Gold Will Reach Unbelievable Price and Silver Will Outperform Gold

Commodities / Gold and Silver 2011 Feb 02, 2011 - 07:26 AM GMTBy: GoldCore

Hopes of economic recovery swept stocks higher in New York yesterday and this confidence spread to Asian equity markets. European stocks are tentatively higher as concerns about Egypt and geopolitical risk may be hampering gains. Oil prices remain near recent record highs (brent rose above $102 a barrel) and there are hopes that geopolitical tensions will subside, markets will remain calm and there will not be panic buying of oil and a new oil crisis.

Hopes of economic recovery swept stocks higher in New York yesterday and this confidence spread to Asian equity markets. European stocks are tentatively higher as concerns about Egypt and geopolitical risk may be hampering gains. Oil prices remain near recent record highs (brent rose above $102 a barrel) and there are hopes that geopolitical tensions will subside, markets will remain calm and there will not be panic buying of oil and a new oil crisis.

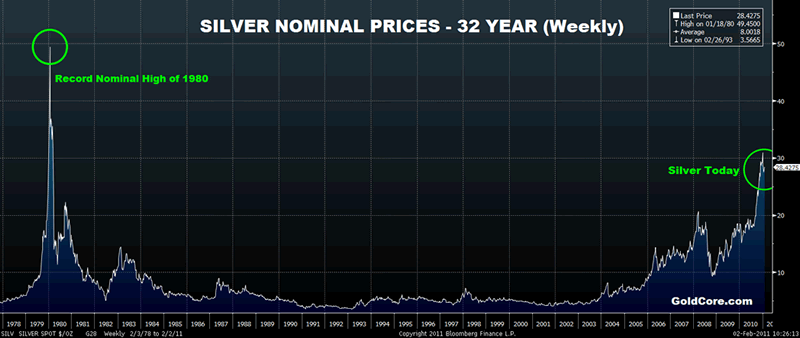

Silver in Nominal USD – 1978 to Date (Weekly)

Gold and silver are marginally lower today in all currencies, but recent action suggests we may have seen capitulation and are in the process of bottoming out. Physical demand remains robust and both jewelers and investors are using the sell off as an opportunity to buy on the dip.

Demand for US Silver Eagles exceeded the record of monthly sales in 1986 by nearly 50% with 6,422,000 one ounce silver bullion coins sold. Yesterday alone saw another 50,000 Silver Eagles sold showing that physical demand for silver remains very robust. Reports of shortages of 100 ounce silver bars are overstated at this stage but there is certainly a degree of tightness developing in the market that we have heretofore not experienced.

Premiums for gold bars in Hong Kong and Singapore remain at the highest level since 2004. While Chinese New Year demand has ebbed, wedding season in India is next month and Indians will accumulate on the dip as they always do. Gold imports in India, the world's largest consumer of the precious metal, already rose 18 percent in January to 40 tons. Indians buy gold, and increasingly silver, jewellery at religious celebrations and weddings and use it as a store of value.

Legendary investor Jim Rogers speaking to investors in Amsterdam this morning, said that gold is still far from being a bubble and investors should sell bonds and buy precious metals. The chairman of Rogers Holdings, who predicted the start of the global commodities rally in 1999, said that “gold should have a rest but it’s far from being a bubble yet.”

“Gold will have reached an unbelievable price before it starts falling,” Rogers said, who owns gold but prefers silver due to it remaining cheap relative to gold and cheap on a historical basis.

Rogers recently said “silver is going up, but silver is 40% below its all time [nominal] high. Yes, commodities have been going up recently, but they are still extremely depressed on a historic basis.”

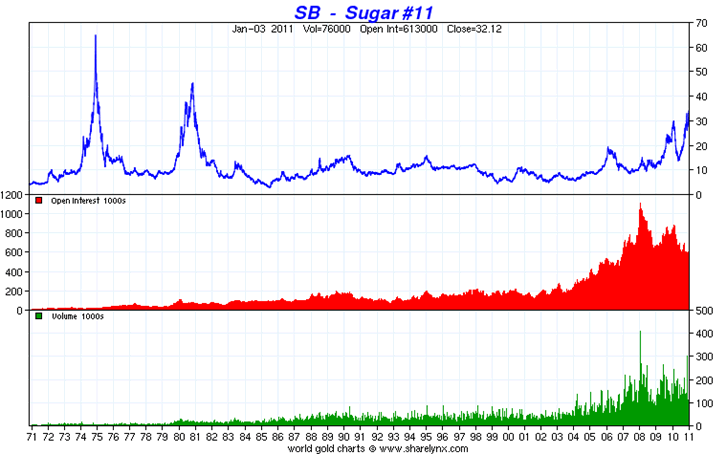

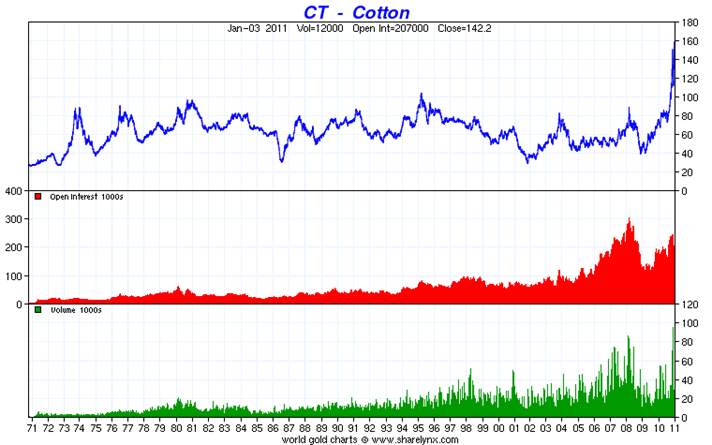

Rogers is referring to the fact that while some commodities, such as copper and cotton, have risen to record nominal highs recently, many remain close to and not far above average prices seen back in the 1970s. Since that time there has been significant inflation and therefore adjusted for inflation, which is always crucial to do, many commodities remain well below their inflation adjusted highs of more than 30 years ago.

