Crude Oil Price Impact on Stock Market Trends

Stock-Markets / Stock Markets 2011 Mar 28, 2011 - 04:16 PM GMTBy: Nadeem_Walayat

Whilst the mainstream press as ever looks in the rear view mirror to pick events as reasons for the rise in the oil price, such as the ongoing breakout of freedom in the middle east, however as stated in the January 2010 Inflation Mega-trend ebook (FREE DOWNLOAD) and updated below, the consequences of peak oil ensures an escalator effect for the ramping up of oil prices into ever higher trading ranges that will one day make today's high oil prices look cheap, as oil prices continue a volatile mega-trend to north of $200 per barrel.

Whilst the mainstream press as ever looks in the rear view mirror to pick events as reasons for the rise in the oil price, such as the ongoing breakout of freedom in the middle east, however as stated in the January 2010 Inflation Mega-trend ebook (FREE DOWNLOAD) and updated below, the consequences of peak oil ensures an escalator effect for the ramping up of oil prices into ever higher trading ranges that will one day make today's high oil prices look cheap, as oil prices continue a volatile mega-trend to north of $200 per barrel.

Oil Price Inflationary Mega-trend

Crude oil is both a major driver and beneficiary of the inflation mega-trend because during times of high inflation or expectations of future high inflation the highly liquid crude oil market is utilised to both hedge against and speculate in favour of future inflation, thus one could say illustrates the self full-filling prophesy at work as witnessed during 2008 that saw inflation hedging result in a surge in the crude oil price to $148, which had the effect of dragging inflation higher, only to crash as a consequence of the financial crisis which continued into the deflation of late 2008 and early 2009. In addition to its inflationary impact, crude oil is also subject to Peak Oil, which the next section touches upon.

Peak Oil Mega-trend

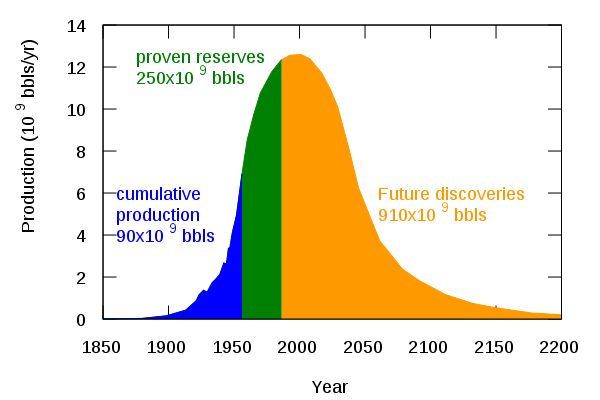

Firstly, Peak Oil does not mean that the world is running out of oil any time soon, peak oil means that the world is about to pass the point of maximum rate of production after which production is expected to decline as it becomes ever more costly to find and extract new oil fields thus resulting in diminishing supply. The theory of Peak Oil is based on the principle originally developed by M King Hubbard in the 1950's, who observed the rate of production and depletion of oil output from the United States oil fields over time which culminated in a bell shaped curve. M King Hubbard went on to use his findings to accurate predict that U.S. oil production would peak by 1970 and decline rapidly. The below updated graph illustrates the most recent forecast projection for global Peak Oil which implies that the supply output peak is imminent, where the test will come when supply fails to respond to rising demand as the worlds economies return to trend growth.

http://en.wikipedia.org/wiki/File:Hubbert_peak_oil_plot.svg

Whilst the developed world continues to stabilise and in some cases cut back on total oil consumption due to improvements in technology and switch to renewable's and alternatives such as natural gas. However much of the reduced western oil demand (ignoring the recession) for oil consumption can be attributed to the exporting of industrial production abroad to China and India, which remain several decades away from reaching the level of West in terms of stabilisation of consumption as the collective total of 2.5 billion people of both countries consume on a per capita basis less than 10% of that of the average western person.

Peak Oil is a reality, the major cheap oil fields across the big producing nations have already passed their peak outputs and are declining fast in output and where discoveries of new economically recoverable reserves are not keeping pace with. We got a taste of the consequences of peak oil during 2008 when Crude oil soared to $147, where a small shift in the supply demand balance can cause extreme shifts in price as MARKET SENTIMENT (speculators) drives prices into ever increasingly volatile price trends.

Therefore, oil and energy commodities despite continuing to exhibit high price volatility over the next 10 years, will still result in an rising trend curve as the oil price escalator repeatedly moves to ever higher trading ranges, therefore I expect we will continue to see extremely high price volatility in the region of 50% as speculative funds continue to dominate short-term trends in the highly liquid crude oil markets, which the long-term inflationary mega-trend (as a consequence of emerging markets growth, population growth and fiat money printing) continues to force oil prices ever higher.

Oil Price Impact on the Stock Market

The consensus view as iterated on a near daily basis in the mainstream press and on the internet is that rising oil prices are generally bearish for the stock market, and falling oil prices are generally bullish. However, the below graph of the Dow and Crude Oil price illustrates that most of the time the oil price and the stock market (Dow Jones index) can be expected to trend in the same direction. This clearly implies that most of the time a rising oil price is associated with economic growth and thus rising future prospects for corporate earnings are discounted by rising stock prices. Whereas a falling oil price is associated with weaker future economic activity and thus implies lower future corporate earnings which is again discounted in the present.

As mentioned earlier, rising oil prices are part of an inflationary mega-trend, which means that as higher oil prices trend higher, the associated costs can be expected to be passed into consumers in an orderly manner, thus the peak oil mega-trend is bullish for nominal stock prices.

The only fly in the ointment is that as illustrated by the oil price trend during the first half of 2008, when there was a serious divergence between the stock market and the oil price as mania gripped the market that sent inflation soaring, and thus as the oil price soared the stock market entered into a severe bear market. However this divergence did not persist as oil price bubble burst sending the oil price literally crashing lower, playing catch up to the stocks bear market into the March 2009 low.

Conclusion

A rising trend for oil prices is bullish for the stock market as long as it does not involve a parabolic mania driven spike that is likely to kill future economic demand and is thus discounted in the present by the stock market trending lower, with the oil prices soon catching up to the stock price decline as occurred during the second half of 2008.

The current situation with oil prices hovering just above $100, is not bearish for the stock market as long as the oil price does nothing more than just trend higher rather than enter into a mania driven spike for instance to say $150 by mid summer, therefore a gradual uptrend is unlikely to impact negatively on the stock market.

Inversely a weak oil price is likely to be bearish for the stock market. However the current outlook is at worst suggestive of oil prices consolidating before trending higher and therefore continue to support a bullish outlook for stock prices.

Stock Market Trend Forecast for 2011.

This analysis forms part of a series that is working towards a trend conclusion for the stocks stealth bull market for the remainder of 2011. Ensure you are subscribed to my always free newsletter to get this in your email in box on completion (including ebook).

Recap of Stock Market Trend Forecast for 2010 - 02 Feb 2010 - Stocks Stealth Bull Market Trend Forecast For 2010

Dow 10,067 - Stocks Multi-year Bull Market that bottomed in March 2009 will trend Sideways during first half of 2010 attempting to break higher. The second half will see a strong rally to above 12,000 targeting 12,500 during late 2010.

Source and Comments: http://www.marketoracle.co.uk/Article27213.html

By Nadeem Walayat

Copyright © 2005-2011 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of two ebook's - The Inflation Mega-Trend(Jan 2010) and The Interest Rate Mega-Trend(Mar 2011) that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of two ebook's - The Inflation Mega-Trend(Jan 2010) and The Interest Rate Mega-Trend(Mar 2011) that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.