Global Economy, PMI, Employment Data and Monetary Policy Review

Economics / Economic Statistics May 07, 2011 - 07:50 AM GMTBy: EconGrapher

This week we take a look at the Purchasing Manager Index data for the US and China. Then there's a review of the US employment report, before an overview of the employment data from New Zealand, we then wrap up with a review of some of the key monetary policy decisions over the past week.

This week we take a look at the Purchasing Manager Index data for the US and China. Then there's a review of the US employment report, before an overview of the employment data from New Zealand, we then wrap up with a review of some of the key monetary policy decisions over the past week.

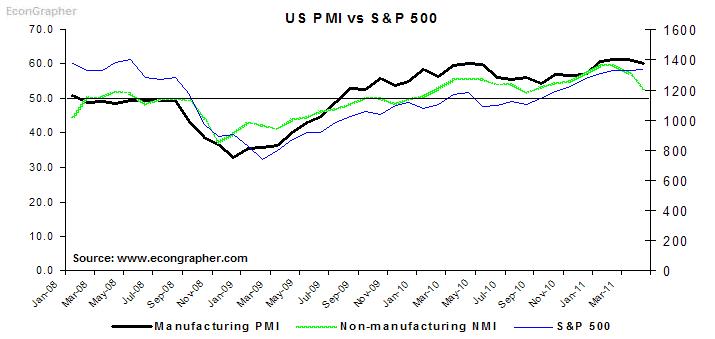

1. US PMI

The US recorded some relatively disappointing numbers, with the manufacturing PMI falling to 60.4 from 61.2 and the non-manufacturing PMI falling to 52.8 from 57.3. Sure both numbers were still in positive territory, and both still in the expansionary indicator space. But much of the weakness was in the wrong spots, e.g. things like non-manufacturing PMI falling -11.4 points, and new export orders also falling -5.5 points and business activity -6 points. While the manufacturing index saw negatives in production -5.2 points and -1.6 on new orders. However within the manufacturing PMI, there was a 8.5 point increase in backlogs and a 6 point increase in new export orders which are both interesting positives that should point to at least a short term continuation of momentum in manufacturing.

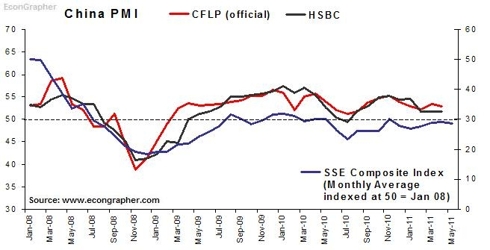

2. China PMI

The official CFLP manufacturing PMI came in at 52.9 in April, down slightly from 53.4 in March, and below the Bloomberg consensus of 53.9. The preliminary HSBC/Markit reading was 51.8, the same as the March reading. The readings show the manufacturing sector in China still in expansionary mode, which bodes well for the Chinese economy. But it could well herald another move by the People's Bank of China, particularly given recent comments that it will continue to fight inflation. Next week is China's monthly data release, where inflation is likely to moderate compared to March's 5.4% reading, but it could be an opportune time for the People's Bank of China to do one last interest rate increase.

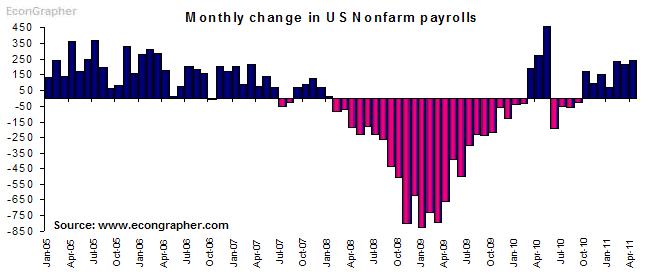

3. US Nonfarm Payrolls

The US added 244k nonfarm payrolls in April, up slightly versus March's 221k, and compares to 277k in April 2010. The figure brings 2011 net new nonfarm payrolls to 768k YTD. Less meaningfully, the unemployment rate rose slightly to 9.0% from 8.8% in March. So, all up it was a reasonably positive result. The US economy is finally starting to see consistency in jobs added, and this area will likely be a key aspect for a recovery in consumer spending, and thus a key factor in the housing market, as well as general inflation levels. It's likely that job growth will continue to expand in the months ahead, but as identified in the PMI results, there are due downside risks to the US economy, and an early peak in the PMI could well be negative for the jobs outlook.

