Gold and Silver Higher as Eurozone Downgrades

Commodities / Gold and Silver 2011 Mar 30, 2011 - 07:10 AM GMTBy: GoldCore

Gold and, particularly, silver are higher in European trading, especially in Japanese yen, which has come under pressure again today. The initial 'repatriation funds' yen rally in the days after the natural and nuclear disaster has abated.

Gold and, particularly, silver are higher in European trading, especially in Japanese yen, which has come under pressure again today. The initial 'repatriation funds' yen rally in the days after the natural and nuclear disaster has abated.

Gold is again close to record nominal highs in yen (119,000/oz) and other currencies. The outlook for the yen is not good due to massive fiscal and demographic challenges, zero percent interest rates and ongoing currency debasement - none of which will be helped by the nuclear disaster.

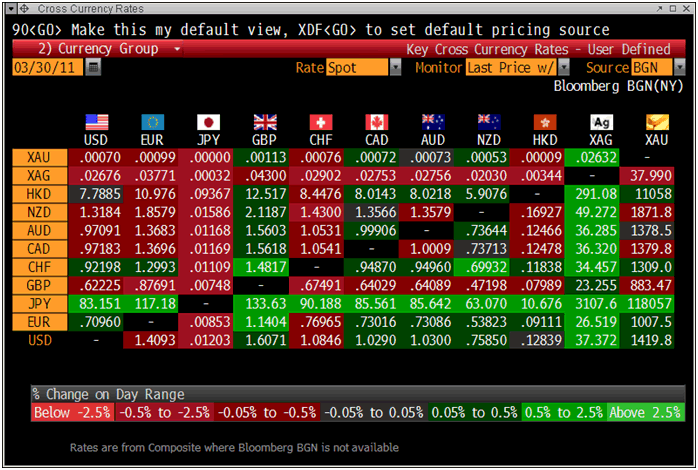

London AM Fix - Cross Currency Rates (1030 GMT)

Risk appetite remains high with investors buying equities and shrugging off considerable geopolitical and sovereign debt risk. The downgrades of Portugal and Greece have led to new record high 10-year bond yields for both - at over 8.02% and 12.73% respectively.

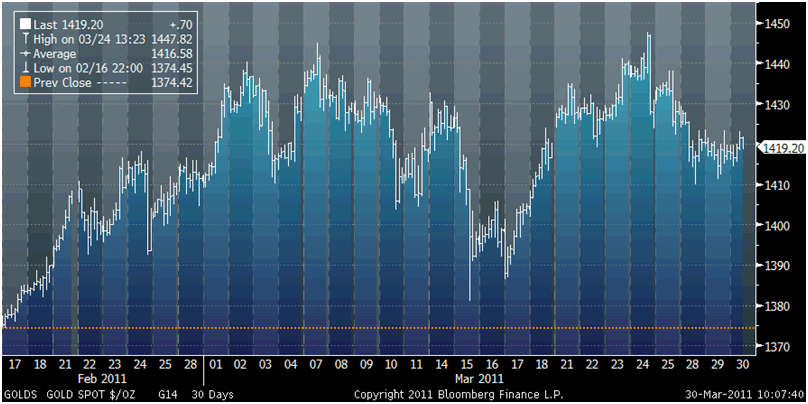

Gold in US Dollars - 17 February 2010 - 30 March 2011 (Tick)

Gold is supported at $1,410/oz and at $1,380/oz and €995/oz. A close above the record nominal high of $1,447.82/oz would likely see gold rise to psychological resistance of $1,500/oz in short order.

Gold commenced 2011 at $1,420.78/oz and with two days of trading left in the first quarter, gold is marginally higher at $1,420/oz. It is therefore flat for the quarter after another quarter of correction and consolidation.

A lower quarterly close would be the first lower quarterly close in 9 quarters. This may be beneficial to some of those short the gold market who may be attempting to 'paint the tape' and engineer a lower quarterly close - in the forlorn hope that this could lead to momentum selling by trend, following hedge funds and traders.

