To QE3 or not QE3? That is the Question

Stock-Markets / Quantitative Easing Apr 28, 2011 - 03:03 AM GMTBy: PhilStockWorld

QE3 or not QE3?

QE3 or not QE3?

That is the question. Whether 'tis stupider in the US to erode its buying power with outrageous inflation or to take loans from overseas nations and, by defaulting, to end them? Ben lies: we're sheep; No more; and by being sheep we suffer the heart-ache and the thousand pricing shocks unmeasured by the CPI, 'tis a consumer tax, despite what you had wish'd. Ben lies; we're sheep: living a dying dream: Aye, there's the rub; when fleecing sheep what jobs may come when we have scuttled all their buying power?

While Obama's all talk and no action style of governing does tend to remind us of a short-lived Danish Prince, Ben Bernanke is no Polonius - more like Claudius who poisons our Father the Dollar and spends the rest of the play attempting to cover it up, mostly through word play and various machinations. The prince, meanwhile, although told of Claudius' guilt by his Father's ghost and seeing a mountain of evidence build in front of him - does virtually nothing until, at the end, everyone dies.

While Obama's all talk and no action style of governing does tend to remind us of a short-lived Danish Prince, Ben Bernanke is no Polonius - more like Claudius who poisons our Father the Dollar and spends the rest of the play attempting to cover it up, mostly through word play and various machinations. The prince, meanwhile, although told of Claudius' guilt by his Father's ghost and seeing a mountain of evidence build in front of him - does virtually nothing until, at the end, everyone dies.Yep, that pretty much sums it up for our economic situation with today's "QE3 or not QE3" speech by Bernanke coming late in the play when everyone in the audience KNOWS QE2 is destroying the Global Economy and doing no good at all for the American people - other than those able to speculate in the markets. Yet here we sit, rapt and dumbfounded, by the inaction of our leaders - as helpless as any theater audience to interrupt what is clearly an unfolding tragedy playing out on the stage before us. If only we had a more decisive leader:

Oh wait, we gave that guy a chance and he blew it too, didn't he? Of course these are complex problems with many players on the World stage but, as I mentioned to Members in chat - not every nation is going to be willing to sit back and play their part in this disaster anymore. The S&P cut Japan's debt outlook to Negative this morning, we discussed in yesterday's post how Trichet is putting his foot down and now China is saying "it's over Benny" as a front-page "official" editorial in the China Securities Journal comes out very strongly against supporting Uncle Ben's monetary madness anymore:

China’s foreign exchange reserves increased by 197.4 billion U.S. dollars in the first three months of this year to 3.04 trillion U.S. dollars by the end of March. Zhou Xiaochuan, governor of China’s central bank, said on Monday that China’s foreign exchange reserves "exceed our reasonable requirement" and that the government should upgrade and diversify its foreign exchange management using the excessive reserves.

China should reduce its excessive foreign exchange reserves and further diversify its holdings. As the U.S. dollar keeps declining, many economists have criticized the U.S. government and the Federal Reserve for implementing policies they say have increased inflation globally. A weaker dollar helps U.S. exporters to sell goods and products in the world and at the same time ease the country’s fiscal pressure which faces a record deficit.

China Securities Journal advise that China should set up a foreign exchange stabilization fund to switch off the interaction between foreign reserve and basic currency supply in a short time.

The Chinese are not the only ones just saying no to America. 3M (MMM), for the first time in the company's 109-year history, will place most of its capital spending ($1.1Bn) OUTSIDE THE US. How does the cheap dollar build jobs or encourage manufacturing in the US? It does not - that's a lie you are being told. Like the rest of the top 1%, 3M is moving their operations out of the US step by step, PLANNING to cut US manufacturing from 65% of their output to 55% and, already, 70% of their sales come from overseas. This year “is the first time the company is now having more than 50 percent of its capital deployed internationally,” Chief Financial Officer David Meline said on a conference call. “As we see the recovery in demand, we are adding capacity and where we’re adding it is internationally, close to where the growth is.”

