Gold, Stocks and Dollar Trend Analysis and Forecast

Commodities / Gold and Silver 2011 Feb 03, 2011 - 04:06 AM GMTBy: Chris_Vermeulen

Do I See Lipstick On A Pig? Or Is The Stock Market and Gold Still Going Up?

Do I See Lipstick On A Pig? Or Is The Stock Market and Gold Still Going Up?

As most sophisticated investors and traders are aware, the U.S. Federal government has run up significant deficits and the long term debt burden is becoming a drain on Gross Domestic Product. That being said, most economists are discussing the possibility of a major decline in the value of the U.S. Dollar going forward as inflationary monetary policy begins to strangle growth. While that view point may prove right over the long haul, in the short run most traders are not likely expecting the U.S. Dollar to rally.

The U.S. Dollar is expected to reach a multi-year cycle low in the near future. From the cyclical low, I expect the U.S. Dollar to regain a strong footing and work higher against the crowd. This is not to say that the U.S. Dollar will not eventually decline, but financial markets do not work that easily. Shorting the U.S. Dollar is a crowded trade and Mr. Market punishes crowded trades quite often by pushing prices the opposite of what the heard is expecting. Should the U.S. Dollar find a strong underlying bid, precious metals and domestic equities would feel the brunt force of such a move. While it remains to be seen if the U.S. Dollar rallies, if it does it will catch many traders and economists by surprise and the unwinding of the short dollar trade could unleash a wave of buying that we have not seen for quite some time.

Let’s take a look inside the market…

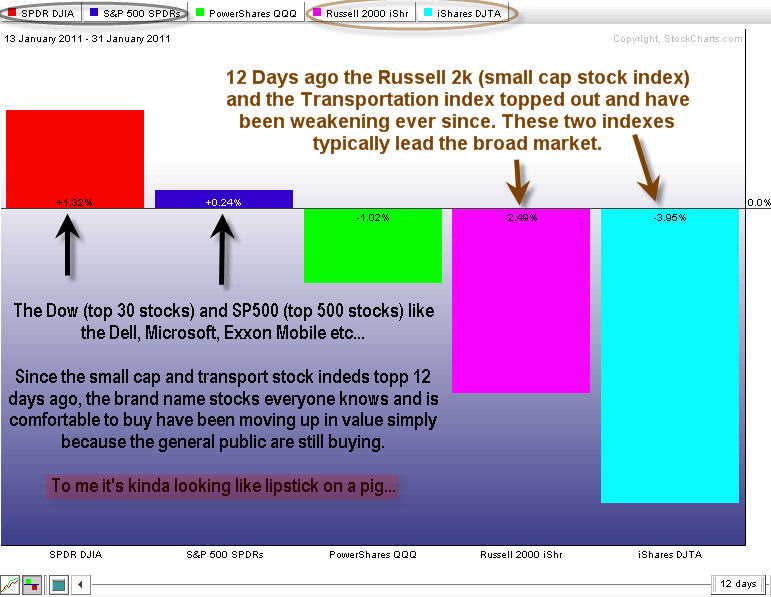

Major Index Price Action Over The Past 12 Trading Sessions - Bearish

Below is a table showing the main indexes used for tracking the market. The interesting thing about this data is that the indexes which typically lead the market have been deteriorating for the past 12 days and no one has noticed.

In short, the Nasdaq, Russell and Dow Transport indexes typically lead the market

Every radio station and business channel covers the Dow and SP500 indexes therefor the general public hears the market performance based on the those indexes. The problem here is that the Dow only consists of 30 stocks and the SP500 only holds the top 500 companies which is not a full view of the overall market because there are thousands of stocks listed on the exchanges.

The analysis below can be taken two ways depending which boat you are in… which I will explain in just a minute. The way I see things is a bit of both, I’m not really in or boat or the other… rather I have one foot in each because I have seen the market do things which support both sides (manipulation and measured technical moves) during my 14 years trading.

Ok here are my thoughts/opinions/forecasts…

Idea #1: Dow and SP500 indexes which 99% of the public use to gauge the market are moving higher on light volume. I feel because these indexes hold the stocks which everyone knows and is comfortable buying that this is the reason why they keep going up while the rest of the market silently erodes. It’s the simple thought that big money is moving out of leveraged positions (small cap stocks, transports, technology) in anticipation of a market correction, and the Average Joe continue to buy into brand name stocks boosting the Dow and SP500 thinking things are peachy..

Idea #2: We all know there is market manipulation, the question is how much of the price action is manipulation and how much is real supply and demand? No one will ever really know and that’s just part of the market and trading we have to deal with as traders. But I know there are traders out there blaming the Feds, POMO, and PPT for pushing the market up month after month. So the question is if these invisible forces manipulating the top 30-500 stock prices by buying them up which naturally boosts the Dow and SP500 indexes to keep everyone bullish on the market?

My thinking is that it’s a bit of both and that a correction is just around the corner.

Gold Miner Stocks Underperform Gold – Not a good sign

Gold stocks today (Wednesday) underperformed the price of gold and are also forming a bearish chart pattern. If this plays out then we can expect another sizable pullback in both gold stocks and the price of gold because this index typically leads the gold.

US Dollar Multi Year Support Trendline

The US Dollar is trading down at a key support level and if we get a bounce and possibly even a rally then we could see a sizable correction in stocks and commodities across the board. As we all know everyone is shorting the dollar, buying gold and buying food commodities…. So it makes sense that all these crowded plays are about to see a major shift. Now this is just my contrarian point of view and those of you who follow my work know I’m not bias in my trading. I just take the market one day or week at a time and play the setups. But you must step back and look at the larger picture and at least give it some thought…

Concluding Thoughts:

In short, the major indexes are moving higher on light volume which is not a strong sign, and other key indexes are pointing to lower prices. The question everyone wants to know is how low will this correction be? The answer to that is that you must play the trend as you never know if a trend will last 2 days or a year. I take the market one day at a time continually analyzing price action.

If you would like to get more of my daily analysis to join my newsletter at www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.