Silver Reaches New 38-Year High at $38.50/oz - Backwardation Ends But COT Data is Bullish

Commodities / Gold and Silver 2011 Apr 04, 2011 - 10:23 AM GMTBy: GoldCore

The positive momentum of gold and silver continue with both higher in European trade as oil prices have risen due to geopolitical tensions in oil rich nations and the euro has fallen on Eurozone debt concerns.

The positive momentum of gold and silver continue with both higher in European trade as oil prices have risen due to geopolitical tensions in oil rich nations and the euro has fallen on Eurozone debt concerns.

Focus will be on interest rates this week with the ECB likely to increase interest rates, and renewed speculation as to whether the Federal Reserve will attempt to increase interest rates or embark on QE3.

Contrary to some misinformed analysis, rising interest rates will be bullish for gold and silver as they were in the 1970s.

Silver for immediate delivery has gained another 1.7 percent to $38.50 an ounce, the highest level since February 1980, the year silver reached a record of $50.35/oz. An ounce of gold bought as little as 37.32 ounces of silver in London today, the lowest level since September 1983.

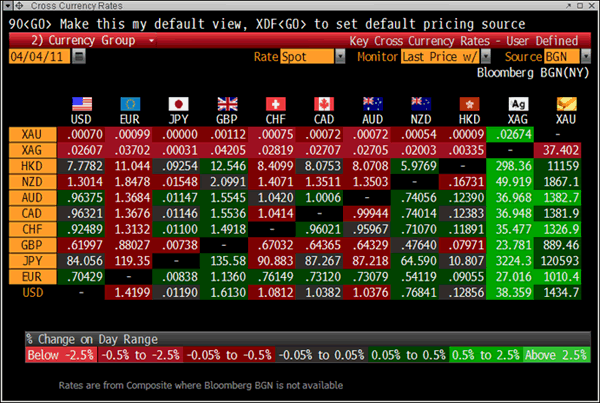

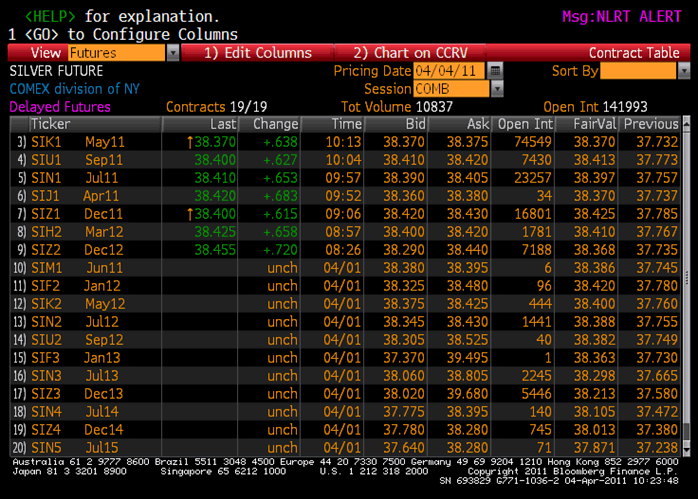

Silver has come out of backwardation and returned to contango with longer dated future prices again higher than nearer month contracts and spot for delivery (see table below). This suggests that default on the COMEX, as warned of by some analysts, is not imminent and the tightness seen in the physical silver market may have abated somewhat.

However, the Dec 12 contract trading at only cents over spot for delivery (less than 10 cents) suggests that tightness remains. Given the degree of tightness in the physical silver market, silver may return to backwardation sooner rather than later.

While silver is overbought in the very short term, its outlook remains bullish.

Momentum remains very strong with a series of higher weekly, monthly, quarterly and annual price gains. Silver remains the preserve of a handful of contrarian and hard money advocates and is only beginning to enter the consciousness of the mainstream. Allocations remain tiny compared to allocations to conventional investments.

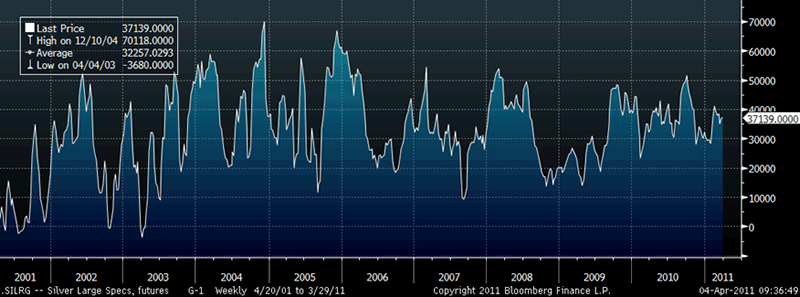

Finally, speculative fever is not only missing from the mainstream public (most of whom would not even know the price of an ounce of silver) but it also remains subdued on the COMEX on Wall Street. Little or no irrational exuberance or “piling in” being seen in the trading pits. The latest COT report shows speculative long positions, or bets prices will rise, outnumbered short positions by 37,139 contracts (see chart below). This is a level of net longs by hedge fund managers and other large speculators that was seen as long ago as 2002.

Silver Large Speculators, Futures

Thus, despite silver’s sharp gains in recent months, speculative fever remains very tame. This may suggest that much of silver’s gains in recent weeks may have been short covering by Wall Street banks being investigated by the CFTC for holding massive concentrated short positions.

There is also evidence that some hedge fund managers are choosing to bypass the COMEX and buy actual physical silver bullion in allocated accounts.

