Playing the Lyre of U.S. Budget Madness as the Empire Burns

Politics / Government Spending Apr 14, 2011 - 02:14 AM GMTBy: BATR

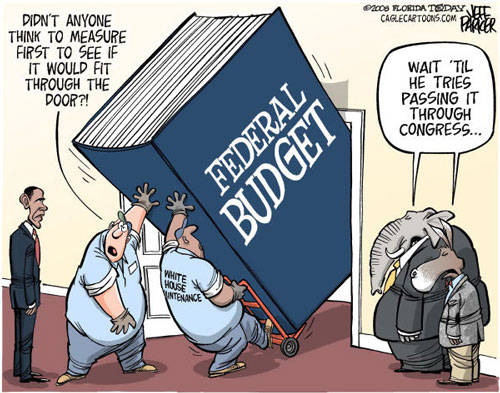

SARTRE writes: By Washington DC standards the just concluded budget agreement for funding the federal government through September, is a big win for Republicans. Emily Miller in Human Events describes, "The final agreement will be for $38.5 billion in cuts from current spending over the remaining six months of the current fiscal year, which ends on Sept. 30. The spending cuts, although historic in size, account for only 2.5% of this year's projected budget deficit of $1.6 trillion." Here lies the obscenity of the central government; namely, that a mere drop in the bucket reduction in a historic deficit is lauded as the great achievement of compromised negotiations.

SARTRE writes: By Washington DC standards the just concluded budget agreement for funding the federal government through September, is a big win for Republicans. Emily Miller in Human Events describes, "The final agreement will be for $38.5 billion in cuts from current spending over the remaining six months of the current fiscal year, which ends on Sept. 30. The spending cuts, although historic in size, account for only 2.5% of this year's projected budget deficit of $1.6 trillion." Here lies the obscenity of the central government; namely, that a mere drop in the bucket reduction in a historic deficit is lauded as the great achievement of compromised negotiations.

Viewing the inside partisan game and keeping score between two branches of the same corrupt party system guarantees habitual surrender to the curse of public debt. How can any far-sighted and judicious person accept that victory is defined as curbing the speed of an out of control train rushing to cross a trestle with rotten support timbers as a flood washes away the foundation of the structure? In today’s twilight zone of self-delusion, the mainstream media and political apologists pontificate that the ship of state was saved from crashing upon the reef of sunken vessels. REALLY !!!

March Madness: U.S. Gov't Spent More Than Eight Times Its Monthly Revenue, points out the incontrovertible.The Wall Street Journal in Debt Ceiling Looms as Next Big Battle, sets up the next round."The U.S. Treasury has released a final statement for the month of March that demonstrates that financial madness has gripped the federal government.

During the month, according to the Treasury, the federal government grossed $194 billion in tax revenue and paid out $65.898 billion in tax refunds (including $62.011 to individuals and $3.887 to businesses) thus netting $128.179 billion in tax revenue for March.

At the same, the Treasury paid out a total of $1.1187 trillion. When the $65.898 billion in tax refunds is deducted from that, the Treasury paid a net of $1.0528 trillion in federal expenses for March.

That $1.0528 trillion in spending for March equaled 8.2 times the $128.179 in net federal tax revenue for the month."

"The divisive fight has raised concerns among lawmakers and government officials that Democrats and Republicans in Congress will find it even harder to decide whether to increase the federal debt ceiling above $14.294 trillion in the next few weeks. And after that, they will have to turn to crafting a government budget for 2012 and eventually to tackling the long-term federal deficit."

Enter Paul Ryan’s proposed alternative GOP budget. Watch The $4 Trillion Man WSJ video for an analysis of a serious attempt, echoing the famous words of Winston Churchill, "Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning." If you really believe this claptrap, you must be one of those beleaguered souls who still contribute to the financial appeals of your anointed incumbents for the next election.

Ryan’s own video pitch, The Path to Prosperity, honestly admits the severity of the debt juggernaut that dooms the Republic. His key points and summary are a mandatory read.

