Bernanke "Fed Prepared to Respond as Necessary" to Support Economic Recovery and Price Stability

Economics / US Economy Mar 02, 2011 - 06:36 AM GMTBy: Asha_Bangalore

A likely threat of inflation following the Fed's extraordinary monetary accommodation and rising commodity prices is the most discussed topic in recent days. Chairman Bernanke addressed concerns about inflation in lucid terms in his semi-annual testimony this morning. First, he noted that the "rate of pass-through from commodity price increases to broad indexes of U.S. consumer prices has been quite low in recent decades, partly reflecting the relatively small weight of materials inputs in total production as well as the stability of longer-term inflation expectations."

A likely threat of inflation following the Fed's extraordinary monetary accommodation and rising commodity prices is the most discussed topic in recent days. Chairman Bernanke addressed concerns about inflation in lucid terms in his semi-annual testimony this morning. First, he noted that the "rate of pass-through from commodity price increases to broad indexes of U.S. consumer prices has been quite low in recent decades, partly reflecting the relatively small weight of materials inputs in total production as well as the stability of longer-term inflation expectations."

Therefore, higher commodity prices are likely to translate into temporary and "relatively modest" gain in consumer prices in the United States. Second, sustained rise in prices of commodities would "represent a threat to both to economic growth and to overall price stability, particularly if they were to cause inflation expectations to be become less well anchored." He closed his comments on inflation with the strong conclusion that the Fed is "prepared to respond as necessary to best support the ongoing recovery in a context of price stability."

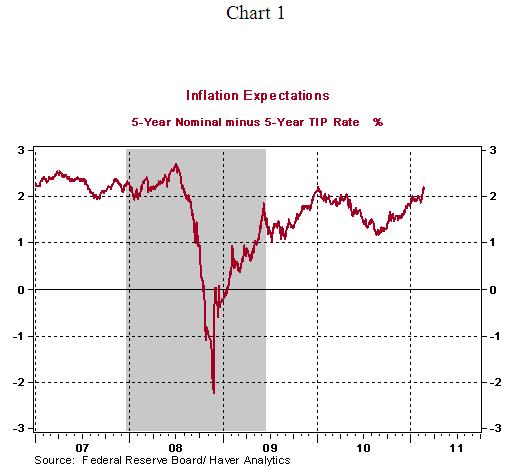

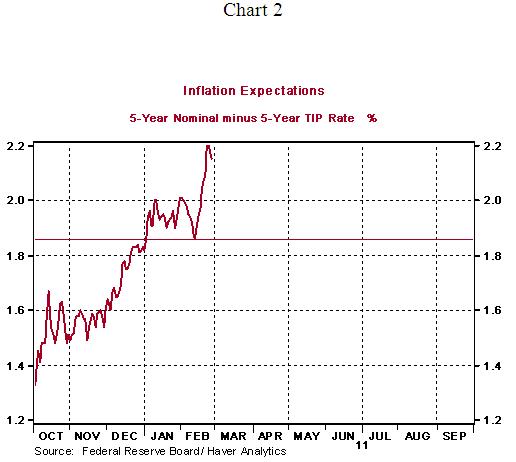

Chart 1 depicts inflation expectations as measured by the difference between the nominal 5-year U.S. Treasury note yield and the 5-year inflation protected security. Based on this measure, inflation expectations are stable, for the most part, with the exception of the recent increase (Chart 2 focuses on inflation expectations in recent weeks). Inflation expectations moved up to 2.20% as of February 21 from the February 14 reading of 1.86%, reflecting the impact of the crisis in North Africa and the Middle East, but it has moved down to 2.15% as of February 28 as market participants have reassess the situation. Therefore, market estimates of inflation expectations suggest they are not unmoored, as yet.

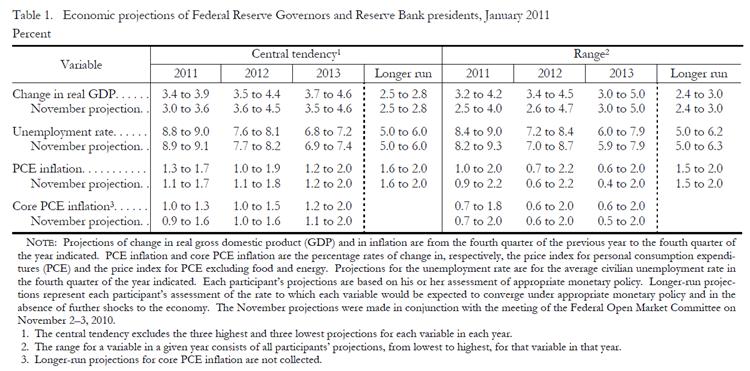

The Chairman's remarks are reassuring to markets. But, skeptics would wonder how the Fed would justify a tightening of monetary policy if the gain in commodity prices is persistent under circumstances of an elevated unemployment rate. The Fed remains optimistic on this front given its forecast of inflation (see the nearby table).

Source: www.federalreserve.gov

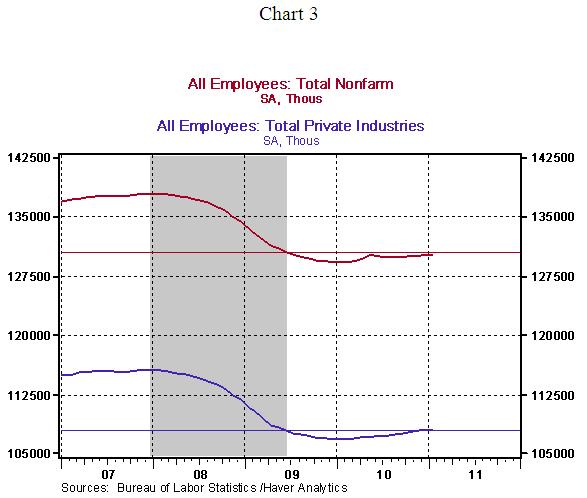

Chairman Bernanke noted that the housing market is "exceptionally weak" and indicated that mortgages are hard to obtain, in a few instances, even though homes are affordable. Although the Fed does not expect the unemployment rate to post a rapid decline in the months ahead, Bernanke presented a slightly upbeat reading of the labor market and pointed out that the jobless rate had declined in December and January, initial jobless claims had dropped, and firm plan to hire. He repeated remarks made previously that "until we see a sustained period of stronger job creation, we cannot consider the recovery to be truly established." Chart 3 illustrates the reason for concern; the level of payroll employment has barely budged from the level seen in June 2009, when the recovery commenced.

With regard to monetary policy, Chairman Bernanke presented a defense of the Fed's quantitative easing program as he has done on prior occasions. In light of inflation fears cited in relation to this program, Bernanke indicated that the Fed could raise interest rate paid on excess reserves, conduct reverse repurchase agreements with primary dealers, issue term deposits to drain reserves, stop reinvestment of principal payments on securities held at the Fed and put upward pressure on short-term interest rates.

He listed these options to highlight the tools available to reduce the current level of monetary accommodation and underscored the Fed's resolve to prevent inflation from rising to an undesirable level with the following remark: "The FOMC remains unwaveringly committed to price stability and, in particular, to achieving a rate of inflation in the medium term that is consistent with the Federal Reserve's mandate." In the Q&A session, Chairman Bernanke indicated that self-sustained economic growth and inflation of about 2.0% would allow the Fed to withdraw monetary accommodation.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.