Gold on the Verge of Going into Correction Mode

Commodities / Gold and Silver 2011 Jan 11, 2011 - 09:06 AM GMTBy: Clive_Maund

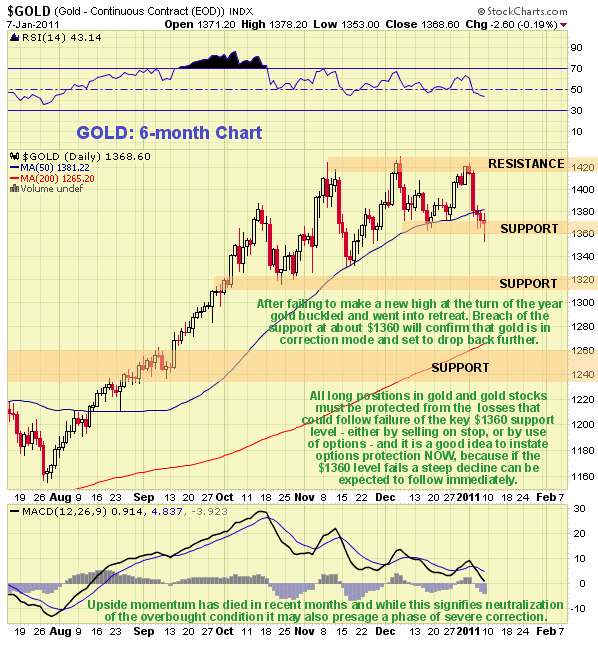

The rally in gold in the final trading days of December was unable to make new highs, and now it is on the verge of going into correction mode. On the 6-month chart we can see how, after a sharp drop on Monday, gold just held key support at $1360 from Wednesday through Friday. If this support should fail soon, which looks increasingly likely, then gold can be expected to go into retreat.

The rally in gold in the final trading days of December was unable to make new highs, and now it is on the verge of going into correction mode. On the 6-month chart we can see how, after a sharp drop on Monday, gold just held key support at $1360 from Wednesday through Friday. If this support should fail soon, which looks increasingly likely, then gold can be expected to go into retreat.

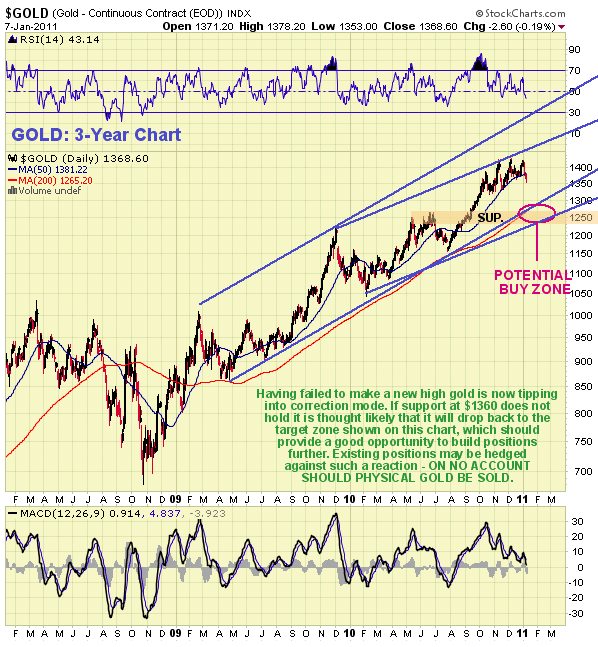

On its 3-year chart we can see that if gold breaches $1360 then a retreat towards the 200-day moving average now approaching $1270 is on the cards, with a lesser probability of it stabilizing at support in the $1320 area and bottoming there. Should we see such a retreat, any possibility to obtain physical gold (and silver) should be seized. ETFs should be avoided. On no account should physical gold and silver be sold - at times like this holdings should be hedged by means of options etc which can be liquidated for a profit to offset bullion losses when a bottom is thought to have been reached. That way you are insulated from losses and capitalize fully on the impulse waves. Options protection should be implemented BEFORE $1360 is breached, as prices can be expected to ramp if $1360 is breached as a steep drop is likely to follow immediately.

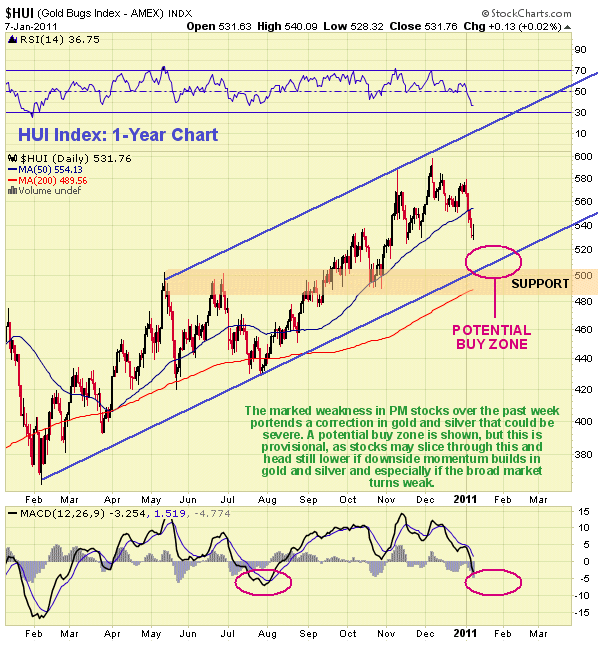

Stocks have, as usual, anticipated the weakness in bullion and portend further weakness. On the 1-year chart for the HUI index we can see that it has dropped away quite sharply. A potential buy zone is shown, but this is only provisional, as the index may slice through this and head lower if downside momentum in gold and silver builds and especially if the broad market turns weak.

Fundamentally, a reason for the current weakness in the Precious Metals is thought to be a certain "lightheadedness" amongst investors who are being increasingly being taken in by the recovery talk, but unfortunately a recovery created by printing money is not a real recovery, and any so called gains resulting will be more than cancelled out by inflation.

The fear factor certainly doesn't seem to be in decline in this video entitled The Day the Dollar Died - see you down at the store!

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.