Gold

Gold is trading at $1,437.90/oz, €1,012.04/oz and £891.00/oz.

Silver

Silver is trading at $38.48/oz, €27.08/oz and £23.85/oz.

Platinum Group Metals

Platinum is trading at $1,782.00/oz, palladium at $781/oz and rhodium at $2,350/oz.

News

(Bloomberg) -- Silver Climbs to $38.23 An Ounce, Highest Since February 1980

Silver for immediate delivery rose 1.1 percent to $38.23 an ounce by 7:52 a.m. in London, the highest price since Feb. 13, 1980.

(Bloomberg) -- Gold May Advance on Geopolitical Risks, Outlook for Inflation

Gold, trading little changed, may advance as investors buy the precious metal to shield their wealth from geopolitical risks and rising inflation.

Immediate-delivery bullion traded at $1,430.95 an ounce at 1:57 p.m. in Singapore compared with last week’s close of $1,428.80. Gold for June delivery in New York rose 0.2 percent to $1,431.80 an ounce.

“Geopolitical risks linked to the Middle East and Japan, as well as the European debt crisis, have yet to show an improvement,” said Hwang Il Doo, a Seoul-based senior trader at KEB Futures Co. “These, coupled with the inflation outlook, will continue to power gold.”

Libyan leader Muammar Qaddafi’s acting foreign minister, Abdul Ati al-Obeidi, met with Greece’s prime minister yesterday to seek a political solution to the nation’s crisis, Greek Foreign Minister Dimitris Droutsas said. The U.S., Britain and France have been enforcing a United Nations-backed no-fly zone over the country as rebels battle Qaddafi’s forces for control.

In Japan, Tokyo Electric Power Co.’s attempt to clog a cracked pit with sawdust, newspaper and plastic failed to stop radioactive water leaking into the sea from a crippled power plant, which was damaged in the March 11 quake and tsunami.

Marc Faber, publisher of the Gloom, Boom & Doom report, said last week investors should have 10 to 20 percent of their portfolio in gold as an inflation hedge. The unemployment rate in the U.S. unexpectedly fell to a two-year low of 8.8 percent in March, adding to evidence that a recovery in the world’s largest economy is gaining traction.

Survey Outlook

Eleven of 25 traders, investors and analysts surveyed by Bloomberg, or 44 percent, said that bullion will rise this week. Nine predicted lower prices and five were neutral. Spot gold reached an all-time high of $1,447.82 an ounce on March 24.

Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended March 29, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 193,121 contracts on the Comex division of the New York Mercantile Exchange, the commission said in its Commitments of Traders report. Net-long positions rose by 18,284 contracts, or 10 percent, from a week earlier.

“We believe prices will remain supported as long as real interest rates stay low and trepidation over global growth prevails,” Hussein Allidina, head of commodity research with Morgan Stanley Research, wrote in a note to clients.

Cash silver rose 0.6 percent to $38.025 an ounce, approaching the highest level since 1980. The metal last touched $38.165 an ounce on March 24.

Palladium for immediate delivery increased 0.3 percent to $775.75 an ounce, while platinum was little changed at $1,763.13 an ounce.

(PTI) -- India's gold demand to rise over 1,200 tonnes by 2020: WGC

Gold demand in India will continue to grow and is likely to reach 1,200 tonnes or approximately Rs 2.5 trillion by 2020, at current price levels, according to a research by World Gold Council (WGC).

"The rise of India as an economic power will continue to have gold at its heart. India already occupies a unique position in the world gold market and, as private wealth in India surges over the next ten years, so will Indian demand for gold", WGC Managing Director for India and the Middle East Ajay Mitra said in a statement here.

Indian gold demand has grown 25 per cent despite 400 per cent price rise of the rupee in the last decade, making the country a key driver of global gold demand, the research said. Gold purchases in India accounted for 32 percent of the global total in 2010.

Further, the council expects an increase by over 30 per cent in real terms.

"India's continued rapid growth which will have significant impact on income and savings, will increase gold purchasing by almost 3 percent per annum over the next decade," the council said in a statement.

It added, "In gold terms, India is a market with significant scale. In 2010, total annual consumer demand reached 963.1 tonnes. As seen in the last decade, Indian demand for gold will be driven by savings and real income levels, not by price".

According to Mitra, in parallel to growth, socio and demographic challenges will need to be addressed given its immense diversity.

"This also applies to the gold market. Nevertheless, gold purchasing will continue, underpinned by India's long-standing and deep cultural affinity for gold; a love affair which transcends generations and makes India unlike any other gold market," he said.

At more than 18,000 tonnes, Indian households hold the largest stock of gold in the world.

'India: Heart of Gold' is the second in a series of WGC research with focus on India.

The first paper, 'India Heart of Gold: Revival' was released in November 2010, and focused on the historical demand of the past 10 years and the revival in 2010.

Together they form a compendium, with the latest research including forecasts from the Centre for Monitoring the Indian Economy (CMIE), as well as contributions from leading academics and industry experts, Dr. D. Pattanaik and Dr. R. Kannan, which have been specially commissioned for the World Gold Council.

(Bloomberg) -- Silver Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York silver futures in the week ended March 29, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 37,139 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 364 contracts, or 1 percent, from a week earlier.

Silver futures rose this week, gaining 1.8 percent to $37.73 a troy ounce at today's close.

Miners, producers, jewelers and other commercial users were net-short 55,295 contracts, an increase of 113 contracts from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.