A Good Looking Economy is Not Always a Good Economy

Economics / Austrailia Mar 14, 2011 - 02:29 AM GMTBy: Gerard_Jackson

It is said that many look enviously upon the Australian economy's success in not only weathering the global financial crisis but to continue to prosper. Of course, there is no gainsaying the role that the resources sector played in providing the country with a vital economic buffer. But is everything as rosy as many seem to think, including some of our Treasury boffins?

It is said that many look enviously upon the Australian economy's success in not only weathering the global financial crisis but to continue to prosper. Of course, there is no gainsaying the role that the resources sector played in providing the country with a vital economic buffer. But is everything as rosy as many seem to think, including some of our Treasury boffins?

The Reserve Bank of Australia reports that miners are preparing for the country's biggest investment boom. What is puzzling some commentators is the apparent absence of overheating and accelerating inflation. It was only yesterday -- so to speak -- that we were being told that income from the booming resource sector would soon begin to push up prices as it made its way through the economy, forcing the RBA to once again raise rates. So what happened? These people forgot that Australia has a floating currency.

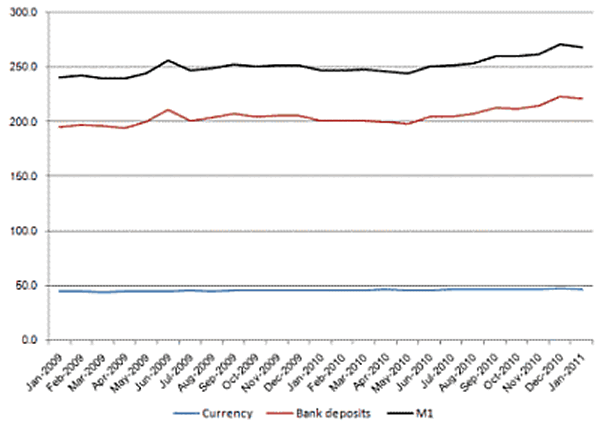

One argument in favour of a float is that it helps to protect the economy from the monetary excesses of its trading partners. This means that no matter how much our trading partners expand their money stocks they cannot influence the supply of Australian dollars. If they want to buy Australian resources they must first acquire Australian dollars. Given this fact one can only wonder how these economic commentators were able to conclude that the mining sector's revenues would eventually raise the money incomes of the rest of the country. Dollar incomes could only continue to rise if the money supply was expanding. The following chart shows that from January 2009 to May 2010 the money supply was somewhat stable. But from May to January 2011 bank deposits rose by 22.8 per cent and M1 by 10 per cent, the latter averages 13.3 per cent per annum. This is a worrying trend.

It is argued that by allowing the Australian dollar to rise instead of inflating the money supply it is acting as "an inflationary relief valve that takes pressure off the Reserve Bank to lift interest rates". Now this is contradictory. If the money supply is not growing then the fall in the price of foreign currency cannot be described as anti-inflationary simply because it makes imports cheaper. What happened is that since the early 2000s the demand for our resources lifted the trade-weighted value of the dollar by about 70 per cent. (It rose by 13 per cent last year.) The result is that mining boom is inadvertently squeezing other industries.

In the 1920s Eli F. Heckscher explained that if the foreign demand for a country's goods rises then that country basically has two choices: let the exchange rate fall or keep it at its previous level by expanding the money supply. This is important because he was was refuting Gustav Cassel's theory that the quotient between the price levels of the two countries would always provide the equilibrium point for their exchange rates. Therefore a country's exchange rate was determined solely by its purchasing power parity.

But Heckscher's response showed that this was clearly not the case. Which means that a country can have an overvalued currency even on a floating exchange rate, a point I have argued in the past and one that Professor Davidson, a fellow at the Institute of Public Affairs, denied even though he later admitted that an exchange rate can deviate from its purchasing power parity. Moreover, a currency can remain overvalued or even rise further in the face of a domestic monetary expansion. As we have already seen, the Australian dollar rose by 13 per cent last year despite the fact that M1 grew significantly.

The reason for this apparent paradox, in the absence of political considerations, is that so long as the rest of the world is prepared to buy dollars at the current price and at the rate we are creating them the currency will remain overvalued. This situation could have devastating consequences for manufacturing. Now it could be argued that the value of the Australian dollar would be even higher if it were not for the current monetary growth. Be that as it may, the fact remains that an overvalued dollar sucks in imports at the expense of domestic production. (Think of it as a reverse tariff.) In these circumstances a monetary policy that raises nominal incomes will continue to suck in more imports. However, I am perfectly prepared to concede that in the absence of a monetary expansion the flow of imports could still be the same.*

Once one accepts that floating currencies can be overvalued then the argument that any reduction in manufacturing output brought about by cheaper imports is always a case of comparative advantage falls to the ground. This brings us to the the "hollowing out problem" which was bound to give rise to protectionist feelings, which is now the case. The Australian Workers Union has launched an anti-dumping campaign, claiming that firms need to be protected against the predatory pricing tactics of foreign firms.

