Stock Market Breakdowns and Divergences Signal Trouble Ahead

Stock-Markets / Stock Markets 2011 Jan 24, 2011 - 11:49 AM GMTBy: Anthony_J_Stills

This week was notable for the official state visit of the Chinese President, Hu Jintao, to American soil. I liken it to the landlord coming to visit his tenants. The visit lasted three days and I saw little in the way of news and comments among the usual suspects. In fact as Hu boarded the plane, these were the headlines on www.msn.com:

This week was notable for the official state visit of the Chinese President, Hu Jintao, to American soil. I liken it to the landlord coming to visit his tenants. The visit lasted three days and I saw little in the way of news and comments among the usual suspects. In fact as Hu boarded the plane, these were the headlines on www.msn.com:

- 18 Commandments foe a Bangin Body

- The Surprising Secret for Increasing Passion

- Frigid Weather

- America’s Most Dangerous Jobs

- Taking Justice into Their Own Hands (Phoenix Jones considers himself a superhero)

Gripping to say the least, and certainly newsworthy! I guess you have to play to your audience, or in this case play down to your audience.

I guess I come from another time and place but I remember when people actually sat around the table and had an intelligent discussion. The news came on once a day back in the 60’s, a half an hour of local news at 6 pm followed by thirty minutes of national news. Walter Cronkite was the best thing since sliced bread as he reported the news ala Edward R. Morrow. Ask any teenager today who Edward R. Morrow is and he won’t have a clue. That’s a shame but then again so is what passes for news today. NFL football, actors and sports celebrities who get arrested or send inappropriate text messages, radical abs, and other minutia capture and stimulate the imagination.

Perhaps our news is more conspicuous for what’s absent. There was little said about the Chinese President’s visit because we truly didn’t want to know. After all we owe his country close to three trillion dollars, we’re paying him in a fiat currency that has been losing value for a decade, and we’re generating more and more of it with each passing day. I suppose the majority of Americans feel it’s best not to know what he thinks. Ignorance is bliss, or something along that line.

I am probably one of the few people walking this planet who truly believe that you can’t hide the truth from the market. We live in a time where manipulation is running amuck and just about everyone believes that its okay and it can go on forever. I don’t buy into that. I think the market is like a giant earthmoving machine in that it always gets where it’s going to go, just not when you want it to. Some markets are harder to manipulate due to their size or the fact that the cost is greater than the reward. The Fed is an expert at manipulating gold and the stock market because its just “paper”. The US dollar is another example, but this is the only case where the manipulation is actually following the trend.

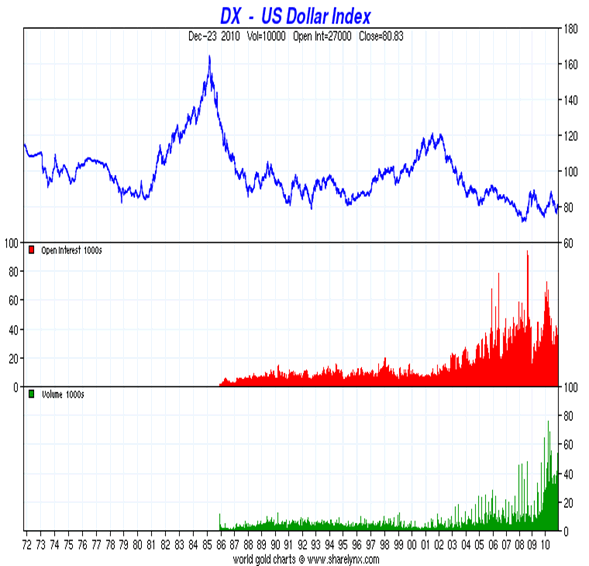

Here is an historical chart of the US Dollar Index showing the decline began from the all-time high in 1985 and made an all-time low as recently as 2008:

