Geopolitical Instability in Middle East, Gold Like 1970s?

Commodities / Gold and Silver 2011 Feb 01, 2011 - 08:35 AM GMTBy: GoldCore

Spot gold and silver fell 6% and 9% respectively in January. The January price fall looks very much like another price correction and consolidation and is to be expected after the 30% rise in dollar terms seen in 2010. Absolutely nothing has changed with regard to the fundamentals of the gold and silver market and investors should use this sell off as another opportunity to diversify into the precious metals.

Spot gold and silver fell 6% and 9% respectively in January. The January price fall looks very much like another price correction and consolidation and is to be expected after the 30% rise in dollar terms seen in 2010. Absolutely nothing has changed with regard to the fundamentals of the gold and silver market and investors should use this sell off as another opportunity to diversify into the precious metals.

Correction: Yesterday our market update said that gold bar premiums in Hong Kong were at 17-year highs. They are in fact at 7-year highs, their highest level since 2004.

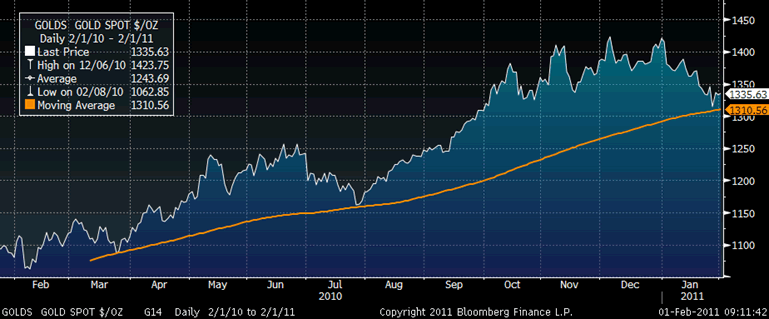

Gold in USD – 1 Year (Daily)

Gold’s 150 day moving average is at $1,310/oz and as can be seen in the chart above this has provided strong support in recent months. Interestingly, gold fell some 1.5% in January 2010 and continued to fall in February before bottoming after the first week in February (08/02/10). Gold then rose slightly in February, consolidated in March and rose strongly in April, May and June. July saw another correction prior the strong gains seen from August to December.

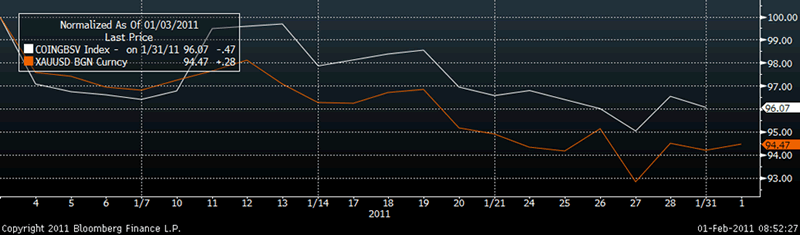

Gold in USD and British Sovereigns in USD – 30 Day (Daily) – Sovereign Premiums Rise

Nothing has changed regarding tight supply and robust demand and indeed, the geopolitical events in Tunisia, Yemen and Egypt and tensions in the Middle East provide another important catalyst for higher gold prices in 2011. With all the attention on Egypt, the risk of war between Iran and Israel and possibly the U.S. has been forgotten about – for now.

There is a concern that we could see geopolitical contagion and the crisis spreading to the undemocratic oil rich states of United Arab Emirates, Kuwait and Saudi Arabia. This could lead to an oil crisis and at the very least it will likely lead to higher oil prices and most likely a sustained period of higher oil prices. This will lead to even higher trade deficits and inflation in oil importing countries - especially the U.S. which is one of the most oil dependent countries in the world.

The Middle East remains very unstable with real tensions between Israel and its Arab neighbours and Iran. The IMF's Managing Director, Strauss-Kahn, warned in Singapore overnight that "as tensions within countries increase, we could see rising social and political instability within nations -- even war."

Gold in USD – 1971-2011 (Weekly)

The two oil shocks of the 1970s saw gold prices rise by more than 24 fold (2,300%) in just 9 years - from $35/oz to $850/oz see chart above).

To put that in perspective, today gold's rise has been far more gradual and it has risen some 5 fold (430%) in 11 years - from $250/oz to $1,330/oz. In this regard it resembles gold’s rise from $35/oz in 1971 to nearly $200/oz in late 1974 – a six fold increase.

Given the significant macroeconomic, systemic, monetary and geopolitical risks of today gold is likely to perform again as it did in the 1970s. A 20 fold increase from trough in 1999 to peak sometime in the coming years would see gold rising to over $5000/oz .

This may seem outlandish to those unaware of gold's fundamentals but the very small supply of gold internationally, increasing demand (particularly from investors and central banks), the sovereign debt crisis in the EU (soon to spread to the U.S.) and the debasement of the dollar, the euro and other currencies internationally makes this increasingly possible.