A lower quarterly close may be achieved but the fundamentals of anaemic supply and continuing strong demand both from the investment sector, but also from the jewellery and industrial sectors (dental and electronics primarily) internationally, and particularly in China and Asia in general will likely see gold continue to rise in 2011.

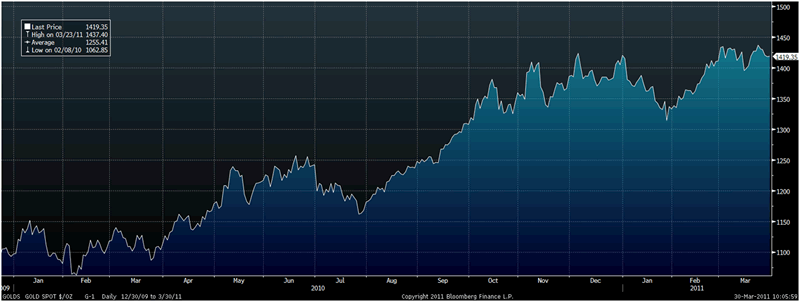

Gold in US Dollar - 1 January 2010 - 30 March 2011 (Daily)

Interestingly, March 2010 and the first quarter last year (see chart above), also saw gold flatline prior to strong gains in April and the second quarter of 2010 (Q2 10). Gold rose by nearly 6% last April and by nearly 12% in the quarter.

The unresolved eurozone debt crisis and the emergence of the Japanese natural and nuclear disasters and geopolitical risk in oil producing nations means that the fundamentals today are as sound as they were in 2010 - if not more sound.

Bearish predictions that higher gold prices would lead to sharp falls in industrial and jewellery demand are being proven wrong as seen in the figures released by the CPM group this morning (see news).

Gold

Gold is trading at $1,418.94/oz, €1,008.84/oz and £883.09/oz.

Silver

Silver is trading at $37.38/oz, €26.58/oz and £23.27/oz.

Platinum Group Metals

Platinum is trading at $1,741/oz, palladium at $748/oz and rhodium at $2,350/oz.

News

(MSN Money) -- Gold price may hit $US1,600 an ounce

The gold price could climb to a record $US1,600 an ounce this year if investment demand remains strong amid sovereign debt fears, a metals consultancy says.

London-based GFMS World Gold Ltd managing director Paul Burton said the gold price was likely to remain strong this year.

Gold, at about $US1,420 an ounce, is nearing the recent all-time record of $US1,444 an ounce.

"We're probably going to see the $US1,500 (per oz mark) broken and certainly the $US1,600 mark is within range this year," Mr Burton told Paydirt's Gold Conference in Perth on Wednesday.

"We're still quite optimistic, going out for two years.

"But I could be speaking here this time next year and the whole economic scene could have changed radically."

He said all the economic factors were lined up for investment demand to stay high for gold.

"It really depends on how the major economies of the world, how the governments, react and try to keep growth within our economies," Mr Burton said.

"How you see governments respond to the economic crises around the world and if they continue with their quantitative easing, it is going to have a major impact on investor demand and where the gold price is going.

"If we start to see countries, central banks especially ... increase interest rates, other investments will start to look attractive.

"But if we do see the gold price fall, you're not going to see anything below $US900.

"I think the base level is pretty high.

"We don't certainly see the gold price going down to the 2001 $US250 an ounce level again."

Mr Burton warned delegates that rising costs of production would continue to be a challenge for gold miners.

"Basically, the sector needs the gold price to stay above $US800 an ounce for a producer to stay in business," he said.

(Bloomberg) -- Japan Says Radiation From Nuclear Plant Not 'Big' Seafood Threat

Japan's government said levels of radiation emitted from the crippled Dai-Ichi nulcear plant in Fukushima will not have a "big impact" on seafood. The plant including reactors No. 5 and No. 6 will be shut down and the government hasn't ruled out sealing the facility in concrete, Chief Cabinet Secretary Yukio Edano told reporters today in Tokyo.

(Bloomberg) -- Mali Cuts 2011 Gold Output Forecast More Than 17%, Reuters Says

Mali cut the amount of gold it expects to produce this year by more than 17 percent after mining companies reduced their guidance, Reuters reported, citing Bafa Sangare, an official at the Ministry of Mines.

