Financial Markets and the U.S. Orwellian Non Farm Payrolls Report...

Politics / Market Manipulation Feb 05, 2011 - 12:32 PM GMTBy: Jesse

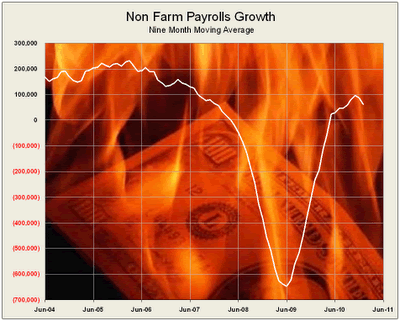

The weather ate the recovery.

The weather ate the recovery.

Now we know why the Wall Street demimonde had been pimping the unemployment number as 'the key number to watch' as compared to actual jobs added earlier this week. Although at the time they never really said why.

The weather was too bad for people to go to work, but it didn't matter when it came to registering for unemployment benefits. And over 500,000 unemployed people apparently disappeared in snow drifts, and are no longer counted in the labor force, thereby improving the percentage of remaining people who do not have jobs. It's a shrinking denominator thing.

The weather was too bad for people to go to work, but it didn't matter when it came to registering for unemployment benefits. And over 500,000 unemployed people apparently disappeared in snow drifts, and are no longer counted in the labor force, thereby improving the percentage of remaining people who do not have jobs. It's a shrinking denominator thing.So, there are plenty of new jobs out there. The people just could not get to them because of the snow.

Even J. Bradford DeLong, stalwart Democonomist from Berkley, was a little put out by this report.

"I want a trained professional to analyze this. It is not unusual for the series to do something odd around Christmastide. It is not unusual for the series to diverge. Not this much."

And Brad is not the overly fussy sort, because a few years ago he said that Alan Greenspan had never made a policy decision with which he disagreed.

The trained professionals trotted out on financial television say that this means that the recovery is here. Wait until you see next month's numbers. Yada-yada. And it is time to buy stocks.

Here is my own trained professional opinion of how to analyze this report, and Obama's economic policies in general. We can't stop here. This is bat country!

O tempora. O mores. O Bernanke. O Bama.

From the Cafe commentary on 2 Feb:

"Now it is fairly well known that the unemployment rate is a less important metric, since people stop being counted as unemployed when no longer receiving unemployment benefits, or when they take a menial low paying job. And in a prolonged downturn you can therefore have improvements in the unemployment rate without any real improvement in overall unemployment like the labor participation rate and the median wage, which are the key indicators of a sustainable recovery.

So it makes me wonder what antics the government and the pigmen might have up their sleeve to rattle the swill bucket for mom and pop to get back into stocks, and most likely once again at a top."

Here is another trained professional opinion from another era:

"...there must be an end to a conduct in banking and in business which too often has given to a sacred trust the likeness of callous and selfish wrongdoing. Small wonder that confidence languishes, for it thrives only on honesty, on honor, on the sacredness of obligations, on faithful protection, and on unselfish performance; without them it cannot live. Restoration calls, however, not for changes in ethics alone. This nation is asking for action, and action now."

Franklin Delano Roosevelt, First Inaugural Address, 1933

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.