Destruction of the U.S. Dollar, The Real Reason Paul Volcker Wants Out

Currencies / US Dollar Jan 06, 2011 - 03:57 AM GMTBy: Jeff_Berwick

The news that Paul Volcker plans to step down from a "panel of experts" advising Barack Obama today will likely whip market participants into a bit of a frenzy analyzing what this could possibly mean.

The news that Paul Volcker plans to step down from a "panel of experts" advising Barack Obama today will likely whip market participants into a bit of a frenzy analyzing what this could possibly mean.

But, the problem with their conclusions will be that they are starting from an incorrect premise. The great majority of market participants believe that Paul Volcker was responsible for ending the inflation of the 1970s. And, as usual, the great majority of market participants are wrong.

First, Paul Volcker didn't actually slow inflation down. This chart, taken from an excellent article (Kitco: Inflation, Manipulation, and Long-Term Market Trends) written in 2006 by Steven Saville, shows that money supply growth did not stop upon Volcker's arrival in August, 1979.

In fact, money supply growth which had spiked to over 12% four years before Volcker arrived on the scene had declined somewhat, to about 7.5% when he took office. In the ensuing four years after Volcker took the reins at the Fed money supply increased dramatically, peaking again around 12% in 1983.

Furthermore, if you look at the black line which denotes the actual M2 money supply it showed no change of trajectory, whatsoever, during Volcker's entire time as Fed Chairman.

By objectively looking at the growth in money supply it not only appears that Volcker did not "slow" inflation but it appears as if he did absolutely nothing at all. Nothing changed, in terms of money supply growth, during his time in office.

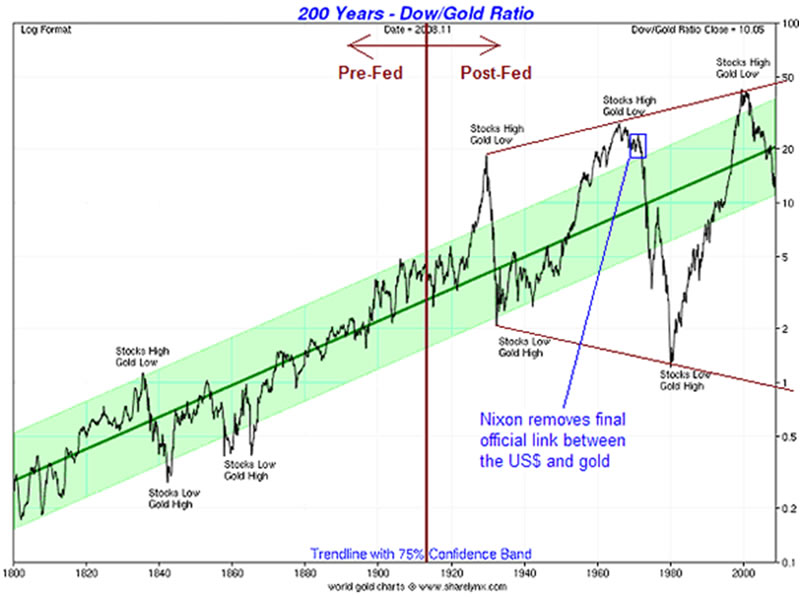

Steven Saville later points out in another article from 2008 (Kitco: Increasing Instability) that what did happen in 1979, upon Volcker's arrival, is that the inflation shifted from gold and commodities, which had reached heights not seen since the 1800s into more appealing assets such as the stock market.

The gold bull market of the 1970s ended in January of 1980, about 5 months after Volcker took the helm of the Fed. During this 5-month period the gold price rocketed upward, driving the Dow/Gold ratio down to around 1 and thus making gold more expensive relative to the US stock market than it had been at any time over the preceding 100 years.

This extreme overvaluation of gold and extreme undervaluation of the stock market had nowhere else to go but in the other direction. But this change had nothing to do with Paul Volcker slowing inflation.

Many people also believe that Paul Volcker's increasing of interest rates is what "ended the inflation". But that also is not entirely true. The markets demanded higher interest rates and moved rates higher.

All Paul Volcker did is not try to stop them. Had he tried to stop them by artificially holding the real interest rate 10-15% below the market demanded rate he would have likely destroyed the US dollar in a hyperinflation.

So, what did Paul Volcker really do in the end? He just didn't completely destroy the dollar.

Fast forward 30 years later and Ben Bernanke has an even tougher job than Volcker. Impossible actually.

In 1979 the total debts of the United States Government were not large enough that 16% interest rates would have bankrupted the Government.

A quick look at the US Government's income (taxes) and expenses show the following income:

· $1.061 trillion - Individual income taxes

· $940 billion - Social Security and other payroll tax

· $222 billion - Corporation income taxes

· $77 billion - Excise taxes

· $23 billion - Customs duties

· $20 billion - Estate and gift taxes

· $22 billion - Deposits of earnings

· $16 billion - Other

Note that they include Social Security payroll tax as "income". This is highly fraudulent. Quite theoretically, these payments are supposed to be held and/or invested on behalf of the payee. But the US government just includes it as revenue and immediately spends it (which is why, under GAAP, the US now has such a massive unfunded liability of over $75 trillion).

So, if the $940 billion in Social Security payments are, rightfully, taken out of "revenue" then the actual income of the US government was $1.44 trillion in 2010.

In 2010 the US government paid $414 billion in interest expenses. Considering the US had approximately $13 trillion in "official" debt in 2010 that implies a 3.1% interest rate. At what interest rate would interest payments on current debt outstrip the current government income (minus social security taxes) of $1.44 trillion? 11.1%.

Ben Bernanke must somehow keep interest rates below 11.1% or 100% of the US Government's income will be paid solely to interest costs rendering the Government insolvent.

The problem is if he holds interest rates at artificially low levels much longer the US dollar will go into hyperinflation.

Paul Volcker had two options: Hold interest rates artificially low and destroy the US dollar in a hyperinflation or allow the market to achieve its natural interest rate level (which ended up being nearly 16%) and allow the game to continue on a while longer.

Ben Bernanke also has two options: Hold interest rates artificially low and destroy the US dollar in a hyperinflation or allow the markets to achieve its natural interest rate and bankrupt the US Government, destroying the dollar.

Both of Bernanke's options end up in the destruction of the US dollar.

No wonder Volcker didn't want to be around to have his picture taken on the day that happens

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.