOz.

Good trading / investing.

Regards,

Neil Charnock

GoldOz has now introduced a major point of difference to many services. We offer a Newsletter, data base and gold stock comparison tools plus special interest files on gold companies and investment topics. We have expertise in debt markets and gold equities which gives us a strong edge as independent analysts and market commentators. GoldOz also has free access area on the history of gold, links to Australian gold stocks and miners plus many other resources.

Neil Charnock is not a registered investment advisor. He is an experienced private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are his current opinion only, further more conditions may cause these opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.