Social Network: Why So LinkedIn?

Companies / Tech Stocks May 11, 2011 - 05:26 AM GMTBy: Dian_L_Chu

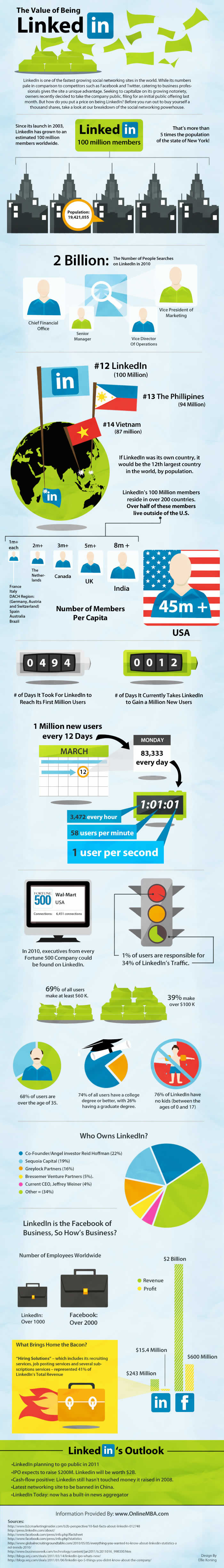

Dubbed as the Facebook of business professionals, Linkedin has expanded into many parts of the globe with 101.5 million members worldwide by the end of March. That's 12 million members more than it had at the end of 2010.

Dubbed as the Facebook of business professionals, Linkedin has expanded into many parts of the globe with 101.5 million members worldwide by the end of March. That's 12 million members more than it had at the end of 2010.

SFGate quoted a document Linkedin filed with the U.S. Securities and Exchange Commission (SEC)

"While it took us nearly 500 days to reach our first 1 million members, during the second half of 2010, on average, we added more than a million new members every 10 days."Based in Mountain View, California, LinkedIn is a private company, but filed with the SEC on Jan. 27 that it plans to raise as much as $175 million in an initial public stock offering. And in another filing on May 4, the company has chosen to have its IPO with the Big Board--NYSE--under the stock ticker LNKD. Although Nasdaq is typically the more popular listing choice with tech companies, more companies now seem to value NYSE's big company 'blue chip' image branding benefit.

It looks like LinkedIn would be among the first wave to cash in on the social media craze. Renren Inc., China's biggest social-networking site by page views, started trading on the NYSE on May 4. Groupon could launch its IPO as early as second half of this year. Facebook, with two newly minted high profile investors--Golman Sachs and Russia's Digital Sky Technologies--may also go public in 2012.

For Linkedin, 2010 is its first profitable year. According to the company filing, for the full year of 2010, LinkedIn posted revenues of $243.1 million and net income of $15.38 million, versus revenues of $120.1 million and a net loss of $3.97 million in 2009.

However, Linkedin had this to say in its filing:

“We expect our revenue growth rate to decline, and as we continue to invest for future growth, we do not expect to be profitable on a GAAP basis in 2011.”Facebook is said to be worth $59.4 billion, while a report from last summer put LinkedIn net worth at more than $2 billion. By my rough estimate, both companies are valued at more than 120x P/E multiples, which was one of the reasons I wrote about a Tech Bubble 2.0, but this time in the social networking sub-sector.

Valuation aside, Linkedin is one social network site that could really help job seekers as the company generated almost half of its revenue last year from tools that recruiters use to find job candidates, particularly for tech jobs. The site also has a 'knowledge service'--LinkedIn Answers--where users can answer and also ask a wide range of questions like "What are the best credit cards for small business?", and receive answers from their connection network and experts who use LinkedIn.

So being Linkedin does have benefits, and this infographic illustrates the scale of its virtual reach, and how anyone may start his/her own global network one connection at a time.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://www.econmatters.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.