Markets Rocked By Japan Megaquake, Gold Mixed as Yen Surges

Stock-Markets / Financial Markets 2011 Mar 11, 2011 - 06:48 AM GMTBy: GoldCore

The massive earthquake and tsunami that has rocked Japan is being digested by markets and the economic ramifications and uncertainty is leading to risk aversion.

The massive earthquake and tsunami that has rocked Japan is being digested by markets and the economic ramifications and uncertainty is leading to risk aversion.

The massive earthquake measured 8.9 on the Richter scale and is the largest earthquake since 1896 and the 6th largest earthquake ever measured. It has triggered alarm that tsunamis may hit coastlines throughout the Pacific including on the U.S. western seaboard. A state of emergency has been declared at one of Japan’s nuclear stations due to a fire and the process for cooling the nuclear reactor is 'not going as planned'.

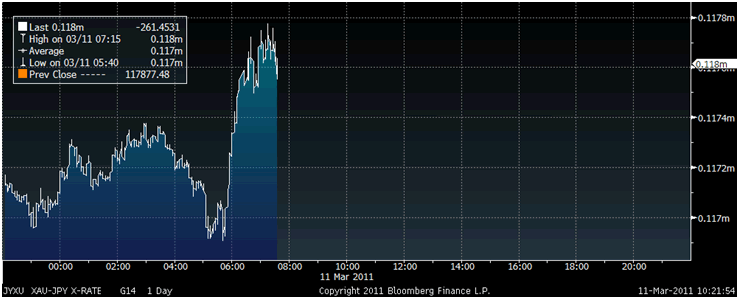

Gold in Japanese Yen – 1 Day (Tick)

Tokyo gold futures rose on the news with the most active gold contract on the Tokyo Commodity Exchange, February 2012 inching 0.22% higher to 118,000 yen prior to giving up those gains. Gold is marginally lower in dollars but higher in euros, Swiss francs and British pounds.

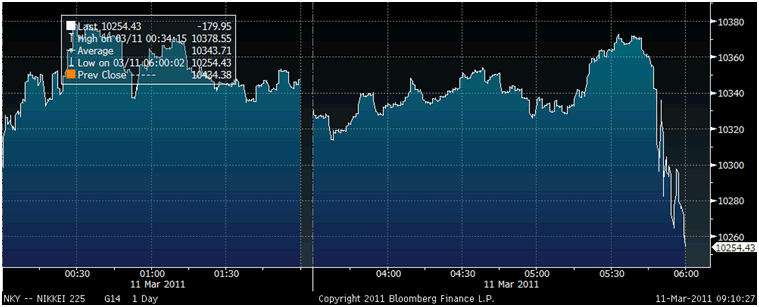

Nikkei – 1 Day (Tick)

After the falls on Wall Street yesterday the Nikkei was already under pressure when news of the quake broke at the end of the trading day. The Nikkei fell 1.7% today and is down over 4.11% for the week.

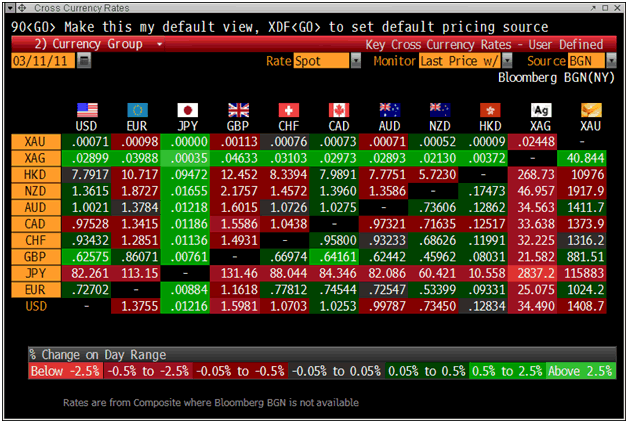

The Japanese yen was sold in the immediate aftermath of the quake. Counter-intuitively it then recovered and is the strongest currency in the world today (see table). Market participants appear to be seriously underestimating the risk posed by the megaquake to the Japanese economy and assets.

Cross Currency Table

Alternatively, there may have been intervention by the Japanese authorities in order to maintain confidence and protect the value of their currency and bonds. The Bank of Japan, like the Federal Reserve, regularly intervenes in foreign exchange markets and has even intervened in equity markets by buying ETFs linked to the Nikkei and the Topix.

