Hedge Funds Speculators and Their Poverty Premium

Politics / Financial Markets 2011 Apr 26, 2011 - 03:20 AM GMTBy: BATR

The short sale protection racket known as hedge funds is a speculators’ dream come true.

The short sale protection racket known as hedge funds is a speculators’ dream come true.

According to Investopedia, What Does Hedge Fund Mean? is defined as, "An aggressively managed portfolio of investments that uses advanced investment strategies such as leveraged, long, short and derivative positions in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Hedge funds use dozens of different strategies, so it isn't accurate to say that hedge funds just "hedge risk". In fact, because hedge fund managers make speculative investments, these funds can carry more risk than the overall market".

The public intuitively understands the practice of speculators. Gambling to make a quick buck is a simple concept. However, the use of esoteric financial instruments to squeeze out gains and shift risks onto the backs of other parties escapes most observers. Yet it smells of a stacked deck.

Shorting a market or a currency is a tactic used to make fast cash. If you are correct in the collapse of the stock or exchange rate, you can make a killing. However, if you bet wrong the losses can be terminal. Thus the invention of managing risk by hedging your positions became commonplace.

On the surface, this protection seems prudent. However, the mechanics of manipulating puts becomes a session of playing musical chairs. When the song stops, the abrupt result has someone holding the bag.

Gabriel Kurland in Hedge Fund Hidden Risks Identification makes the following points.• Option Sellers can exhibit no down month for a long period of time until their fat tail show up

• Since the 1998 Russian Debt crisis, financial markets around the world have experienced at least 10 extreme shocks none of which were supposed to occur more than once every few billion years (assuming a normal distribution)

• Strategies like Convertible Arbitrage or Mortgage Backed Securities are exposed to an array of very complex Default risk, Credit Risk, Interest Rates risk, Early Repayment risk, Volatility risk

If a hedge fund wants to speculate with funds of high net wealth players, charge 2% fee on the capital, and take 20% of the gains, some may say so what. Yet the full negative impact of shorting is hidden from the public with parodies of greedy capitalists, when the largest speculator of all is the Federal Reserve. The accompanying proof demonstrates the desperate condition of the counterfeit national currency.

"The Committee could sanction the use of various derivative instruments on conventional Desk operations as a way to influence longer-term yields, which is outlined in exhibit 8. Options of some form are a possibility, as are forward operations. For example, we could sell a sequence of options on term RPs, covering interlocking time segments that collectively extend as far into the future as desired. In this way, longer-term yields could be influenced and a visible signal of the Fed’s desired path of interest rates could be demonstrated. Forward operations in term RPs could be structured in a similar fashion. Alternatively, we could sell put options on longer-term Treasury securities at strike prices associated with desired longer-term yields.

The other idea I found interesting is selling put options on Treasury securities. Cynically, this could be the salvation for everybody who hedges mortgage securities with long Treasuries. We may be the counterparty of choice. I would like to understand that because the options market is not very deep and I’d like to see how deep it is. If we went that way, how much room would we really have to inject a quantity of liquidity? Or is the scope relatively limited so that we’d have to build a market? So, I think it would be useful to explore further some of these issues that deal with liquidity and the options we have if we want to go the quantitative route."

The Greenspan era at the Fed provided the fuel to burn up the dollar and heightened the oxygen level to expand the debt. In Greenspan We Trust, irrational exuberance was perfected.

"Greenspan, or any Fed head, contrary to popular perception, is no more an architect of prosperity than a president. But the oracle of the central bank can engender conditions that can severely inhibit the normal course of wealth creation. While juggling interest rates effect markets and redirects business decisions, their setting are not instantly transformed into profit. Confidence is the name of the game. A reasonable expectation that financial conditions will generate ongoing and profitable commerce is the desired objective."

The hedge fund model contradicts the fundamental tenants of capitalism. The goal of free enterprise is to create tangible wealth through commerce and business endeavors. By definition, the fruits of production and innovation flow to Main Street if the venture operates under the canons of utilitarian function. Capital is just one component in the process of organizing and operating a real business.