The West African nation now expects to produce about 49.58 metric tons of the precious metal, down from an earlier forcast of more than 60 tons, the news agency said.

(Bloomberg) -- Odyssey Hunts Nazi-Torpedoed Ship's $260 Million of Silver

Odyssey Marine Exploration Inc., the ocean salvager featured in the Discovery Channel series "Treasure Quest," is trying to recover silver valued at as much as $260 million by October from a ship torpedoed by a Nazi submarine in 1941.

The Tampa, Florida-based company was awarded a contract by the U.K. government last year that would allow it to keep about 80 percent of the bullion treasure of the S.S. Gairsoppa, a cargo steamer sunk by a German U-boat off the Irish coast. There's an estimated 4 million to 7 million ounces at the shipwreck site, according to Odyssey President and Chief Operating Officer Mark Gordon.

"This is the year we're going to go out and find it," Gordon said in an interview. He said the cost of the search would be less than $10 million. "The total survey and recovery costs will be a fraction of the value," Gordon said.

Odyssey aims to salvage Gairsoppa's cargo from beneath as much as 14,000 feet (4,270 meters) of water amid surging prices for silver, which has more than doubled in the past year, and gold, which rose to a record last week. The company recovered 17 tons of gold and silver coins in 2007 in an Atlantic Ocean operation it codenamed Black Swan. It also plans to hoist treasure from at least five other ships, including HMS Sussex, which sank in 1694 near Gibraltar and may hold gold that the New York Times has estimated is valued at as much as $4 billion.

'Big Idea'

"We've got a buy rating on the stock; it's what we call a big idea," Mark Argento, a Minneapolis-based analyst at Craig- Hallum Capital Group LLC, said in a telephone interview. "It's got biotech-type returns without the massive upfront capital. The next few months should prove interesting."

Odyssey climbed 41 cents, or 15 percent, to $3.15 at 11:21 a.m. in Nasdaq Stock Market trading. The shares doubled in the 12 months through yesterday.

Odyssey's other salvaging targets include HMS Victory, which sank off England in 1744 carrying 100,000 ounces of gold, and the Enigma, Shantaram and Firebrand, three merchant ships estimated to have cargoes worth at least $50 million each, Gordon said.

"We're probably the most excited we have ever been," Gordon said of the 17-year-old salvaging company that was featured in the Discovery series in 2009. "We have more projects at relatively late stages than we've ever had in the history of the company."

Wreck Hunters

Depending on the weather, hunting for the Gairsoppa may start as early as May using sonar, metal detectors and undersea robots, Gordon said. The wreck's condition will help determine how quickly the cargo can be extracted, he said.

Odyssey has also signed deals to mine the South Pacific sea floor. Companies such as Nautilus Minerals Inc., Neptune Minerals Plc and an AngloGold Ashanti Ltd. joint venture are seeking gold, copper and silver deposits with technology adapted from deep-water oil exploration.

Odyssey has agreed with closely held Neptune to mine gold, silver, zinc and lead off New Zealand for $3 million in cash and as much as 15 percent of the London-based company's equity, Gordon said. Odyssey also owns 41 percent of closely held Dorado Ocean Resources, which plans to drill near the Solomon Islands in the next few months, he said.

Odyssey returns to the U.S. appeals court in May, Gordon said, to fight a Spanish government claim for about $500 million in coins the salvager found and hauled from the bottom of the Atlantic off Portugal in 2007. The company dubbed the site where the treasure was found the Black Swan, a reference to Nassim Taleb's book on improbable and transformational financial events.

(Irish Times) -- All that Glitters

Gold can yield significant returns, if the investment is timed right. Last week it was hovering around $1,433.90 an ounce, up three per cent since Pricewatch last discussed its value in December, and is set for its 10th consecutive quarterly gain. It may be too late to buy, as speculation rather than heightened demand has fuelled price increases for nearly two years. Gold certificates and exchange traded funds (ETFs) are two ways to fold gold into an investment portfolio. GoldCore is an approved dealer for the Perth Mint Certificate and allows investors buy certificates backed by physical gold bullion. There is an entry charge of 3.9 per cent and an exit cost of 1 per cent. The minimum investment is €8,000. Another Goldcore product allows individuals to invest as little as €150 a month for a 12-month period. Websites such as US-based BullionVault.com allow people to buy gold online. The site charges a commission of 0.8 per cent on transactions and 0.12 per cent storage.

