Agri-Food Price Inflation Chickens Coming Home to Roost

Commodities / Agricultural Commodities Mar 16, 2011 - 01:46 PM GMTBy: Ned_W_Schmidt

Frailty of monetary policy under delusional Keynesians is evident whenever we think about Agri-Food. Price increases for Agri-Foods may be causing measures of consumer prices to rise in many countries. That "inflation," which it is not, is causing some discomfort for politicians around the world. The textbook response, per the ineffective and inbred Keynesian economists, is to tighten monetary policy, perhaps raising interest rates. We ask one simple question: How does raising interest rates cause the supply of Agri-Food to rise, forcing prices lower? Will higher interest rates keep the price of shoes from rising?

Frailty of monetary policy under delusional Keynesians is evident whenever we think about Agri-Food. Price increases for Agri-Foods may be causing measures of consumer prices to rise in many countries. That "inflation," which it is not, is causing some discomfort for politicians around the world. The textbook response, per the ineffective and inbred Keynesian economists, is to tighten monetary policy, perhaps raising interest rates. We ask one simple question: How does raising interest rates cause the supply of Agri-Food to rise, forcing prices lower? Will higher interest rates keep the price of shoes from rising?

"Prices for cattle hides are on the rise as leather demand rebounds and global supplies fall, boosting the returns of meat packers and cattle producers."

"Federal[U.S.] data show hide prices are at their highest level in nearly a decade, jumping 24% in the last year to $82 apiece. Further gains are likely this year as U.S. supplies begin to shrink and consumer demand for leather continues to recover, ..."

"Helping to fuel the jump in prices has been a growing middle class in China, Vietnam and other Asian countries where consumers are increasingly buying leather goods as incomes rise. As economies around the world recover from deep recessions, consumers are again shelling out for luxury leather goods."

"U.S. Commerce Department put the value of cattle hide exports in 2010 at $1.373 billion, up 67.7% from a year earlier when low prices allowed the number of actual hides exported to hit a record 35.6 million pieces.(Commodity News for Tomorrow, 4 March 2011)"

If clothing retailers think cotton prices are a drag, wait till they see what happens in the shoe department. Price of hides and shoes cannot rise sufficiently to induce cattle breeders to expand herds. Such is the Joy of Agri-Food Price Inelasticity. No matter how high the price of shoes might rise, ranchers will not raise more cattle to satisfy demand for leather.

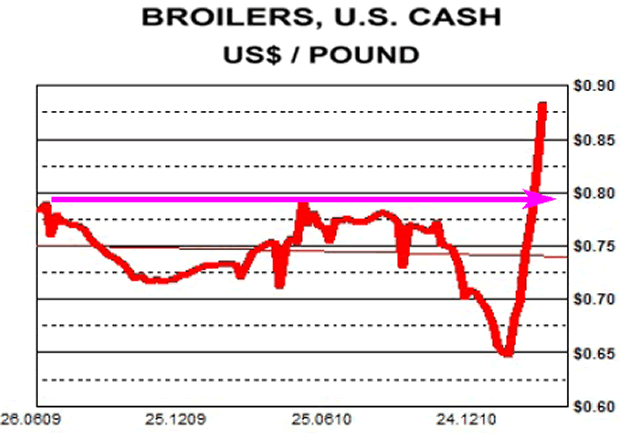

How will QE-2, QE-3,or QE-4, in a chain of futile and doomed policies, or raising interest rates hold down price of chickens? In the above graph is portrayed the price of broilers, table chicken, in the U.S. As is readily evident, even to a Keynesian economist, chicken prices have broke out to upside.

Prices for chicken had long been flat, held down by the brutal, price suppressing power of a group of oligopolistic chicken purchasing companies. All that worked, till grain prices rose dramatically. Profits of chicken raisers disappeared faster than the grain fed to the chickens. Producers had no choice but to unload those chickens into the market. Prices collapsed under that selling. First round effect of higher grain prices is lower meat prices as producers sell animals to avoid feeding them.

Now, it appears, the second round effect has developed. With smaller flocks the buyers have lost some power, and prices have risen dramatically. Could $1.25 per pound chicken arrive in the near future? Quite possibly, and one better enjoy that cheap chicken sandwich at your favorite restaurant while one can.

Investors that missed the latest, but surely not the last, round of excitement in Agri-Equities may get another opportunity this Summer. Agri-Food prices, on average, have dipped to their lowest level in five weeks. That correction is likely to continue well into the North American growing season.

Traders and buyers had simply become too bearish on supply, bullish on prices, in the short-term. Buying of wheat and corn may have been panic driven, and in excess of true needs. Latest USDA WASDE, World Agriculture Supply Demand Estimate, simply did not have enough bear food in it for the supply bears. Next important report is the U.S. planting intentions report due 31 March. It will probably also fail to nourish the supply bears. Add a little of Japan's misery, and we have likelihood of a continuing correction in Agri-Food prices.

Tier One Agri-Equities, large multinational Agri-Food companies, have risen in conjunction with the rally in Agri-Food prices. Likely that they will correct along with Agri-Food prices, as they did after the 2008 run. Tier Two Agri-Equities, Chinese Agri-Equities, then performed the best. As they are over sold relative to Tier One Agri-Equities, investors should be preparing to add to Chinese Agri-Equities in the near future.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.