Robust Global Gold Demand - Rising by 19% in Third Quarter

Commodities / Gold & Silver Nov 15, 2007 - 09:26 AM GMTBy: Gold_Investments

Gold

Gold

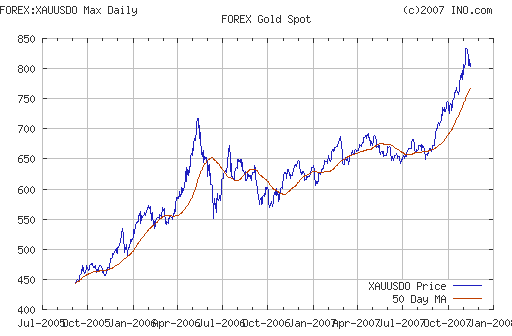

Gold was up $15.40 to $812.40 per ounce in New York yesterday and silver was up 44 cents to $14.99 per ounce. It traded sideways in Asia and has sold off in European trading and is at $803.50 per ounce at 1200 GMT. Gold is flat in GBP and EUR. It is trading at £392.90 GBP (from £393) and €549.80 EUR (down from €550).

Gold is well supported near the recent double lows at $790 per ounce and below that at the 50 day moving average at $767. Unless there is a sharp sell off in oil and a sharp sustained rally in the dollar, gold is unlikely to suffer a sharp sell off and will remain strong and may challenge recent highs in the near term.

The World Gold Council (WGC) confirmed yesterday that gold demand remained very robust in the third quarter. Global gold demand in the third quarter rose a very significant 19 percent year-on-year to 947.2 metric tons on the back of improved jewelry consumption and more importantly, robust inflows into bullion investment funds.

The World Gold Council thus confirmed that real physical demand is fueling this bull market and it is not a speculative bubble.

A surge in investor interest on top of robust jewellery demand made Q3 2007 a further quarter of strong demand for gold. Jewellery demand rose by 6% in tonnage terms over Q3 2006 and by 16% in dollar terms. However, identifiable investment demand was nearly double year-earlier levels in tonnage terms due to a record inflow into Exchange Traded Funds and similar products. The rise in dollar terms was 115%.

The quarter saw a change in demand patterns as investors took over from jewellery buyers as the dominant force in September. The slowdown in jewellery demand was sharper in India than in China (where the price rise had little effect) or in the Middle East.

Industrial and dental demand in Q3 was little changed from year-earlier levels. The supply of gold was more plentiful than in recent quarters due to a sharp reduction in de-hedging by mining companies and to higher central bank sales and not due to increased gold production. As central bank sales slow and they become net buyers this will also contribute to higher prices.

Forex and Gold

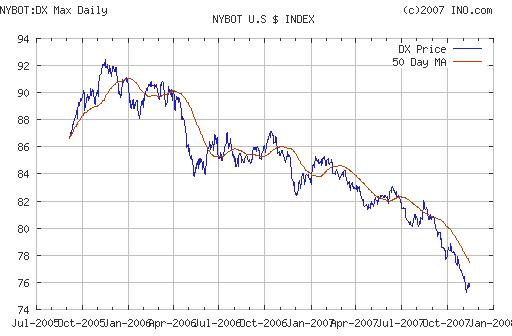

The dollar is largely flat against the EUR at 1.462 (from 1.466) but has strengthened against GBP at 2.045 (from 2.067). The slowdown in the UK housing market and economy is likely to lead to interest rate cuts in the UK (despite record fuel and food prices and rising inflation).

Traders believe the US Federal Reserve will decrease interest rates again in December. Federal fund futures currently price in a 98 percent chance of a 25bp rate cut in December.

Decreasing interest rates in an increasingly stagflationary macroeconomic climate is very inflationary and very bullish for gold as it was in the 1970s.

Silver

Silver is trading at $14.82 at 1200 GMT.

PGMs

Platinum was trading at $1419/1424 (1200 GMT).

Spot palladium was trading at $364/368 an ounce (1200 GMT).

Oil

Light, sweet crude for December delivery rose to $94.16. Oil steadied after rebounding strongly yesterday, as traders awaited U.S. data expected to show crude stocks fell for a fourth straight week last week.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.