The secretive Working Group on Financial Markets or ‘Plunge Protection Team’ in the US is known to intervene in markets in emergencies in order to prevent market panic. Maintaining confidence in the yen and by extension the dollar and the fiat monetary system, may be part of that mandate.

Long term government intervention and manipulation of markets is a recipe for disaster as it leads to distortions, imbalances and massive moral hazard. However, the megaquake in Japan could justify short term intervention and this may explain the yen’s counter-intuitive surge in international markets.

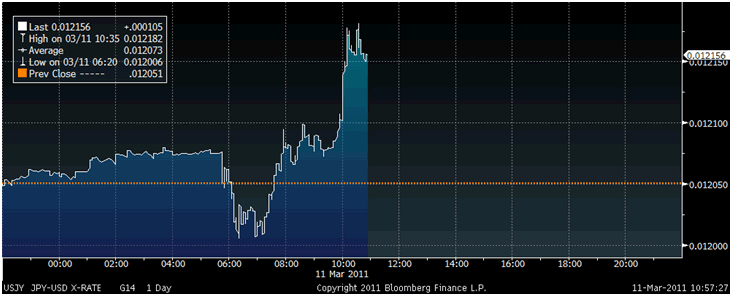

JPY USD – 1 Day (Tick)

Once there is more clarity regarding the scale of the economic destruction – the yen and JPY bonds will likely come under pressure. After the New Zealand earthquakes, there was a delayed reaction prior to selling of the Kiwi dollar and bonds. Incredibly, at its centre, the Japanese megaquake was a thousand times stronger than the one that devastated Christchurch in New Zealand just weeks ago.

Oil prices have pared losses seen on news of the quake and will likely be supported by the uncertainty in Libya and civil unrest in pivotal Saudi Arabia.

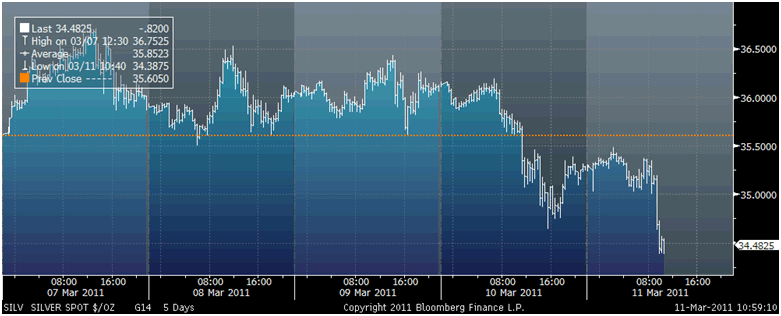

Silver in US Dollars – 5 Day (Tick)

Considering the sharp selloff seen in equity markets in recent days, gold’s resilience is impressive. Gold is down nearly 1% for the week and a lower weekly close could see the short term momentum change and a period of correction and consolidation.

Silver is down 1% for the week and may witness momentum-driven sharp selling on the COMEX in the short term but as ever the long term fundamentals remain very sound.

Sharp falls in equity markets could see margin-driven selling in the precious metal trading pits as was seen in recent years. Selloffs are buying opportunities and will likely again be short and shallow.

Gold

Gold is trading at $1,406.20/oz, €1,020.61/oz and £878.70/oz.

Silver

Silver is trading at $34.08/oz, €24.73/oz and £21.29/oz.

Platinum Group Metals

Platinum is trading at $1,759.25/oz, palladium at $742.00/oz and rhodium at $2,350/oz.

News

(Reuters) -- Tokyo gold futures pare losses after quake, rubber unmoved

The most active gold contract on the Tokyo Commodity Exchange, February 2012 , inched up after an earthquake of magnitute 8.8 struck the north coast of Japan, while the rubber contract for August 2011 barely moved, dealers said on Friday.

The massive quake shook buildings in the capital Tokyo, causing "many injuries", at least one fire and triggering a four-metre (13-ft) tsunami, NHK television and witnesses reported.

(Bloomberg) -- Roubini: Japan Earthquake to Have Significant Confidence Impact

Nouriel Roubini, the economist who predicted the global financial crisis, said the earthquake in Japan will have a 'significant' impact on confidence. He spoke in an interview on Bloomberg Television.