Those who buy this price dip in gold and silver will likely be rewarded again. As ever rather than trying to predict the future price movement of any asset class investors and savers today need to diversify and protect themselves from the significant macroeconomic, systemic, monetary and geopolitical risk in the world today.

GOLD

Gold is trading at $1,337.48/oz, €972.64/oz and £830.48/oz.

SILVER

Silver is trading at $28.27/oz, €20.55/oz and £17.55/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,804.85/oz, palladium at $819/oz and rhodium at $2,450/oz.

NEWS

(Wall Street Journal) --Barrick CFO: Central Banks May Shift More Reserves Into Gold

The world's biggest gold producer expects central banks will likely shift more of their monetary reserves into gold this year, as they worry about soaring stockpiles of U.S. dollars. Jamie Sokalsky, chief financial officer of Canada's Barrick Gold Corp., said there has been a "sea change'' in the past year, with central banks that had stocked up on U.S. dollars starting to buy more gold to diversify their holdings. Many forecasters say that trend will continue this year, since global currency reserves are approaching the $10 trillion mark—the bulk of it in U.S. dollars— even as a faltering economy and climbing debt load look set to depress the value of those dollars, said Mr. Sokalsky, in an interview with The Wall Street Journal.

(Bloomberg) -- Rand Refinery to Upgrade Refining to Boost Coins, Bus. Day Says

Rand Refinery Ltd. of South Africa will spend 500 million rand ($70 million) over the next five years to upgrade its gold and silver processes, Business Day reported, citing Managing Director Howard Craig.

The company will work with commercial banks to encourage retail buying of gold coins, the Johannesburg-based newspaper cited Craig as saying. The smelter’s capacity will double to 8,000 metric tons a year and production of refined silver will increase fourfold, it said.

(Bloomberg) -- Gold Gains as Inflation Concern, Egyptian Protests Boost Demand

Spot gold climbed, rebounding from the biggest monthly drop since 2009, on speculation that rising food and oil prices will increase the metal’s appeal as a hedge against inflation. Protests in Egypt also boosted haven demand.

(Bloomberg) -- Commodities Overtake Stocks, Bonds After Two-Day Gain on Egypt

The biggest two-day rally in commodities since December pushed raw materials past stocks, bonds and the dollar for a second month, after Egyptian riots drove oil, wheat and rice higher.

The S&P GSCI Total Return Index of 24 raw materials gained 3.1 percent in January and rose for a fifth month, the longest streak since 2004, according to data compiled by Bloomberg. The MSCI All-Country World Index of equities climbed 1.6 percent including dividends. The U.S. Dollar Index, a gauge of the currency against six counterparts, fell 1.6 percent. The Global Broad Market Index for corporate and government bonds lost 0.2 percent as of Jan. 28, Bank of America Merrill Lynch data show.

Commodities have beaten stocks for three months, the longest stretch since June 2008, after the Federal Reserve pledged to buy $600 billion of Treasuries and demand for clothes and food lifted cotton, cocoa and copper. Equities were poised to break the streak until Jan. 28, when concern Egyptian President Hosni Mubarak will be ousted sent the MSCI gauge to its biggest retreat since November and boosted food and fuel.

(Bloomberg) -- Gold’s Biggest Gain in 12 Weeks Is ‘Capitulation’ End (Update1)

The “capitulation” in gold that drove the metal to its worst January in 14 years may be ending as escalating violence in northern Africa spurs demand for a haven and after a key technical indicator held.

Futures traded on the Comex exchange in New York jumped 1.7 percent on Jan. 28, the most since Nov. 4, as thousands of people took to the streets of Egyptian cities to protest the 30- year rule of President Hosni Mubarak. Gold earlier rebounded off its 150-day moving average, an indication the metal may surge 21 percent to a record by the end of June, according to technical analysis by the Hightower Report.

(Bloomberg) -- Mexico Gold Output Rose in November, Silver Declined (Update1)

Gold production in Mexico rose 3.3 percent in November to 5,264 kilograms from 5,095 kilograms in the year-ago period, the National Statistics Agency, known as Inegi, said today in a statement on its website.

Silver production declined 3.3 percent to 256,767 kilograms compared with 265,536 kilograms in 2009, Inegi said.

Copper production rose 4.6 percent to 19,291 tons in November compared with 18,449 tons in the same month a year ago, the national statistics agency said.

Overall, mining production in November rose 1.1 percent, Inegi said.

(Reuters) -- Policymakers see dollar losing reserve currency allure

The U.S. dollar's role as a reserve currency will diminish in the coming years as Asian economies like China grow and countries seek to diversify their monetary holdings, policymakers said on Friday.

The U.S. Federal Reserve's policy of quantitative easing -- essentially printing money -- and a call by France to look at ways to wean the world off the dollar as the sole reserve money have put the U.S. currency in the spotlight.

GOLDNOMICS

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.