What is Someone Holding Silver to do?

Commodities / Gold and Silver 2011 May 10, 2011 - 06:54 PM GMTBy: Ned_W_Schmidt

The clay tablets now seem incomplete. Some additional comments, or rules, should have been included One that comes to mind is that all of the above apply to politicians. That Keynesian economists are not excluded from the one about stealing would have been nice. For what else is Keynesian ideology other than a rationale for stealing the wealth and income of working citizens? Also, a tablet suggesting firm rules for certifying bear markets would have been helpful

The clay tablets now seem incomplete. Some additional comments, or rules, should have been included One that comes to mind is that all of the above apply to politicians. That Keynesian economists are not excluded from the one about stealing would have been nice. For what else is Keynesian ideology other than a rationale for stealing the wealth and income of working citizens? Also, a tablet suggesting firm rules for certifying bear markets would have been helpful

We should have all been anticipating an end to the speculative bubble in Silver, and the advent of a bear market. Silver is the secondary play that without Gold would hold little interest. Silver's investment value is derived from Gold. It does not stand alone. When markets turn to the secondary play in a sector, we should always anticipate that the end is near. Lacking fundamentals, other than imaginary ones, to justify the speculative price bubble, Silver's collapse was a when not if situation.

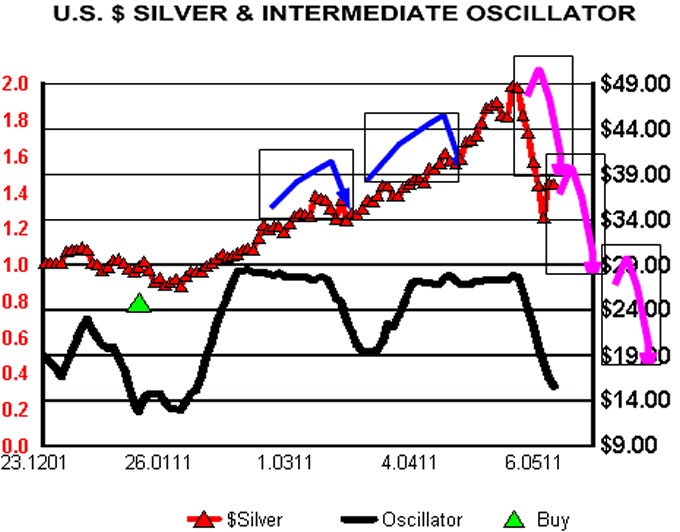

While lacking a specific clay table, we can surmise what might have been on it had one been created. For example, rule one would be that when a debt financed advance in prices has occurred, expect a bear market to develop. Second, when the price drops more than 30% from the high, the smart money is on a bear market. Thirdly, when the market patterns change, as they have in the above chart, acknowledge that a bear market has developed.

In a bull market, the patterns tend to be as those indicated by the blue arrows in the above chart. Long advances are punctuated with sharp, short corrections. The reverse of that is what plays out in a bear market. Sharp, short advances give way to longer correction. Simply reverse the bull market pattern.

Repetitive sets of bear market patterns should be expected after the failure of Silver's parabolic rise. Such periods are without compassion for those that "fight the tape." A reasonable resolution of Silver parabolic pattern failure is a price target of $16.

What is someone holding Silver to do? Answer is simply, look to the alternatives. How do the alternative currency related investments rank at this time? Based on valuation, Silver investors can choose that which to move into.

#1: Rhodium

#2: Chinese Renminbi deposit accounts

#3: Gold

#4: White Sand

#5: Silver

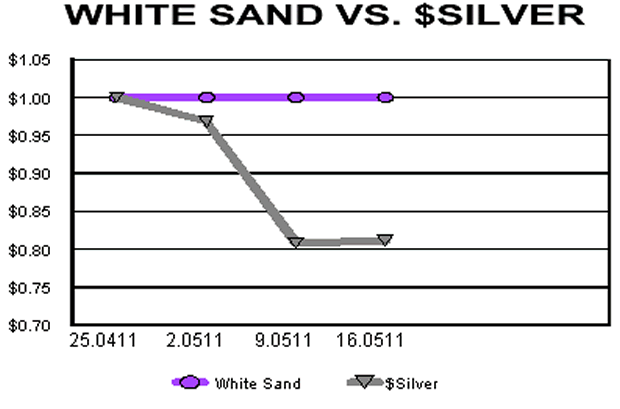

When last we talked, 25 April 2011, the recommended trade was from Silver into White Sand. We received so many wonderful expressions of affection on that trade that we thought an update on it might be on interest. How it came out is shown in the chart below. By the way, those needing an update on market conditions can do so at this link: http://safesand.stores.yahoo.net/ornatplaysan.html

Valuations are updated below.

| US$GOLD & US$SILVER VALUATION Source: www.valueviewgoldreport.com | ||||||

| US$ GOLD | US$ GOLD % | US$ / CHINESE YUAN¹ | CHINESE YUAN % | US$ SILVER | US$ SILVER % | |

| CURRENT | $1,517 | $0.1539 | $38.50 | |||

| SELL TARGET | $1,970 | 30% | $0.5000 | 225% | $35.50 | -8% |

| LONG-TERM TARGET | $1,818 | 20% | $0.3330 | 116% | $33.00 | -14% |

| OVER VALUED | $1,113 | -27% | $20.25 | -47% | ||

| FAIR VALUE | $856 | -44% | $15.60 | -59% | ||

| ACTION | Gold preferred to Silver. | Buy Chinese Yuan | Sell Silver Sell Silver Sell Silver | |||

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.