(Marketwatch) -- Asia stocks tumble on Japan quake, Mideast fears

Japanese stocks fell sharply in late trading on Friday after a powerful earthquake rocked the country’s northern coast, triggering a tsunami and generating tremors that shook buildings in Tokyo.

News of the quake, which struck in the closing minutes of stock market trading in Tokyo, accelerated a fall caused after hefty overnight losses on Wall Street and amid lingering worries over the political turmoil in the Middle East.

The quake — the worst ever in Japan since at least 1896 — had a magnitude of 8.9 and its epicenter was 231 miles northwest of Tokyo, according to the U.S. Geological Survey. Tsunami warnings were also issued for many other countries, including Mexico, New Zealand, Indonesia and Taiwan. Several people were injured in Japan, with nearly four million buildings in and around Tokyo losing power, while fires broke out in many buildings, according to reports on the NHK World news channel.

Japan’s Nikkei Stock Average (JP:NI225 10,254, -179.95, -1.72%) ended 1.7% lower at 10,254.43, with losses deepening in the final minutes of trading, following reports of the quake. Shares of MS&AD Insurance Group Holdings Inc. (MSADF 25.90, +0.15, +0.58%) (JP:8725 2,015, -67.00, -3.22%) fell 3.2%, Japan Petroleum Exploration Co. (JPTXF 0.00, 0.00, 0.00%) (JP:1662 3,715, -125.00, -3.26%) dropped 3.3% and Fast Retailing Co. (JP:9983 12,250, -370.00, -2.93%) (FRCOY 15.35, -0.13, -0.84%) gave up 2.9%.

“It’s probably too early to really assess the impact... There’s always a knee-jerk reaction to such things,” said Andrew Sullivan, director for institutional sales at OSK Securities. “

“The tsunami wave seems to be creating a lot of damage, so the insurers are probably going to be badly hit by that. You generally see construction companies see do quite well after [a quake]... What people will look at before Monday is how [Japanese companies’] American Depository Receipts trade in the U.S. tonight,” he added.

In volatile foreign-exchange trading, the yen fell sharply immediately after the earthquake was reported, before bouncing back against the U.S. dollar. The greenback was recently buying 82.79 yen, after moving in a range between 82.63 yen and 83.30 yen.

Japanese government bonds soared after the earthquake, with the lead JGB futures contract rising 0.66 to 139.20 points, while the yield on 10-year cash JGBs fell three basis points at 1.270%.

Dow Jones Industrial Average (DJIA 11,985, -228.48, -1.87%) futures were down 68 points in screen trade, while April Nymex crude oil futures fell $1.40 to $101.30 per barrel on Globex.

Stocks in some other Asian markets also extended losses in the wake of the temblor, notably in Hong Kong and India, amid fears of damage to Japan’s economy from the quake.

Hong Kong’s Hang Seng Index (HK:HANGSENG 23,250, -365.11, -1.55%) finished 1.6% lower, China’s Shanghai Composite (CN:SHCOMP 2,934, -23.35, -0.79%) dropped 0.8%, Taiwan’s Taiex fell 0.9%, South Korea’s Kospi gave up 1.3% and Australia’s S&P/ASX 200 (AU:XJO 4,645, -54.85, -1.17%) slid 1.2%, while in afternoon trading, India’s Sensex (XX:SENSEX 18,142, -186.38, -1.02%) was 1.3% lower.

USDYEN 82.7300, -0.1800, -0.2171%

Among the losers, China Overseas Land & Investment Ltd. (CAOVY 0.00, 0.00, 0.00%) (HK:688 13.44, -0.42, -3.03%) fell 3% in Hong Kong and Sterlite Industries Ltd. (SLT 14.27, -0.52, -3.52%) (IN:500900 160.00, -5.20, -3.15%) fell 2.5% in Mumbai trade.

Most Asian markets were already lower after China reported its monthly inflation data earlier in the day, raising fears of further monetary tightening in the country.

China’s February consumer price index rose 4.9% from a year earlier, unchanged from 4.9% in January, but topped expectations for a 4.8% rise, according to the median forecast in a Dow Jones poll of analysts. China’s producer price index, a measure of pipeline inflation pressures, rose 7.2% from a year earlier, up from January’s 6.6% rise and higher than expectations for a 7.0% rise.