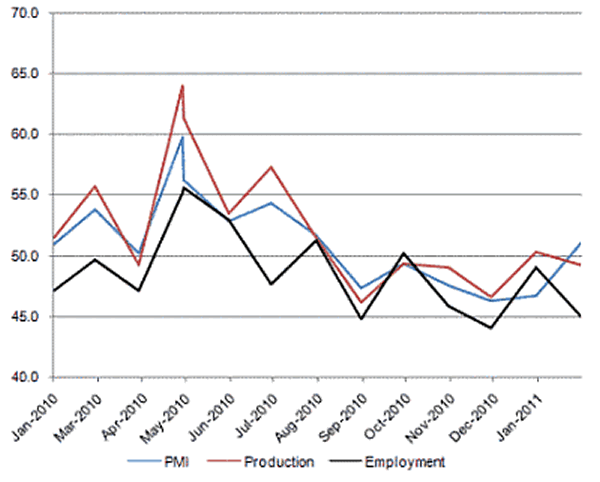

Sinclair Davidson dismisses such concerns by asserting that firms just need to introduce "innovative business practices or products". His blasé attitude, which the Institute for Public Affairs shares, just will not do. Australia is supposed to be undergoing a boom. If this were really the case then manufacturing would also be booming. The following chart shows otherwise. A genuine boom should see the PMI, employment and production at around the 70 mark instead we have witnessed a sharp decline in these factors. Which way one looks at it manufacturing is sick. It ought to be clear by now, even to the Institute for Public Affairs, that the long the dollar remains overvalued, courtesy of the resources boom, the greater will be the decline in manufacturing.

Not only do we need to consider the economics of an overvalued dollar we must also take into account the political and social consequences of ignoring the situation. Senator Christine Milne is a green fanatic and a protectionist who understands how the situation an be exploited for political gain. She argues that the resource sector had hollowed out manufacturing and driven jobs overseas. Because our free marketeers refuse to even consider that the problem is fundamentally a monetary one they find themselves devoid of an effective response. What we generally get are noises about being a service economy and that the growth in jobs proves we don't need a significant manufacturing sector.

Let's look at the job market. III The Australian III reported that 330,000 jobs were created in the past year and that the participation rate had risen to 66 per cent of working-age Australians, the highest since 1978. We know that the mass of these jobs were not created in manufacturing or mining: that leaves only "services", confirming the opinion of many commentators that services are what really counts. Jagdish Bhagwati, Professor of economics at Columbia University, is of this turn of mind. In an article published in the Australian Financial Review ( The Manufacturing Fallacy, 31 August 2010) he basically argued that services could compensate for the disappearance of a large manufacturing sector. I think John Stuart Mill would disagree. He presented the standard classical view when he wrote:

I apprehend, that if by demand for labor be meant the demand by which wages are raised, or the number of laborers in employment increased, demand for commodities does not constitute demand for labor. I conceive that a person who buys commodities and consumes them himself, does no good to the laboring classes; and that it is only by what he abstains from consuming, and expends in direct payments to laborers in exchange for labor, that he benefits the laboring classes, or adds anything to the amount of their employment. (John Stuart Mill, Principles of Political Economy, University of Toronto Press, 1965 p. 80)

In today's jargon we would say -- or should -- that what raises the standard of living is investment in those stages of production that raise the marginal value of labour's product as against spending on consumption. The Austrian school of economics takes it further by explaining that a country's capital structure consists of highly complex and integrated stages of production with each stage made up of capital goods embodying technology. In a growing economy the structure lengthens and the stages become more complex. It is this process that raises the standard of living.

Should the structure shorten then real wages must eventually fall. It follows that if a currency remains overvalued for a sufficiently length of time it can shorten the capital structure making the economy excessively oriented towards services and consumption. The situation will resemble one in which the process of capital consumption has taken hold (See F. A. Hayek, Money, Capital and Fluctuations: Early Essays, Routledge & Kegan Paul, 1984, pp. 145-46).

This is a vitally important issue and it is about time that it was honestly and openly debated.

*This means that if there was no monetary expansion the flow imports would remain unchanged even though monetary incomes remained the same because the further rise in the dollar would lower the price of imports to the point where the rise in real incomes would equal the rise in money incomes that a loose monetary policy would have created. In other words, under either condition real incomes remain the same leaving the level of imports unchanged.

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2011 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.