Since then, the global population has nearly doubled to more than 6.5 billion people, and there has been the emergence of huge middle classes and rising consumption in most of the world; especially in India, China and the rest of Asia.

One example of a commodity that is only marginally above its average nominal price from the 1970s is cotton. World cotton prices have risen to nominal highs in recent days due to robust demand, very low world stocks of cotton, limited supply and a depreciation of the US dollar.

The silver, sugar and cotton charts above show that despite their recent price gains, many commodities remain well below their inflation adjusted prices of more than 30 years ago. This is also the case with gold and silver as their record adjusted for inflation highs from 1980 are $2,300/oz and $130/oz.

This suggests that the recent price gains in commodities and rise in inflation may not be another short term speculative price rise and may be something more sustainable. It may even herald the continuation of the “commodity supercycle”.

Having said that, another bout of deflation and a double dip recession and depression in the US and global economy could see another sell off in commodities – at least in the short term.

Due to safe haven investment and store of value demand, gold and silver would perform well as they did in the deflation of the 1930s and during the recent bout of deflation in the current and ongoing global financial and economic crisis.

GOLD

Gold is trading at $1,333.40/oz, €965.81/oz and £822.63/oz.

SILVER

Silver is trading at $28.25/oz, €20.46/oz and £17.43/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,821.50/oz, palladium at $818.50/oz and rhodium at $2,450/oz.

NEWS

(Bloomberg) -- Gold Is Still Far From Representing a Bubble, Jim Rogers Says

Gold is still far from being a bubble even after prices have been on the rise for a decade, Jim Rogers, the chairman of Rogers Holdings who predicted the start of the global commodities rally in 1999, said.

“Gold should have a rest but it’s far from being a bubble yet,” Rogers said, speaking to investors in Amsterdam today. “Gold will have reached an unbelievable price before it starts falling,” Rogers said, who owns gold, silver and rice. Gold touched a record $1,432.50 an ounce in New York on Dec. 7 and traded at $1,342.30 an ounce in New York at 5:13 p.m. local time.

(Bloomberg) -- Petropavlovsk's Hambro Sees Gold `Spike' by End of 2011: Video

Peter Hambro, chairman of Petropavlovsk Plc, talks about the outlook for the gold price. He speaks with Bloomberg's Ryan Chilcote at Troika Dialog's "Russia Forum" in Moscow. Sees gold at $1,500-$2,000 by end of year due to “real problems with the value of the money”.

(Bloomberg) -- Gold Fluctuates as Recovery Curbs Haven Demand, Inflation Gains

Gold swung between gains and losses as further evidence of an economic recovery in the U.S. blunted demand for a haven, while accelerating inflation in Asia and political tensions in Egypt boosted the allure of the metal.

(Bloomberg) -- Palladium to Average $840 in 2011 on Rising Demand, SocGen Says

Palladium, which quadrupled in the last two years, will extend gains this year as increased industrial demand deepens a global deficit, according to Societe Generale SA.

Spot prices will average $840 an ounce in 2011, David Wilson and Stephanie Aymes, London-based analysts at the bank, wrote in a report dated yesterday. That’s 11 percent higher than their previous forecast of $755 an ounce, and compares with the average price of about $799 an ounce so far this year.

The gains will be “driven by the recovery in the U.S. auto industry, the improving BRIC nations’ auto industry and the gain in market share in diesel emissions-control systems,” the analysts wrote. BRIC refers to Brazil, Russia, India and China.

Palladium supply will lag behind demand by about 300,000 ounces this year and 700,000 ounces next year, excluding demand for exchange-traded products and movements in inventories, they said.

Immediate-delivery metal traded at $824.75 an ounce at 11:07 a.m. in Singapore today.

(Zero Hedge) -- US Mint Sells Absolute Record 6.4 Million Ounces Of Silver In January, 50% More Than Previous Highest Month

As the topic of US Mint silver sales is not new to our readers, after we first brought attention to the record January sales by the Mint, we will not dwell much on it, suffice to say that the final January tally is in. And at 6,472,000 ounces, this is nearly 50% higher than any prior month in the Mint's 26 years of published sales history. This has occurred, despite supposed profit taking in the paper silver market in January. And just today, another 50k, were sold. It seems that physical buyers continue to enjoy the dip in paper silver that is providing them with an attractive entry point.

(Financial Times) -- Commodity super-cycle is back in full swing

Sovereign debt risks, high unemployment, the threat of deflation, regulatory uncertainty. Just a few of the anxieties currently keeping financial markets on edge and which set a less than auspicious backdrop for commodities to stage a strong performance in 2011.

However, raw materials markets are proving highly resilient to aftershocks from the financial crisis. In markets as diverse as copper, sugar, tin, cotton, gold, palladium and pork bellies, prices have now exceeded the peaks set in the bull market of 2006-2008; oil prices are again trading consistently above $90/barrel, while in the UK the cold snap pushed gas prices to almost double where they were in the run up to Christmas 2009 (see News)

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.