Are Obama's Policies Burying the US Economy?

Stock-Markets / Stock Markets 2011 Mar 28, 2011 - 02:02 AM GMTBy: Gerard_Jackson

When Obama ran for president I warned that the man is a dogmatic leftist and Americans -- those with any sense, that is -- would rue the day he sat in the Oval Office. Since then I, along with many others, also pointed out that if unchecked his policies would result in economic stagnation and inflation. Well, this now seems to be the case.

When Obama ran for president I warned that the man is a dogmatic leftist and Americans -- those with any sense, that is -- would rue the day he sat in the Oval Office. Since then I, along with many others, also pointed out that if unchecked his policies would result in economic stagnation and inflation. Well, this now seems to be the case.

For quite a while Obama's media cheer leaders have been hailing the 'growth' in manufacturing output as evidence of recovery and the success of his economic policies. Only about three weeks ago media hack has an organism when the Fed reported that for February the production of furniture, cars, various appliances had risen again, confirming the view that manufacturing was leading the recovery.

It is true that according to Austrian business cycle theory manufacturing should be the 'sector' recover. But Austrian theory is microeconomic, macroeconomic. It does not manufacturing as somehow separate from the rest of the economy. Moreover, it treats manufacturing not as a homogeneous sector but as an incredibly complex structure consisting of stages of production and integrated heterogeneous capital goods.

This is why Austrian economists consider the pattern of production to be so important. They warn that if government's attempt to recover from a recession by stimulating consumption this could increase the demand for more consumer goods. The result would be a change in the structure of relative prices and the shifting of more resources into the lower stages of production at the expense of the higher stages production. If such a policy was continually pressed it would shorten the production structure and reduce the height of real wages. In other words, the capital-labour ratio would shrink as investment in the higher stages of production fell.

For this reason Austrians treat with great caution production figures that focus on consumer goods. We need to know what is happening elsewhere. And what we do know at the moment does not make for a pretty picture, no matter what the Democrats' media stooges assert. Fourth quarter figures show the economy slowing. So while the demand for consumer goods rose the demand by industry for capital goods and primary metals fell, leaving orthodox economists floundering for an explanation. Their discomfort is compounded by the fact that real consumption spending continues to rise and is now higher than it has ever been.

The fundamental root of the problem is the Fed's devotion to vulgar Keynesianism, the idea that if you print enough money the economy will right itself. I reckon just about everyone now knows that Bernanke massively increased in the money supply in an effort bailout Obama. What they don't know is that it hasn't stopped. Since last November he has expanded the monetary base by over $325 billion. His reckless monetary policy is driving down the dollar and driving up commodity prices.

Because commodities are at the highest stage of production -- the furthest point in time from consumption -- they are very sensitive to 'cheap money' policies. To run such a policy the central bank has to continue to expand the money supply. As the dollar is a reserve currency this is bound to rapidly raise the demand for for commodities, a situation that is aggravated by other central banks running the same policy.

As predicted by the Austrians Bernanke's monetary policy is lifting the producer price index, with food rising by 1.6 per cent in February and energy by 3.4 per cent, a yearly average of nearly 20 per cent and more than 40 per cent respectively. Over the last 12 months intermediate goods, those unfinished items that move from firm to firm before reaching their final destination, rose by 7.8 per cent.

Needless to say, the CPI is now averaging about 6 per cent a year. Based on December, January and February figures the PPI is now racing ahead at 14 per cent per annum. Right now the US economy could be looking at an impending dose of stagflation. The rise in commodity prices and intermediate goods are bound to impose a profits squeeze on companies, an usual situation in the absence of an investment boom.

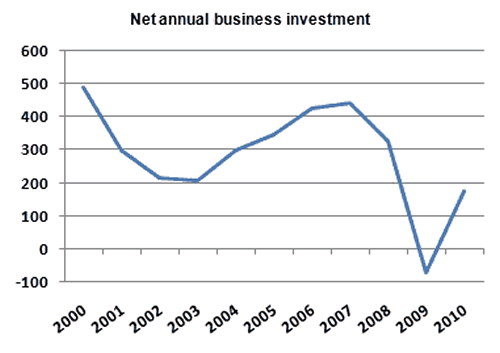

Austrians define growth as net capital accumulation in excess of the population. Using that definition we find that there has been no growth at all under Obama. Not only has net capital accumulation been anaemic it was actually negative for the whole of 2009. The chart below show net business investment starting to dive in 2007. Obama certainly cannot be blamed for that. Moreover, the end of 2009 shows a sharp increase, suggesting that recovery is underway. But if this is so, why the drop in demand for capital goods? The answer lies in the quarterly figures.

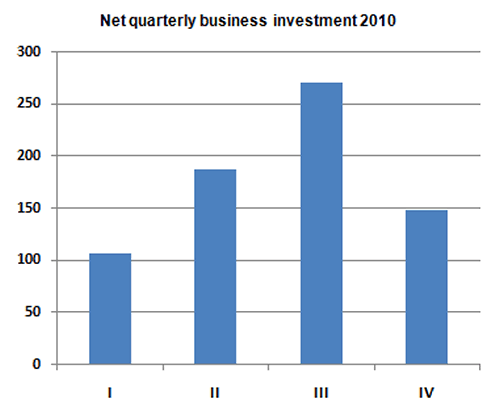

The next chart shows a steady increase in net investment for the first three quarters of 2010. However, the third quarter experienced a sharp downturn. Although this is not an uncommon event we must nevertheless bear in mind that it might be signalling a contraction. If the squeeze on profits is tightening one can expect the demand for capital goods to fall further and net investment with it.

The monetarists and just about everyone else expected Bernanke's monetary policy to send the US economy roaring out of recession. Republicans were scared stiff that by 2011 Obama would be riding a recovery to a second term in 2012. My view was that Obama is a profoundly ignorant man whose extremely narrow view of the world has been shaped by leftists who are just as ignorant as he is. This, I warned, would result in policies and direct meddling in the economy that would retard recovery if not result in stagnation.

The world is uncertain enough without arrogant meddlers like Obama making it worse. Under his administration businesses have become increasingly reluctant to invest. Not knowing what future policies this man will implement with respect to taxes, unions, regulations, energy production, so-called financial reforms, and anything else that obsesses leftists, they have done what any sensible would do: The took cover.

When it comes to regulations every business man knows that devil really is in the details. Because of that they know from experience what a greedy lawyer, a zealous bureaucratic, a leftwing judge or business-hating politicians can and are prepared to do to get their way, irrespective of what it costs the country. After all, did not Obama say he would use the financial crisis to "transform our economy". That he was not elected to do that doesn't faze him. After all, as thuggish Democrats in Wisconsin made perfectly clear, elections only count when they win them.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2011 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.