NetFlix, Butterflies and Option Expiration

Companies / Options & Warrants Feb 22, 2011 - 09:11 AM GMTBy: J_W_Jones

“I love the smell of napalm in the morning” Lt Col Bill Kilgore, Apocalypse Now

“I love the smell of napalm in the morning” Lt Col Bill Kilgore, Apocalypse Now

One of the opportunities available to the knowledgeable options trader is the ability to capitalize on major price movements while maintaining an acceptable risk profile. These opportunities are particularly attractive when they occur late in the options cycle because of the rapidly accelerating decay of the time premium of options. In appropriately structured positions, this time decay can be a wind at your back as the time premium relentlessly goes to zero at the closing bell on options expiration Friday.

Let us consider the recent opportunity presented during the current options expiration week by NFLX. As an aside, for those of you who have read my columns before, remember that we recently discussed an earnings trade on this underlying. Lest you think my screen is stuck on this underlying, remember that not all vehicles exhibit adequate liquidity for options trading.

NFLX is a prime example of such a stock with huge Open Interest (OI), tight bid/ask spreads, and tremendous daily volume. These are the types of vehicles that work best for option trading. Beware of options with little liquidity, they can lead to “Hotel California” syndrome; you can check in but you can’t check out.

But I digress; let’s return to the situation in NFLX. This past Monday, the beginning of the February options expiration week, NFLX gapped up and reached an intraday high of $247.55, a price which represented an all time historic high for this stock. The chart is displayed below:

As is always the case in options trades, it is important to consider the reaction of the implied volatility to this price spike. As shown in the chart below, the rapid price rise resulted in a volatility spike. The at-the-money options went from an implied volatility (IV) of 34% at market close Friday to an IV of 44% at market close Monday. As another aside, many option traders consider that IV is inversely correlated to price. This current reaction demonstrates the more accurate view that IV is more closely correlated to the velocity of price change.

These factors together with my prognostication that this spike in price was, at least for the short term, not sustainable led to the initiation of a high probability trade. The structure of the trade was that of a put butterfly constructed with a bearish directional bias. The essence of the trade was twofold:

1. I expected downward movement in the price of NFLX.

2. A dual impact on the time premium sold within the butterfly.

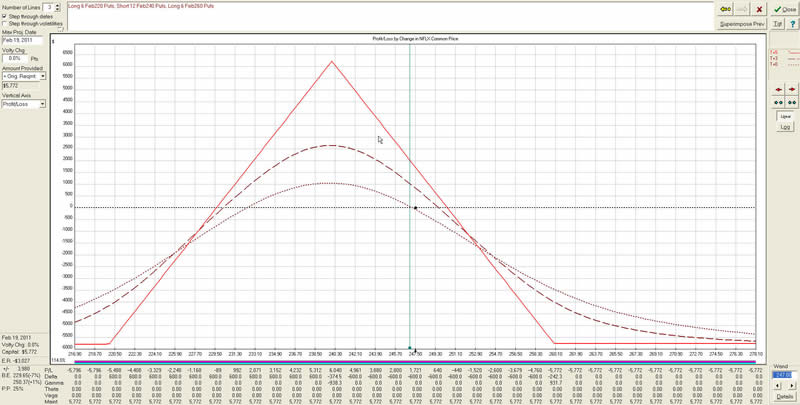

This hypothesized dual impact would be both time decay into expiration and decreases in IV as the unsustainable price velocity slowed. The structure of the trade implemented Monday afternoon and its expected P&L behavior is graphed below:

Pay particular attention to the lowest broken line; this represents the P&L characteristics at the time the trade was initiated. Using the options expiration break even points as stops, the point at which the solid red line crosses the 0 point, a potential risk:reward in excess of 1:7 is possible.

Over the next 2 days of market action, the prediction of a decrease in price came to fruition. At market close Wednesday I removed half of the trade and captured a return of 32.6% on invested capital. The remainder of the trade remains in place and currently shows a profit of around 40% on invested capital.

One of the important functional characteristics of option positions in general is the extreme dynamic nature of their profitability. It is for this reason that it is often wise to remove part of a profitable position in order not to suffer economic loss, and, more importantly, the damage to emotional capital from allowing a winning position turning into a loser.

When considering the dynamic nature of option positions, one of the fastest potential movers is a butterfly at expiration. As the position approaches expiration, the rapid decay of time premium results in extreme sensitivity to price movement. Butterflies turn from gentle creatures lazily flapping their wings in the breeze to man eating dragons as expiration approaches. Be prepared to slay the dragon before he can take your hard earned profits.

Get My Trade Ideas Here: http://www.optionstradingsignals.com/profitable-options-solutions.php

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.