(Editor's Note: Firstly, advising retail investors to 'time markets' is not good financial advice. Secondly, the statement "speculation rather than heightened demand has fuelled price increases for nearly two years" is factually inaccurate.)

(Reuters) -- Bolivia Silver Mine San Cristobal Hit by Strike

Strike grips San Cristobal silver, zinc mine Government says strike started on Friday

A four-day-old strike has paralyzed Bolivia's San Cristobal mine, which produces silver, zinc and lead and accounts for about half the country's mining exports, the government said on Monday.

San Cristobal is the world's third-largest producer of silver and the sixth-largest producer of zinc, according to Japan's Sumitomo Corp (8053.T: Quote), which fully owns the mine. It produced some 620,000 kilograms of fine silver in 2009, official data shows.

Government Mining Director Freddy Beltran told Reuters the strike started on Friday after days of threats by miners, who are calling for improved working conditions and the firing of several officials.

"Today is the fourth day that the mine's been halted, bearing in mind that it keeps operating over the weekend," he said.

A company statement expressed concern about operations at the remote Andean site and for staff safety, without giving further details. Labor disputes are common in Bolivia, a significant global producer of zinc, silver, tin and lead.

(Financial Times) -- Americans feather nests with silver Eagles

At Stack's, a coin dealer in midtown Manhattan, the shop floor is filled with glass cases displaying coins and banknotes ranging from recently-minted pieces to 18th-century antiques. These days, however, customers mainly have eyes for one product: the silver American Eagle.

"Silver's hot. People want it. People don't want to have money in the bank," says Eric Streiner, the shop's manager. Buyers include everyone from "business executives to lunatics", he adds.

The same story is being repeated across the US. Silver has become the favoured investment of disaffected Americans. The recent wave of disenchantment with the economic stewardship of the country's institutions - from the government and the Federal Reserve to big Wall Street banks - has sent demand skyrocketing.

With that, the price of silver has more than doubled since the Fed first raised the prospect of a second round of quantitative easing - effectively, printing money to prop up the economy - in late August. That has made it the best performing precious metal, with nominal prices rising to levels only seen during the height of the Hunt brothers' famous squeeze in 1980.

Daniel Brebner, commodities analyst at Deutsche Bank, says silver investors "don't like where their country is going - particularly in the US but elsewhere as well.

"They are looking at other political alternatives, but they're also looking at diversifying away from conventional assets they've held in the past."

Nowhere is the unbridled enthusiasm for silver clearer than at the level of coins and small bars - the type of product most accessible to smaller investors. All the world's top mints are selling silver coins at record pace: the US Mint has sold 12.4m ounces of silver American Eagles in the first three months of the year - equivalent to about 6 per cent of quarterly global mine output.

David Madge, head of bullion sales at the Royal Canadian Mint, says sales of silver Maple Leaf coins "remain robust with demand still exceeding our supply".

The level of demand means dealers are sold out of popular products. "Anything you can get right now you can sell," says Michael Kramer, president of Manfra, Tordella & Brookes, a New York-based coin dealership. "If I want to, I can sell my [weekly] allocation in five minutes."

The level of demand for products such as 100 ounce bars and silver American Eagles has caused premiums - the cost of particular products over and above the value of the metal they contain - to jump to the highest levels since 2008, dealers said.

Silver has even outshone gold, which shares its perceived quality as a hedge against the debasement of paper currencies. In part that is because the grey metal also has industrial characteristics, which mean it has benefited from the global economic rebound. More important, dealers say, is the perception that silver, with its lower headline price, may have further to rally than gold.

Jonathan Potts, managing director of Fidelitrade, another US bullion dealer, draws a parallel with equity markets, where some investors prefer to invest in cheaper stocks. "We're seeing people from all walks of life, all income levels," he says.