SPENDING |

DEBT AND DEFICITS |

TAXES |

Cuts $6.2 trillion in government spending over the next decade compared to the President’s budget, and $5.8 trillion relative to the current-policy baseline. Eliminates hundreds of duplicative programs, reflects the ban on earmarks, and curbs corporate welfare bringing non-security discretionary spending to below 2008 levels. Brings government spending to below 20 percent of the economy, a sharp contrast to the President’s budget, in which spending never falls below 23 percent of GDP over the next decade. |

Reduces deficits by $4.4 trillion compared to the President’s budget over the next decade. Surpasses the President’s low benchmark of sustainability – which his own budget fails to meet – by reaching primary balance in 2015. Puts the budget on the path to balance and pays off the debt. |

Keeps taxes low so the economy can grow. Eliminates roughly $800 billion in tax increases imposed by the President’s health care law. Prevents the $1.5 trillion tax increase called for in the President’s budget. Calls for a simpler, less burdensome tax code for households and small businesses. Lowers tax rates for individuals, businesses and families. Sets top rates for individuals and businesses at 25 percent. Improves incentives for growth, savings, and investment. |

"Republicans want to spend $40 trillion over ten years. That averages a staggering $4 trillion per year. As recently as 2000, federal spending was only about $1.8 trillion.

They also want to increase the federal debt from $15.0 trillion to $23.1 trillion. I hope our children and grandchildren enjoy paying interest on that extra $8.1 trillion."

Again, if you view this debate in ‘Beltway" terms, Ryan’s bold budget is manna from heaven. Yet the truth about the rejection of "reality culture" is that the political class ignores the irrefutable fact that there is no way to grow the economy enough to produce sufficient revenue for continued servicing of the interest, much less retiring the debt principle.

"Ryan basically stole the budget bacon from President Obama, who should have put this kind of plan in his State of the Union. He didn't. And now he's got to play catch-up. The Senate Democrats are utterly hopeless. But the public mood is still where it was last fall: less government spending and borrowing. Ryan delivers on that and then some with his tax-cut growth booster."

Kudlow is correct about the Democrats, especially about the commander in chief for the indomitable government of theft.

Nero Claudius Caesar Augustus Germanicus and Barack Barry Soetoro Hussein Obama have much in common. Both fiddled when their empire burned. Both incompetent egomaniacs and extreme fanatics worshiped an imperial cult. Both required a scapegoat to blame their failures upon and create a diversion away from their own hands. If Nero uttered his last words, "Qualis artifex pereo" -- "What an artist dies in me!", Obama needs to wail "This is not what you promised me." (Read for the significance)

Nero Claudius Caesar Augustus Germanicus and Barack Barry Soetoro Hussein Obama have much in common. Both fiddled when their empire burned. Both incompetent egomaniacs and extreme fanatics worshiped an imperial cult. Both required a scapegoat to blame their failures upon and create a diversion away from their own hands. If Nero uttered his last words, "Qualis artifex pereo" -- "What an artist dies in me!", Obama needs to wail "This is not what you promised me." (Read for the significance)

What emerges from the budget battle is the clear distinction of opposing viewpoints. The idea that compromise is a necessary aspect of the legislative process is as absurd as the distorted rationalization that the federal government has earned the right to claim legitimacy because it has the power to enforce despotic policies upon a servile population.

The Ryan budget will be fought to the last man standing by the barbarians that claim to be Senators. They practice the proud tradition of debasement. When first introduced, the denarius was a coin, 4.5 grams of pure silver. "With the accession of Nero, however, the content was debased to 3.8 grams, perhaps as a reflection of the high cost of rebuilding the city and his palace, after the fires." This deranged Roman Emperor pillaged the treasury, but in comparison to the sums of credit floated in an expanding universe of the Obama Kingdom, not all the gold in his homeland continent of Africa could keep pace with the mounting debt obligations of T-Bills.The Democratic Party is incapable of governance. Their despotism rests upon the fraud of legitimacy of state authority. The plebeians that beg for bread from the patrician largesse in order to serve in the legions of imperial folly are reduced into the same slavery as the populace of their global empire conquests. The Republican Party does not have the moral integrity of a Cato the Younger in their ranks. Where are the GOP disciples of Cato the Elder, willing to do battle against the statist traitors of the Republic? Where are the conservative torchbearers of Cicero ready to confront the arrogance and treason of a Caesarian dynasty?

A total government shut down should be seen as a necessary step to achieve the dismantling of a corrupt order and the restoration of universal relief. The debt cannot be paid. It must be repudiated with a formal default. Any budget that does not eliminate the myriad of oppressive bureaucracies is bogus. The welfare society and global garrison empire must end. The burning house of cards is collapsing and authentic Christians did not cause the fires that lay at the feet of crazed emperors. Ordinary citizens deserve the fruits of liberty. A civil war against the Globalist New World Order is entering an early stage. When the final demise of the financial markets erupts, who will cheer All Hail Caesar?

Discuss or comment about this essay on the BATR Forum

© 2011 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.