U.S. Economy Crippled

Economics / US Economy May 06, 2011 - 02:01 AM GMTBy: Tony_Pallotta

Something happened in April that crippled the US economy. First it was the reports from four regional Fed manufacturing surveys showing a sharp slowdown in growth. Then weekly jobless claims began printing four handles each week with today's 474,000 on top of last week's 429,000. The real kicker was Wednesday's ISM Services that registered a very sharp drop off and now sits precariously close to contraction.

Something happened in April that crippled the US economy. First it was the reports from four regional Fed manufacturing surveys showing a sharp slowdown in growth. Then weekly jobless claims began printing four handles each week with today's 474,000 on top of last week's 429,000. The real kicker was Wednesday's ISM Services that registered a very sharp drop off and now sits precariously close to contraction.

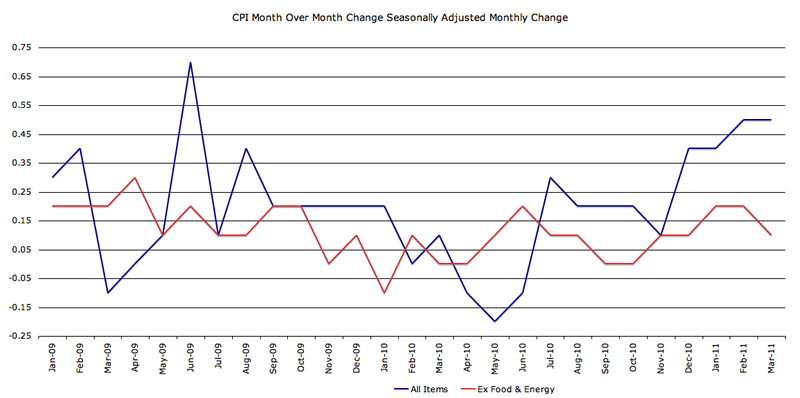

I was going to show you a chart of CPI which has clearly spiked and claim that was the cause.

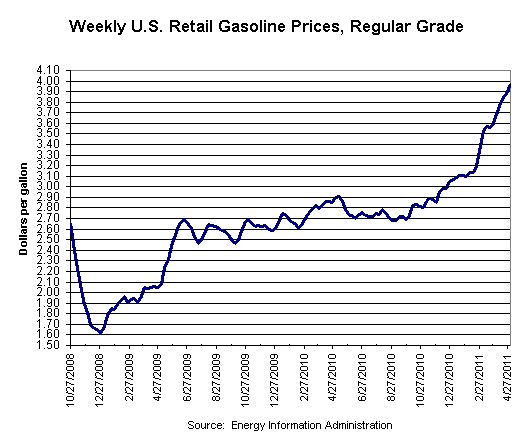

And then I came across this chart of national gas prices and there was the answer. Well at least part of it (couldn't find a chart of average grocery bills). Look at the spike through March and April.

QE was intended to lower long term rates and inspire American's to spend more. The Fed certainly inspired us to spend more but failed to inspire real wage growth. We now spend more on groceries (food at home) and gasoline resulting in less for discretionary purchases.

In the December 60 Minutes interview Bernanke claimed he could adjust rates in "15 minutes." That may very well be true but once inflation hits the pipeline it takes far longer to control. It took some time for inflation to really hit the economy but now that it's here even if prices fell tomorrow we still have a lot of inventory that was built at those higher prices.

Now we have an interesting game on our hands. Let's assume the recent massacre of commodity prices continues, can the consumer handle the UFC style body blows until the ref steps in and stops the fight? How much inflation is in the system that needs to be worked off? Today saw a drop in productivity meaning margins are getting squeezed even further. That means more layoffs. As demand for discretionary purchases falls further that means even more layoffs.

As more consumers lose their jobs, demand falls even further. What if inflation is not "transitory?" What if commodity prices begin moving higher and inflation takes a second leg higher? The problems will only grow. Demand will only fall faster.

During the recent FOMC press conference Bernanke when asked about future QE said, “tradeoffs for QE3 are less attractive.” Group think says that QE3 will begin after a brief pause in June. That is quite possible but in fact the tradeoffs have changed.

QE drives inflation which has killed demand. As the Fed tries to inflate the economy all it is really doing is deflating demand.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.