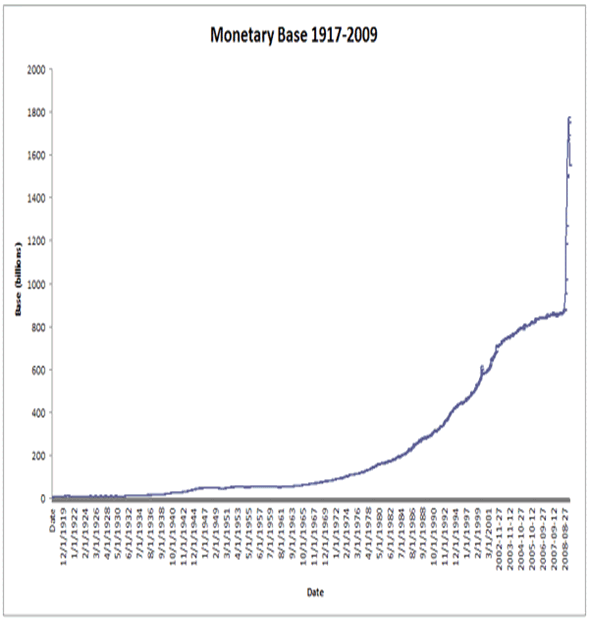

Notice that the dollar made a significant lower high as late as 2001. The greenback was able to get away with this because it occupied the status as the world’s reserve currency, a condition that no longer exists. The reason the dollar is no longer the world’s reserve currency can be found in this chart of the US money supply:

Notice that the supply of fiat dollars began to increase almost exponentially after 1985 and with Alan Greenspan’s reign of terror as Chairman of the US Federal Reserve. This is the same Alan Greenspan who came out in the press on Friday and said that a gold standard in the US would be a good idea!

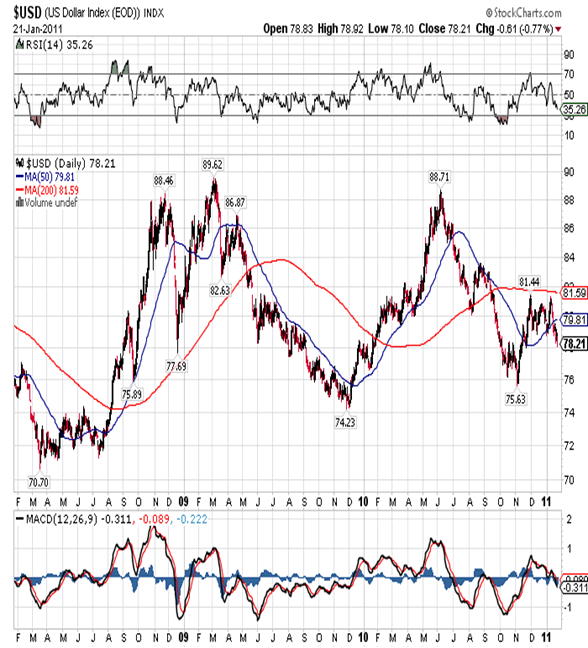

With respect to the US dollar the handwriting was on the wall more than a year ago when it failed on three separate attempts to penetrate strong resistance at 89.96 as you can see below:

It failed on the last attempt a couple of months before the idea surfaced that additional quantitative easing would be necessary. Finally, as if that wasn’t enough the last spike up toward the 89.96 resistance formed part of a head-and-shoulders formation that traced out a neckline at 80.16, and that is almost identical to the old historic low going back decades. When something like that happens, it’s never an accident. It’s a warning that will never be espoused on Bloomberg and it should be taken very seriously. Once the US Dollar Index dips below 76.15, the media will no longer be able to sweep the inevitable under the rug.

I contend that the Fed is manipulating the dollar lower. Most of the debt in the world is in US dollars, and federal, state, and local governments in the US generate most of that dollar denominated debt, so there is a big incentive. A cheaper dollar means that the US owes less in real terms. The flip side is that with every tick down in the US Dollar Index, every American has less wealth and makes less money in real terms. The Fed’s dirty little secret is that they have no intention what so ever of paying off their staggering debt. They are going to devalue the greenback to the point where it is worth nothing and the debt is at zero in real terms. The people who hide behind the Wizard of Oz curtain don’t care because they’re taking all the free fiat paper the Fed secretly gives them and they’re buying gold, silver, Swiss Francs and other tangible items that will maintain their value, acting as a store of wealth, over time. You on the other hand are being played for a world-class sucker.