The speculator is spawned in a stateroom on the Mississippi River paddlewheel. Their passion is for the excitement of the game and money is the tally for keeping score. They are not serious businessmen. Merge the adrenalin junkie of a future trader background with the peddler of a traveling snake oil salesman and you have the profile of a hedge fund manager.

The adverse financial consequences of their ritual euthanasia practice, destroys a healthy economy and starves citizens from access to capital for productive activities. Whining hedge fund proponents will scream that their transactions enhance liquidity for markets. This viewpoint ignores the only real legitimate purpose for a mercantile exchange, which is the raising of capital to fund business enterprises that actually create wealth. Hedge funds skim off money that should be used to build businesses that employ domestic workers. When the velocity of money changes hands with rapidity and consumers and businesses have solid confidence that future spending can and be made from earnings and creative efforts, you have the makings of a viable economy.

The mechanics of how a hedge fund operates is described effectively in How Investment Banks and Hedge Funds Steal Money Legally! The scheme is too long to cite, so read the example for the nuts and bolts techniques that speculators use to wangle out their pound of flesh from the ordinary equity owners of a stock. The result of this lewd process is summed up accordingly."When all is said and done, you more than likely doubled the initial investment capital on one stock in just three weeks. Sure, the back and forth of buying and selling is nerve wracking and time consuming. Trying to keep the buying and selling of options straight is obviously no small feat but you can always take the next month off now that you've legally stolen millions of dollars in investment capital from smaller investors through your effective understanding of how BIG money can manipulate the stock market and legally steal the small investor's capital for your profit!"

If a hedge fund operator with $100,000,000 can cash in so handsomely, just what are the limits on the private Federal Reserve when they control the actual origination of the world reserve currency itself? How could any moral person deny that Ron Paul’s initiative to audit the Fed is a rational and necessary requirement?

Banning thievery practices of sophisticated exploitation has never been more important. The reason why hedge funds are protected under the cover of legal auspices is that the banksters are blood brothers of the speculators family of con men, and their godfathers are the controllers of the Federal Reserve money machine.

Bubbles in markets are designed collapses that benefit the short seller. When arbitrage betting a market has no real risk, ill-gained proceeds are virtually guaranteed. In the instant of a rare market reversal beyond their hegemony, their over leverage losses are made good by the taxpayer. The transfer of the net wealth of Middle America is a foregone conclusion under a regime that games the financial markets under the pretext of hedging risks.

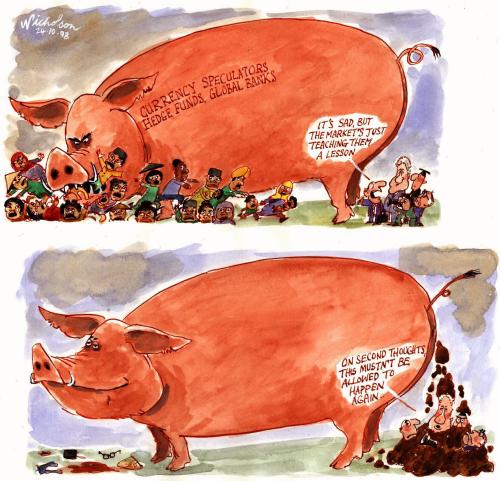

The saying, "Bulls Make Money, Bears Make Money, Pigs Get Slaughtered - Wall Street Truisms that Stand the Test of Time", does not apply to the Fed. Ben Bernanke is the Myron Lansky of the ultimate syndicate. The prosecutor told jurors in his summation at the insider-trading trial of the Galleon Group LLC, co-founder "Raj Rajaratnam corrupted friends and employees of his hedge fund to "conquer" Wall Street."

Bernanke and his crew at the Fed are bent on conquering the globe by selling short the dollar. The needful lesson for the biggest hedge fund hoaxer is: "A chazer bleibt a chazer" - A pig remains a pig.

Discuss or comment about this essay on the BATR Forum

© 2011 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.