(Reuters) -- Gold up on Middle East tension, Japan earthquake

Gold defied weaker oil prices and gained on Friday after a major earthquake struck northeast Japan and lingering worries about further unrest in the Middle East supported bullion.

But spot gold remained on track for its biggest weekly decline since late January, down more than $20 from a lifetime high hit at the start of the week.

Tokyo gold futures on Tokyo Commodity Exchange (TOCOM) pared losses on safe haven buying after an earthquake of magnitude 8.9 struck Japan, including capital Tokyo, causing many injuries, fires and a four-metre (13-ft) tsunami along parts of the country's coastline.

"It's a bad Friday. It's quite a strong tremor but TOCOM is still operating," said a bullion dealer in Tokyo

Gold added $3.66 to $1,416.25 by 0730 GMT, but a firming U.S. dollar could also cap gains. Gold hit a record of $1,444.40 on Monday, when investors poured money into bullion as oil jumped on violence in Libya and after the downgrade of Greece's credit rating reignited worries about euro zone sovereign debt.

"We are waiting for some escalation in the situation within Saudi. If protesters become more aggressive in some way, you might find see more buying but again, it's being pressured on one side by the dollar," said Darren Heathcote, head of trading at Investec Australia in Sydney.

"On the one side, we've got, probably, downward pressure as a result of a stronger dollar and a bit of flight to safety going on. On the other hand, gold's attractiveness as a safe haven would probably increase, given the uncertainties surrounding Middle East and particularly what's going on in Saudi."

Brent crude fell $2 towards $113 on Friday as a quiet start to the planned "day of rage" in Saudi Arabia eased concern that unrest would spread in the world's top oil exporter, prompting investors to unwind positions.

U.S. gold futures for April rose $3.9 to $1,416.4 an ounce. The contract hit record at $1,445.70 on Monday.

Spot gold will fall more next week to a range of $1,360 to $1,376 per ounce based on its wave pattern and a Fibonacci retracement analysis, according to Wang Tao, who is a Reuters market analyst for commodities and energy technicals.

(Bloomberg) -- Japan's Government Bond Trading Halted After Earthquake Strikes

Japan Bond Trading Co. said it halted transactions at 2:49 p.m. in Tokyo after an earthquake struck off the nation's northern coast and forced some of its customers to evacuate.

The country's largest interdealer debt broker said it will decide whether to resume trading on March 14 depending on circumstances over the weekend.

(Bloomberg) -- BNP Paribas Increases 2011 Silver Forecast to $35.50 an Ounce

Silver will average $35.50 an ounce this year, up from a previous forecast of $30.60, BNP Paribas SA said today in an e-mailed report.

The bank raised its 2011 palladium estimate to $860 an ounce, from $825.

(Bloomberg) -- Gold May Gain on Unrest, European Debt Concern, Survey Shows

Gold may gain as concern about unrest in North Africa and the Middle East and Europe’s debt crisis boost the metal’s appeal as an alternative investment, a survey found.

Ten of 16 traders, investors and analysts surveyed by Bloomberg, or 63 percent, said bullion will rise next week. Four predicted lower prices and two were neutral. Gold for April delivery was down 1.5 percent for this week at $1,407.50 an ounce at 11:30 a.m. yesterday on the Comex in New York after reaching a record $1,445.70 on March 7.

Muammar Qaddafi’s forces yesterday resumed air strikes on oil hubs in the central area of Libya’s coastline. In Saudi Arabia, websites have called for a “Day of Rage” today, Human Rights Watch said. Moody’s Investors Service this week cut credit ratings for Spain and Greece. European Union leaders meet today to discuss tackling the region’s debt crisis.

“The likelihood of continuing geopolitical tension in Libya, North Africa and the Middle East and the continuing euro- zone sovereign-debt crisis are a toxic cocktail likely to result in higher gold prices,” said Mark O’Byrne, executive director of brokerage GoldCore Ltd. in Dublin.

The attached chart tracks the results of the Bloomberg survey, with the red bars derived by subtracting bearish forecasts from bullish estimates. Readings below zero signal that most respondents expect a decline. The green line shows the gold price. The data are as of March 4.

The weekly gold survey that started more than six years ago has forecast prices accurately in 202 of 353 weeks, or 57 percent of the time.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.