Aside from the US dollar, the bond market is also leaking value in spite of the Fed’s best efforts to act as a buyer of last resort. Bonds are dollar denominated debt so you have a double whammy: the dollar loses value and the Fed’s manipulation means that interest rates are a lot lower than they should be. Interest is a function of risk and the United States is a very high risk right now so rates should be “banana republic” high instead of “AAA” low. Since the folks who run Standard & Poor’s don’t want to share a jail cell with Wikileak’s owner Julian Assange, they tow the company line and maintain the “AAA” rating for US debt. By the time they finally get around to lowering the rating the horse will have been long since gone from the proverbial barn and you can put your worthless bonds in the same drawer as your worthless dollars.

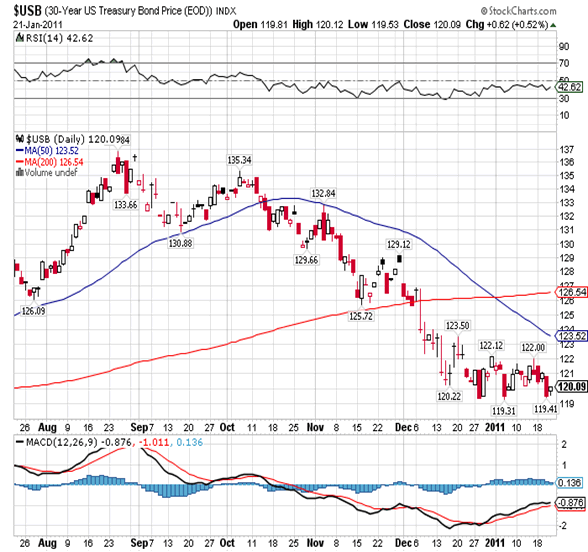

The bonds share a lot of similarities technically with the US dollar as you can see in this daily chart of the 30-Year Treasury:

As far as deterioration is concerned the bonds lag the US dollar by a couple of months. The dollar began its leg down in May whereas the bonds began their latest move down in August and have yet to break out of their trading range. There is good support at 119.50 and you can see that the bond is in its third attempt at breaking down through it. On Friday it looked like it would succeed at moving lower but some afternoon buying saved the day. The Fed perhaps? In any event you can see that the 50-dma is now below the 200-dma and is pointed down. This is in spite of the fact that the Fed is buying billions of dollars a week in US government debt in an effort to keep rates low. This effort is doomed to failure and rates will rise whether the Fed likes it or not. Much has been made about the economic recover in the US and the “blow out numbers” being posted by the big companies and I believe it’s a lot of smoke and mirrors.

Here’s the typical spiel: “shares of the world’s largest maker of jet and turbine engines rose 7% on Friday, hitting their highest level since the thick of the financial crisis in November 2008, and making GE the biggest lift to the blue-chip Dow Jones industrial average. Investors called the results a sign that the economy was strengthening.” This came after GE announced better than expected earnings, earnings that in my opinion are quite deceptive due to the fact that GE has tons of OTC derivative that aren’t marked to market, but rather to some fictional value that will never be realized. GE is just one of a host of institutions that engage in this type of activity and when taken as a group it creates the illusion that things are better than they actually are.

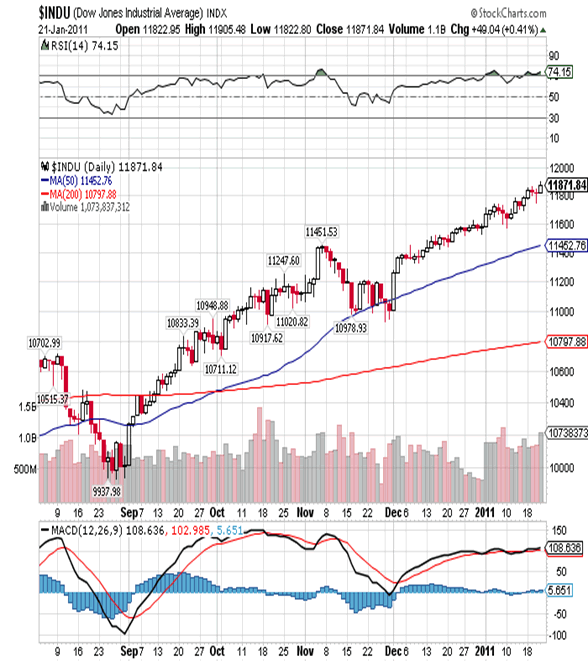

The Dow has been the beneficiary of all this activity as stocks continue to power higher, but the movement has become more selective with each passing day. By that I mean the Dow is literally going it alone of late as almost all the major indexes, at home and abroad, have turned down. First take a look at the Dow:

