Gold Secular Bull Market Mania Phase 2011-2013

Commodities / Gold and Silver 2011 May 23, 2011 - 08:01 AM GMTBy: John_Hampson

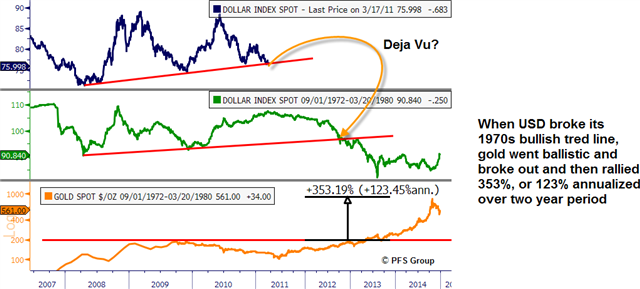

I propose that the third and final phase of gold's secular bull since 2000 has begun in early 2011 and will end in 2013. I suggest that this third phase, a popular and parabolic mania, was announced by both silver's mega move January to April 2011 and the US Dollar's break beneath long term rising support, and will proceed to conclusion in a similar way to the last secular gold bull of the 1970s.

I propose that the third and final phase of gold's secular bull since 2000 has begun in early 2011 and will end in 2013. I suggest that this third phase, a popular and parabolic mania, was announced by both silver's mega move January to April 2011 and the US Dollar's break beneath long term rising support, and will proceed to conclusion in a similar way to the last secular gold bull of the 1970s.

Source: Zealllc

Source: PFS Group

Gold will finally enter genuine bubble territory and conclude in a manner similar to previous asset manias.

For a deeper understanding of forecasting the gold secular bull to end around 2013, please read my previous articles:

End Of The Secular Commodities Bull (March 7th)

Solar Activity And The Financial Markets, Parts I and II (March 30th, April 4th)

--------------------------------------------------------------------------------

Let's now look near term.

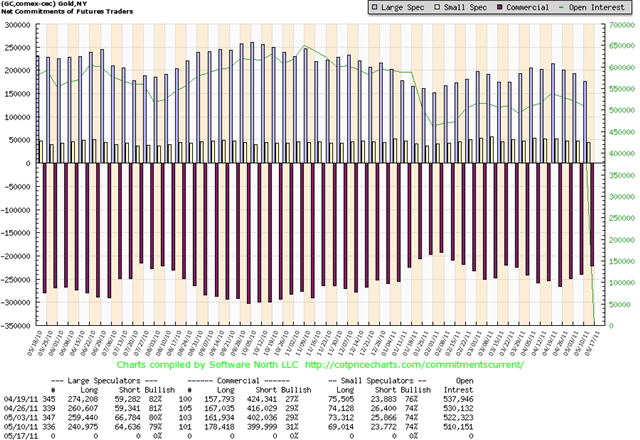

Currently, gold open interest is at a level on par with late January 2011 and late July 2010, the last two significant lows for gold.

Source: Biiwii

And gold has just broken out from its recent consolidation range.

The gold Hulbert sentiment indicator fell to just 7% in early May, a historic contrarian buy range, and excessively bullish sentiment has now truly washed out against silver. However, I believe silver needs more time to consolidate following its parabolic blow-off, so expect gold to outperform for a period.

Source: Sentimentrader.com

The PFS Group long term gold indicator is bullish as of early 2011.

Underlying Source: PFS Group

I previously noted that the 200EMA has supported the secular gold bull to date (see first chart above) and is currently at $1400, which I believe would offer ultimate support for any consolidation move down. However, I believe the COT and sentiment readings together with the recent range break out for gold mean that we may be looking at a new leg up in gold (even if stocks and commodities generally take a mid-year breather), which means the recent bounce at $1462 would be the low.

This idea may also gain strength should the US Dollar stall soon at the backtest of its long term rising support break - around 77.5 on the USD index. Such a stalling may occur if the European debt issues are once again kicked further down the road whilst Euroland interest rate rises and increasing rate differential over the US return to the fore. But as shown in the third chart above, US Dollar weakness is not necessary for gold to advance, whilst real interest rates remain negative.

If I am right that we have entered the final phase of the gold secular bull market then the dynamic of this phase means that there will be little opportunity to time the market. What appears to be potential headwinds for commodities currently (potential economic slowdown and debt issues re-emerging) may well be spun into tailwinds for gold (low rates and stimulus to extend and gold perceived as a safehaven).

The biggest gains of the secular bull will be made in this final phase 3. Summarising the above, I believe the question needs to be asked now, not later: do I have enough money in gold?

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.