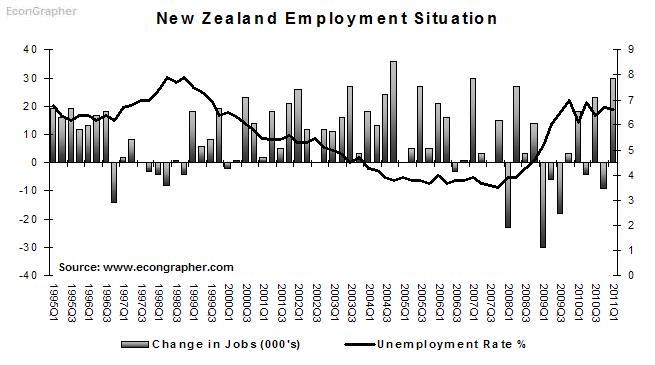

4. New Zealand Employment Data

New Zealand reported a 30k increase in jobs through the first quarter of this year, with 20k being part time jobs and 10k being full time. The unemployment rate eased slightly to 6.6%, down from 6.7% in Q4 2010, and off of the peak of 7% in Q4 2009. The employment picture in New Zealand is slowly improving, albeit with the negative contribution from the Christchurch earthquake. But with the rugby world cup event soon approaching there should be a noticeable pick up in part-time jobs, at least in the medium term. After that it's more about how the broader economy can gain momentum and leverage off loose monetary policy, high terms of trade, and one-off boosts. The downside is the need for fiscal tightening, with the government likely to announce a more prudent budget in the next couple of weeks as it seeks to sure up government finances and maintain its AA+ credit rating.

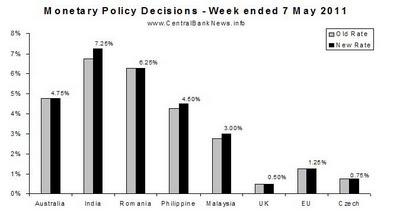

5. Monetary Policy Review

On the monetary policy front, the past week was characterized by continued emerging market policy tightening, and continued developed market policy caution. Of the central banks that made decisions on monetary policy settings this week, those that increased were: India +50bps to 7.25%, Philippines +25bps to 4.50%, and Malaysia +25bps to 3.00%. Meanwhile those that held rates were: Australia 4.75%, Romania 6.25%, United Kingdom 0.50%, European Union 1.25%, and the Czech Republic 0.75%. Next week there's interest rate decisions from Poland (11 May) currently 4.00% , Norway (12th May) currently 2.00%, South Africa (12th) currently 5.50%, and South Korea (13th May) currently 3.00%. Most of these banks will probably increase or maintain a hawkish stance.

Summary

So we saw some relatively disappointing PMI results from the US, but with some glimmers of strength still showing through in the manufacturing index. Over in China there was a slight weakening, but generally things were still strong - perhaps allowing scope for another interest rate increase. Meanwhile the US reported a good nonfarm payrolls figure in April, with some promise for continued strength. Over to New Zealand, the March quarter saw a decent employment report, with a positive outlook as the New Zealand economy looks set to gain momentum. On monetary policy the theme of emerging market tightening continued, and is likely to continue for the time being, meanwhile the overriding theme for developed market central banks was policy caution.

Sources

1. US Institute for Supply Management www.ism.ws & Yahoo Finance finance.yahoo.com

2. CFLP www.chinawuliu.com.cn & Markit/HSBC www.markiteconomics.com & Yahoo Finance finance.yahoo.com

3. Bureau of Labour Statistics www.bls.gov

4. Statistics New Zealand www.stats.govt.nz

5. CentralBankNews.info www.centralbanknews.info

Article Source: http://www.econgrapher.com/top5graphs7may11.html

By Econ Grapher

Bio: Econ Grapher is all about innovative and insightful analysis of economic and financial market data. The author has previously worked in investment management, capital markets, and corporate strategy.

Website: http://www.econgrapher.com

Blog: http://econgrapher.blogspot.com

© 2011 Copyright Econ Grapher - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.