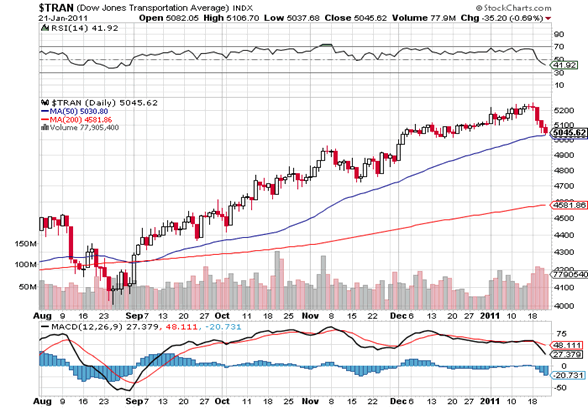

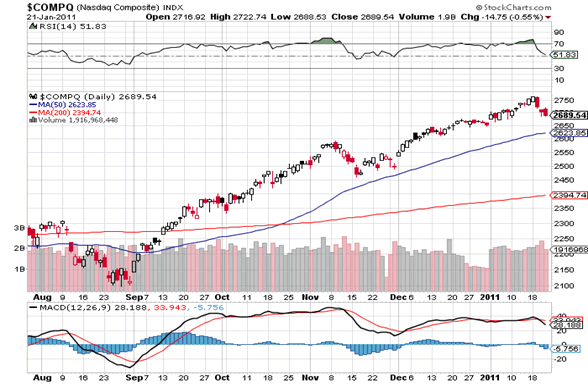

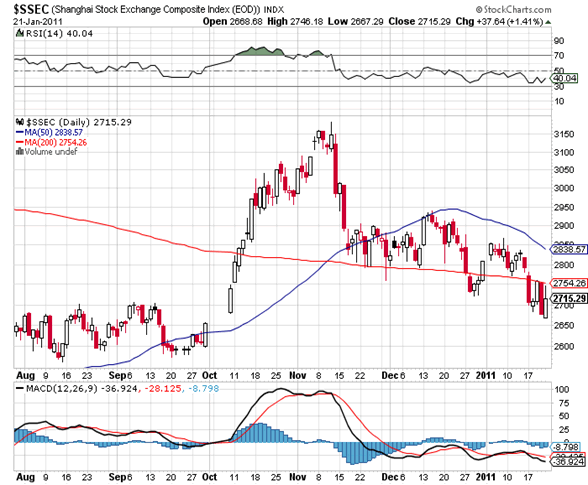

You can see on Friday that the Dow made yet another new closing high for this leg up as it ended Friday’s session at 11,871, and it did so alone. Now take a look at charts for the Transports, the NASDAQ and the Shanghai Stock Exchange:

In particular you can see the Shanghai Stock Exchange has really melted down and that will probably come as a shock to many people since China is considered the world’s economic engine right now.

Focusing on the Dow you can see a real divergence with the Transports and that is usually a sign of trouble ahead. Two times this week we saw the Dow start to head lower and then buyers came to the rescue. You have to wonder what’s going through the head of investors who buy into a market that pays a microscopic average dividend of 1.8%. That’s as low as I recall in my adult lifetime. Then there’s the fact that RSI has yet to confirm any of the new highs in the Dow, another warning sign. The number of new 52-week highs has now fallen all the way down to 81, down from the 475 averages we saw back in August. There’s more that I can say but I think you get the general idea. We have signs of weakness if you want to see them.

For more than two months I have been saying that the Dow will rally up to a test of strong resistance at 12,266 and I’m also projecting a top on or very close to March 1st. Why March 1st? It is the two-year anniversary of the March 2009 low and it coincides nicely with the 90-day cycle, its 180 days from low and 90 days from another low. Furthermore I’ve been saying that if that is the case there could also be a low around the 29th of January at 60 days from a low and make the last drive 30 calendar days. For that to happen we need to see a correction start on Monday and run throughout the week. The market definitely had its chance to correct this week but the Dow absolutely refused to give up the ghost. To further complicate the scenario we could by chance see a run to a higher high on the 29th, creating an inversion, and that could prove to be the top followed by thirty days of distribution and a retest between the 29th and March 1st. These things are never easy to predict, especially since there are so many distortions built into the market place. Finally, I am convinced that once this top is in the indexes will quickly turn down and the decline will be violent.

