Get Ready For The Coming Stock Price Tsunami

Stock-Markets / Corporate Earnings Mar 17, 2011 - 05:02 AM GMTBy: Dian_L_Chu

Vitaliy N. Katsenelson writes: Profit margins are a tick away from all-time highs and are creating the impression of cheap equity valuations. But that impression is a mirage, because today’s generous margins are destined to shrink.

Vitaliy N. Katsenelson writes: Profit margins are a tick away from all-time highs and are creating the impression of cheap equity valuations. But that impression is a mirage, because today’s generous margins are destined to shrink.

I first wrote about this in January 2008. Stocks are allegedly cheap now, at 15.7 times 2010 earnings. And they are cheap by historical standards. Only 10 years ago, their price/earnings ratios were double today’s; they are even cheaper if you compare their forward (2011) earnings yield of 7.3% to the 10-year Treasury yield of 3.40%. They are cheap, cheap, cheap!

Or so we’ve been told.

Unfortunately, the cheapness argument falls on its face once we realize that pretax profit margins are hovering close to an all-time high of 13.3% (the all-time high was 13.9% in 2007), almost 58% above their average of 8.4% since 1980. Once profit margins revert to their historical mean, the “E” in the P/E equation will decline. If the market made no price change in response, its P/E would rise from 15.7 to 24.9 times trailing earnings.

Many disagree that profit-margin reversion will take place. Here are their most common arguments, and some food for thought on why this supposed common sense doesn’t translate to sensible logic.

Who said that margins have to revert to a mean; why can’t they just remain high?

“Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly.” ~ Jeremy Grantham

Profit margins revert to the mean not because they pay tribute to mean-reversion gods, but because the free market works. As the economy expands, companies start earning above-average profits. The competition reacts to fat margins like bees sensing sugar water. They want some, so they fly in and start cutting into these above-average margins.

What about the billions of dollars U.S. companies poured into technology - Weren’t they supposed to make their operations more efficient and bring higher profit margins?

Those billions of dollars did not go to waste; companies are more productive now than ever before. Efficiency gains stemming from productivity were a source of competitive advantage and higher margins when access to proprietary technology was a competitive advantage. For example, Wal-Mart’s rise in the retail industry was achieved through a very efficient inventory-management and distribution system that passed cost savings to consumers and drove less-efficient competitors out of business.

Today, however, that same – or even better – technology is available off-the-shelf to retailers like Dollar Tree and Family Dollar, whose outlets are about the same size as a couple of Wal-Mart restrooms put together. Oracle or SAP will gladly sell state-of-the-art distribution/inventory software systems to any company able to spell its name correctly on a check. Increased productivity didn’t and won’t bring permanently higher margins to corporate America – the consumer is the primary beneficiary of lower prices. If profit margins didn’t respond as they do, Wal-Mart’s net margins would be 25% today, not 3.5%.

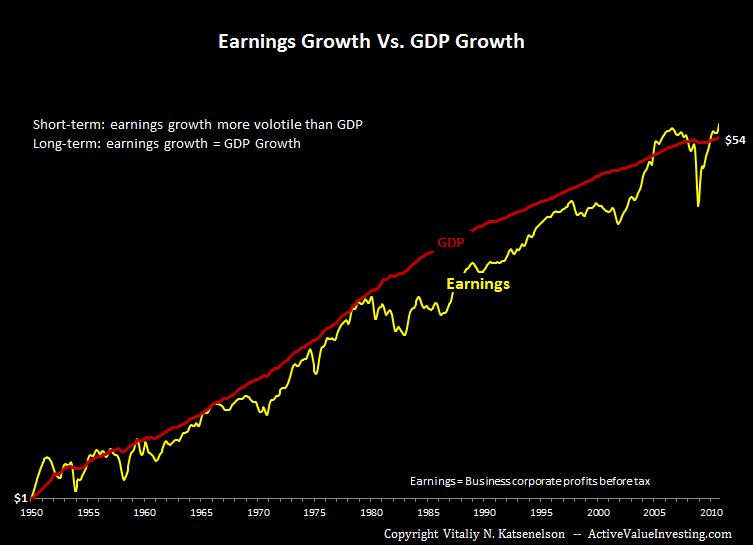

Over the past 70 years, growth in corporate earnings and GDP haven’t differed significantly. On the other hand, there has been a permanent benefit from increased operating efficiency: It lets companies hold less inventory and adjust more quickly and precisely to changes in demand. This has led to less volatile GDP.