"A lot of people believe that silver has a lot more upside potential than gold right now."

Disenchanted Americans are not the only driver for silver's rally. Consumption in other countries has also jumped, led by China and India. Over the past three years China has shifted from being a net exporter to a significant importer of the metal.

Nonetheless, many traders confess to bafflement at the strength of the grey metal, pointing to rising supply from mine production and growing scrap levels as factors that ought to damp price gains.

Some investors appear to be equally wary. According to Edel Tully of UBS, "while many market participants are impressed by silver's industrial and retail demand, and are concerned about physical shortages, another portion believe there is too much speculative noise in the market right now".

But for every investor or analyst concerned about silver's fundamentals, there are plenty of others calling for much higher prices.

Mr Brebner of Deutsche Bank is expecting silver to average a record $50 a troy ounce next year, compared with current prices of $37. Others are even more bullish, calling for the ratio of gold to silver prices to fall in line with the relative abundance of the two metals in the earth's crust - about 19:1 - or for silver to surpass its inflation-adjusted high of 1980, which stands at about $150.

For the time being, at least, the silver bugs are making more noise than their detractors.

On a recent call to discuss the results of Pan American Silver, the fourth-largest miner, one private investor's comment was less a question than a rallying call: "With the entire United States of America, the states going bankrupt, which means they'll have to unleash ... QE3 because the Federal Reserve will not allow them to go [bankrupt], and [with] silver [above] $35, the sky is the limit."

Industrial boom

It is not just investors that are driving silver demand higher,writes Jack Farchy.

Industrial use of silver, in everything from electrical circuits in mobile phones to plasma television screens, has risen sharply, accounting for more than half of total silver consumption.

According to forecasts from consultancy GFMS this week, industrial silver demand is set to rise 37 per cent between 2010 and 2015, with much of that coming from the use of silver in solar power cells, which is expected to double from 2010 levels.

(Bloomberg) -- Gold May 'Tread Water' Following Investment Gains, CPM Says

Investment demand for gold increased 24 percent last year amid wide currency swings and escalating sovereign debt in Europe, CPM Group, a commodity- research company, said.

In its annual outlook reported released today, the New York-based company said that "continued economic problems following the financial crisis which began in 2008 and political issues worldwide" also spurred gold demand. Investors added 33.8 million ounces to holdings in 2010, compared with 27.3 million ounces in 2009, CPM said.

The price may "tread water" for the next couple of years as "investors become less concerned about the economic and financial problems," Jeffrey Christian, CPM's managing director, said in a presentation in New York. Buyers may pull back later in 2011 or in 2012, causing "a sharp fall" to as low as $1,160 an ounce, he said.

In 2010, gold prices gained 30 percent, climbing for the 10th straight year. The metal reached a record of $1,448.60 on March 24. Today, gold futures for June delivery fell $3.80, or 0.3 percent, to $1,417.50 on the Comex in New York. The most- active contract has dropped 0.3 percent this quarter.

"The proliferation of relatively new investment vehicles such as exchange-traded funds has helped boost investment demand in recent years," CPM said in a statement. Futures of smaller contract size and gold ATMs also attracted buyers, the group said.

Central banks and government institutions increased holdings by 10.2 million ounces and were net buyers for the third straight year, CPM said. Fabrication demand rose 0.6 percent to 76.8 million ounces, the company said.

Total gold supply increased 0.3 percent to 120.8 million ounces as mine production increased, CPM said.

(Bloomberg) -- Sales of 1-Ounce American Silver Coins Fall, U.S. Mint Says

Sales of 1-ounce American Eaglesilver coins are heading for a three-month low, according to the U.S. Mint.

About 2.767 million coins have been sold in March, data on the Mint website showed. That would be the lowest since December and the smallest March total since 2008. Purchases also declined in February. In January, the monthly total reached 6.422 million, the highest since sales began in 1986.

Silver futures for May delivery dropped 10.1 cents, or 0.3 percent, to $36.987 an ounce on the Comex in New York today. The price touched a 31-year high of $38.18 last week as investor demand for precious metals as alternative investments surged.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.