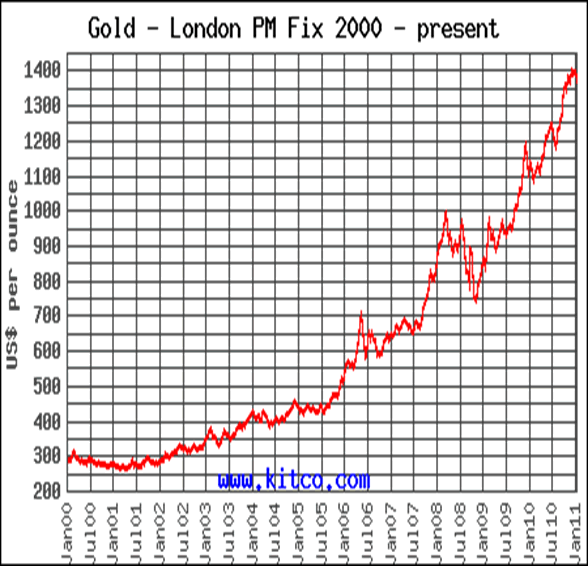

Obviously I don’t believe in paper and I believe that commodities will fall through the floor once the Dow turns down, so that only leaves cash or gold. Since all the central banks in the Western world are on a printing binge, gold is the only salvation. Unfortunately many speculators are more than a little disenchanted with gold as we’ve seen the dollar fall and commodities prices soar, fertile ground for the yellow metal, and yet the price of gold is falling. You can blame it on manipulation but you haven’t solved the problem. To a great degree the real problem seems to be a lack of patience and to a lesser degree involves unreal expectations. As you can see in the following historical chart, the rise in the price of gold is almost machine-like. Historical charts are almost always monthly charts and takes out a lot of rough patches and volatility that occurs over short periods of time:

As you can see over the last ten years an investment in gold is second to none. The problems come when you sit in front of the screen everyday and hang on each and every price gyration. Here you get a better picture of the ups and downs that try the patience of those trying to make a living trading the yellow metal:

When you look at the price movement for the current secondary trend the story is the same. Yes, we can see reactions but the trend is higher, it is intact and it is not even close to being violated. Now look at the sideways price movement from March 2009 through July 2009 that most mistook for an end to the bull market. Then look at the price movement from July 2009 to December 2009, a strong move higher, and how a sideways movement followed it that everybody again thought was a top. Finally in July 2010 we saw another strong move to a new all-time high that produced an extremely overbought market. This has now been followed by yet another sideways movement the still managed to produce slightly higher highs and yet work off the overbought condition. RSI is now at 38 and approaching extremely oversold territory indicating that a bottom is either here or close.

The spot gold closed out the week at 1,342.50 and still well above the first line of strong support at 1,330.00. So far the price has fallen 6% over a period of thirteen sessions so there is a decent chance that Friday produced a bottom. In the off chance that gold does test 1,330.00 it will not in any way affect the primary or secondary trends and a worst case scenario is that gold trends sideways to lower for another two weeks bouncing along a bottom around 1,298.60. Personally I think we’ve seen the worst and I remain convinced that we are simply seeing a mild reaction, as I said before 6% and thirteen days so far, and gold will soon head higher. A lot higher! Given the fear among speculators, I have to believe that very few will benefit from the rise to 1,600.00 and that’s the way it usual is in a bull market.

CONCLUSION

I grew up in a moderately sized Midwestern town, population 150,000, and enjoyed a reasonably privileged life. I went to catholic schools until I was sixteen and the nuns educated me, American nuns I might add. I don’t think American nuns even exist any more. I guess the Vatican found it was cheaper to train nuns from India and Pakistan and ship them to the States. Also, I believe they figured out that it was much easier to “control” them in the sense that didn’t grow up in a free society and were less likely to deviate from established norms. The nuns I knew were between the ages of thirty and seventy and all of them had post-graduate degrees, and for the most part they were free thinkers. Without exception they were good human beings and they took great pains to educate their charges and they looked out after them. This meant that they sometimes bumped heads with the priests and that caused friction. Don’t forget that the Catholic Church was and is run by men, for the benefit of men, and women didn’t have much of a voice in 1962.

