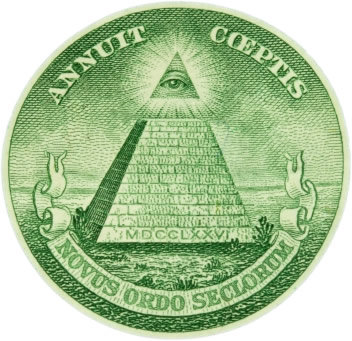

Investors Beware of Gold and Silver Pyramid Schemes

Commodities / Gold and Silver 2011 Feb 02, 2011 - 04:19 AM GMTBy: GoldSilver

Join silver expert David Morgan of Silver-Investor.com and Michael Maloney in Las Vegas, where the famous Luxor Casino pyramid provides the perfect backdrop for a discussion of the latest gold and silver investment pyramid schemes.

Join silver expert David Morgan of Silver-Investor.com and Michael Maloney in Las Vegas, where the famous Luxor Casino pyramid provides the perfect backdrop for a discussion of the latest gold and silver investment pyramid schemes.

Gold and silver are “honest money,” David says, but “like any financial instrument there’s good and bad in it.” Among the bad: pyramid schemes luring unwary investors with promises of rich profits on silver coins and numismatics.

The basic premise is this, Mike explains: the new investor comes in on the bottom of the pyramid, agreeing to purchase one or two or 10 coins each month at a certain price, which is considerably higher than retail price of the bullion or the collectable premium of the coin. The new investor also brings in two new buyers to join the club. When the two new buyers purchase their coins at the same ridiculously high price, the original investor who recruited them receives a small cut of the profit, and the bulk of the profit gets passed up the line to the top of the pyramid. The idea is that as the investor works his way up the pyramid, his take grows larger and larger, eventually covering the cost of his own monthly coin purchase.

The basic premise is this, Mike explains: the new investor comes in on the bottom of the pyramid, agreeing to purchase one or two or 10 coins each month at a certain price, which is considerably higher than retail price of the bullion or the collectable premium of the coin. The new investor also brings in two new buyers to join the club. When the two new buyers purchase their coins at the same ridiculously high price, the original investor who recruited them receives a small cut of the profit, and the bulk of the profit gets passed up the line to the top of the pyramid. The idea is that as the investor works his way up the pyramid, his take grows larger and larger, eventually covering the cost of his own monthly coin purchase.

There are several problems with this model, Mike explains. For one thing, “what happens is, there comes an end to every bull market. And 82% of the people that have come in don’t end up breaking even. They end up transferring some of their wealth to the top 18%.”

The “entrepreneurs” who started the pyramid sit at the top, skimming the majority of the profit. “They’re the ones that are really getting wealthy off of this,” Mike says. “Everybody is paying them, and they never go out of the top of this pyramid. They are sitting at the top permanently.”

Bottom line—know what you’re doing, David says. “Keep it simple, know what you’re buying, pay a fair price to the dealer, start small until you’re comfortable, and go on from there. These types of schemes, to my knowledge, never work out for you. After all, Mike and I are looking out for you.”

What is a Pyramid Scheme?

Pyramid schemes now come in so many forms it makes spotting them difficult though they share in one overriding characteristic. They promise investors huge profits from recruiting others to join their program, rather than proceeds from real investments or sales of goods. Some pyramids claim to sell products, but they often simply use the merchandise to hide their pyramid structure.

There are two telltale signs for these schemes: inventory front-loading plus a lack of retail sales.

Inventory front-loading is when a firm's incentive program forces a recruit to buy loads of products, often at inflated prices. If this occurs in the company’s distribution system, the people at the top of the pyramid reap substantial profits, regardless of the fact that little or no product is sold to the market. While folks at the bottom make excessive payments for inventory which simply accumulates.

Lackluster retail selling is also a red flag that a pyramid exists. Pyramid schemes typically claim their product is selling in huge volume but upon close examination, the sales either occur between people who are inside the pyramid or to new recruits who are joining the pyramid con, not to consumers out in the general public.

In a pyramid scheme, the pitch can be quite seductive as delivery on a high rate of return to a few early investors over a short period of time can produce temporary credibility and testimonials. Yet, pyramid schemes are illegal for a reason… they inevitably must fall apart. When the scheme collapses, most investors find themselves at the bottom, unable to recoup their losses

How to Spot a Pyramid Scheme?

1. Beware of plans with exaggerated earnings claims, especially when there are no underlying product sales or investment profits.

2. Be careful of any plan that offers commissions for recruiting new sellers, particularly when there is no product involved or when there is a distinct, up-front membership fee. Also don’t assume that a presence of products or services, removes all danger. The Federal Trade Commission has caught pyramids offering investment opportunities, charity benefits, off-shore credit cards, jewelry, women's underclothing, makeups, cleaning supplies, and even energy.

3. If a plan purports to sell a product or service, check to see whether its price is inflated, if new members must buy costly inventory, or whether members make most "sales" to other members instead of the public. If these conditions exist, the purported "sale" of the product or service may simply mask a pyramid scheme that promotes an endless chain of recruiting and inventory loading.

4. Beware of programs that claim to have secret plans, foreign connections or special relationships that are difficult to verify.

5. Beware of any plans that delay meeting its commitments while asking members to hang in there. Many pyramid schemes advertise that they are in the preliminary launch phase, yet they never can nor do launch for by definition a pyramid scheme can never fulfill its obligations to all its participants. To survive, pyramids need to keep and attract as many members as possible. Thus, promoters try to appeal to a sense of community or solidarity keeping its marketing arm intact, while rebuking outsiders or doubters.

6. Finally, beware of programs that attempt to capitalize on the public's interest in newly deregulated markets or high technology.

Bottom Line: Every investor fantasizes about becoming wealthy overnight, but in fact, getting rich is usually the result of enterprising ideas and hard intelligent work. If it sounds too good to be true, chances are high that a con is going on.

- Mike Maloney

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2011 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.