Shouldn’t average profit margins be higher now as the U.S. economy has transitioned from an industrial (low-margin) economy to a service (higher-margin) economy?

It is not as much of a change as we might think. In 1980, services represented about 51.3% of GDP. After 30 years and a lot of changes like outsourcing, services have increased to 65.3% of GDP. If we assume that the service sector has double the margins of the industrial sector (a fairly conservative assumption), increases in the service sector should have boosted overall corporate margins by about 40 to 80 basis points above their 30-year average – to between 8.8% and 9.2%, but still far below today’s 13.3% margin. Thus, if we adjust corporate margins to reflect the transformation toward a service economy, corporate profit margins are still 45% above their long-term mean.

Shouldn’t globalization allow U.S. companies to increase margins?

A larger portion of U.S. companies’ profits is coming from overseas than ever before. However, globalization is a double-edged sword – U.S. companies are expanding and will continue to expand overseas and capitalize on new opportunities. But as the world flattens, they also face new competition at home and abroad.

For example, Motorola – a company that used to represent American might in the telecommunications arena – has been marginalized in the U.S. and around the world by companies whose names we didn’t recognize 15 years ago – Finland’s Nokia and South Korea’s Samsung. (It’s very interesting how much the smartphone industry has changed in three years - Apple, a company I did not even mention in my 2008 article, has transformed the industry. Motorola, which was almost dead then, is coming back to life. Nokia is becoming irrelevant very quickly, and LG and HTC are important players.)

Although Wal-Mart is rapidly expanding overseas, it will soon face a new breed of competition. U.K. retail giant Tesco recently entered the American market (Cisco Systems has been successful in Asia, but its home turf has been attacked by the Chinese company Huawei.) U.S. companies may get a larger portion of their earnings from overseas (the weak dollar will help), but they’ll have to fight to defend home turf.

International expansion doesn’t guarantee fatter margins; quite the opposite: We are facing competition from countries such as Korea and China that may be more concerned with increasing market share, even at the expense of short-term profitability.

Higher oil prices are here to stay, so maybe multiyear higher margins in the energy sector are here to stay as well.

This would be the case if energy companies sold their products to customers in another galaxy where somebody else bore all the costs of high-energy prices. Petroleum products are consumed by corporations and individuals. The benefits of higher profit margins to the energy sector are achieved at the expense of lower margins for companies that consume their products – which is the rest of the corporate world, to varying degrees.

Today’s stock valuations are a lot higher than it appears if you normalize earnings to lower profit margins. And while it’s hard to tell when earnings will embark on a fateful journey to their historic mean, competitive forces will make that happen sooner than later. Earnings will either decline or grow at much slower pace than GDP.

Companies that don’t have a sustainable competitive advantage will not be able to keep their competition at bay, and will face margin compression, along with lower earnings growth or declining earnings. Look at your portfolio: Can the companies whose margins are hitting all-time highs sustain them?

Robust (above-average) earnings growth from the depth of a recession creates a false appearance, usually reflected in forward earnings estimates, that earnings can and will grow at a faster rate than the economy for a long period of time – but they don’t (see chart below, the growth of $1 of earnings and GDP from 1950 to 2010).

For earnings to grow at much higher rate than the economy (GDP) for a long time, profit margins have to keep expanding, and as I’ve discussed in the past, capitalism (i.e. competition) doesn’t allow that to happen.

Aboout The Author - Vitaliy N. Katsenelson, CFA, is Chief Investment Officer at Investment Management Associates in Denver, Colo. He is the author of The Little Book of Sideways Markets (Wiley, December 2010). To receive Vitaliy’s future articles by email, click here.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at http://econforecast.blogspot.com/.

© 2011 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.