Our particular parish was very fortunate in that Monsignor MacKacken, a/k/a Father Mac, ran the show and he got along famously with the good sisters. No excesses were every allowed and to the best of my knowledge none ever occurred. Every school has a moral compass and mine was no exception. Sister Lucy was a five-foot tall, wiry, eighty-five year old bat right straight from hell. Mean as a snake! She could wrestle to the ground and pin any two priests on any given day. She could also wing a piece of chalk across the room, at a velocity that would have made Sandy Koufax proud, and take out a fly sitting harmlessly on the edge of the desk. More often than not though a student whose attention had drifted was the target. Everybody, even Father Mac, gave her a wide berth. I lived on the golf course in those days and the sport was Father Mac’s Achilles heel and I knew it. On a sunny spring day it didn’t take much to convince him to abandon his post and head to the golf course. Well one day we were sneaking back in just before the final bell and Sister Lucy caught us. Father Mac was no slouch at 6’ 2” and 210 pounds but he wanted no part of the good Sister. He took one look at me and said, “Son, you’re on your own!” and went off to hide in the Sacristy. Detention followed shortly there after.

Aside from telling a cute story I am trying to make a point. Fifty years ago we still educated people in the United States. Teachers taught and they cared about what they did and the students they reached out to. Abuses were not allowed but discipline was. When a student couldn’t adapt to a curriculum the teachers wanted to know why. Early on I was one of the worst students and I seemed distracted. They took the time and effort to figure out why. It seemed that my intelligence was higher than the norm so I was simply bored, so they developed a curriculum that was adequate for me. The same was true for kids on the other end of the spectrum. Simply put they modified the curriculum to meet the student’s needs. The student had priority! In today’s world the pendulum has swung to the other extreme. If a child can’t conform he is labeled “ADD” and filled with Ritalin until he can conform to the curriculum. Since this system is hopelessly flawed quotas are introduced and children are pushed through the system as long as they’re quiet and conform. Unfortunately, they haven’t enjoyed the benefits of a real education. To quote something I read the other day “few realize that we are changing the brains of schoolchildren through medication in order to make them adjust to the curriculum, rather than the reverse”.

That’s our society today in a nutshell, and I am convinced that it is by design. We fill them up on Ritalin, give them a X-box filled with mind-numbing violence and sexual innuendo, and then we’re all surprised when someone walks into a high school and kills fifteen people. Hell, I’m surprised that it doesn’t happen every week! Why would anybody purposely want a dumbed-down populace? For one it’s a lot easier to control someone who has little awareness of what’s going on around him. Remember the headlines I posted at the beginning of this report? Superficial bullshit designed to distract and entertain. Throw in the appeal of the Roman Coliseum in the form of NFL football and the masses have their entertainment. Keep them all busy while you plunder their wealth. Convince them that flipping hamburgers at McDonalds for minimum wage is “employment”. Load them down with cheap credit so the feel wealthy while at the same time they sell their soul to the company store. Give them football five nights a week while you slowly take away their rights and their liberty that their forefathers sacrificed so much for.

I know you’re tired of hearing this, and god knows I’m tired of saying it, but this will not end well. I have the impression that there is an air of desperation in Washington as the puppet politicians come to the conclusion that they are about to be castrated in the court of public opinion for blindly following their masters. The small group of men, who hide behind the curtain of anonymity like the Wizard of Oz, will simply move on to where the pickings are better. I have to believe that the United States will weather the storm and we’ll see a better nation as a result, one without the Obama’s and the Bushes. Maybe we’ll even go full cycle and end up with the Republic that Ben Franklin gave us 240 years ago. It won’t be easy because we’ve made a lot of enemies along the way, and when the US defaults on its debt, it will make a lot more. You can’t hold yourself up to be the moral compass for the world, fail miserably, and expect everybody to greet you with open arms.

Competition will be fierce and China wants to be the world’s dominant superpower, they have a good plan, and they are implementing that plan. The US is like a ship adrift without a rudder, trying to put out one fire after another, and wasting what little opportunities that are left. We need to return to a small government where one man has one vote. We need to end this idea where politicians in Washington “get sophisticated implicit, unspoken promises to work for large corporations” in return for a favorable vote. Finally, I want to leave you with one thought: we need to stop trying to understand events and we need to start causing events to happen.

Anthony J. Stills / Steve Betts

analyst@theablespeculator.com

© 2011 Copyright Anthony J. Stills - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.