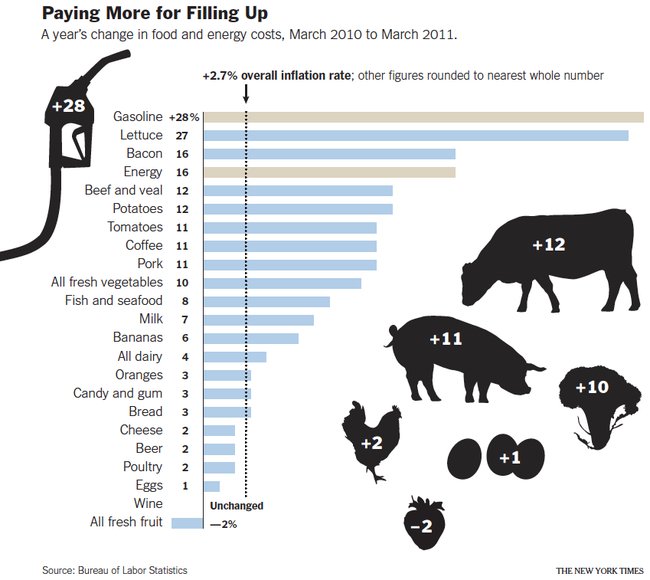

While the only kind of growth we have here in the US is inflation, driven by our declining Dollar's buying power, other nations have a slightly healthier combination of actual growth plus inflation that may be sustainable as they are being driven by actual wage gains, driving pricing power from the bottom up. In fact, without the commodity inflation that the US is exporting around the World, we may even have a legitimate recovery on our hands.

Meanwhile, Australian Consumer Prices gained the most in 5 years last Quarter, up 1.6% in 3 months. The report propelled Australia’s currency to the highest level since it was freely floated in 1983 as measures that strip out volatile prices such as food and energy exceeded forecasts. The Reserve Bank of Australia has held rates at 4.75 percent for the past four meetings to help Queensland’s economy recover from damage and destruction to mines and crops.

“Even in the absence of flood distortions, core inflation spiked higher and arguments suggesting today’s result is a one- off have no merit,” said Adam Carr, a senior economist at ICAP Australia Ltd. in Sydney. “With an unemployment rate of 4.9 percent, the RBA needs to remember its mandate and hike rates.”

A mandate to control inflation - imagine that! 33 of 44 economists surveyed by Bloomberg feel the Fed MUST remove "extended period" from today's statement - indicating, in the very least, that our zero-rate policy will come to an end in 2011. Meanwhile, Barclays (BCS) is trying to stay ahead of the Fed by auctioning off $900M in commercial real estate assets, including the St. Regis in Washington, DC and the 4 Seasons in Vail - two properties I wouldn't mind owning. This is a dump of almost 1/3 of their US commercial holdings as they wisely sell into the excitement of the little bounce we've gotten in CRE.

A mandate to control inflation - imagine that! 33 of 44 economists surveyed by Bloomberg feel the Fed MUST remove "extended period" from today's statement - indicating, in the very least, that our zero-rate policy will come to an end in 2011. Meanwhile, Barclays (BCS) is trying to stay ahead of the Fed by auctioning off $900M in commercial real estate assets, including the St. Regis in Washington, DC and the 4 Seasons in Vail - two properties I wouldn't mind owning. This is a dump of almost 1/3 of their US commercial holdings as they wisely sell into the excitement of the little bounce we've gotten in CRE.

PIMCO says we are at a "Keynesian Endpoint" in the "QE2 Ponzi Scheme" and calls for a shift to proper stimulus in the US, including infrastructure spending as the only sensible way to get the US back on their feet. Like China, PIMCO owns many hundreds of Billions of Dollars worth of US paper, which is looking more and more like junk bonds every day and, like China, they are threatening the Fed, in no uncertain term - letting them know that, should they persist in this mad money printing - the will begin competing with Treasury by selling their notes as fast as people will buy them. This will leave the Fed as the ONLY buyer of our own debt - a ridiculous and unsustainable situation.

The U.S. must invest in its people, its land, and its infrastructure, as well as promote free trade, to achieve economic growth rates fast enough to justify consumption levels previously supported by debt. - PIMCO

Good luck with that plan and good luck to all of us today as we wait for this afternoon's Fed decision.

Picture credit: Elaine Supkis, Culture of Life News

To try Phil's Stock World, click here >

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.