The ISM Manufacturing Survey Kicks Off the New Year on a Bullish Note

Economics / Economic Recovery Jan 04, 2011 - 05:26 AM GMTBy: Asha_Bangalore

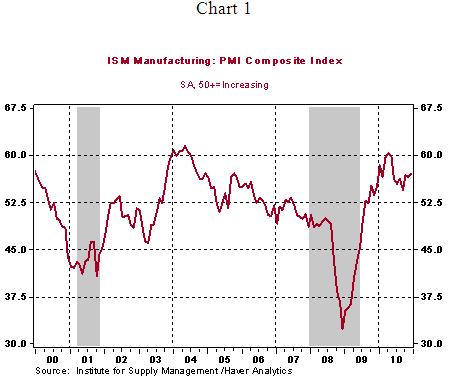

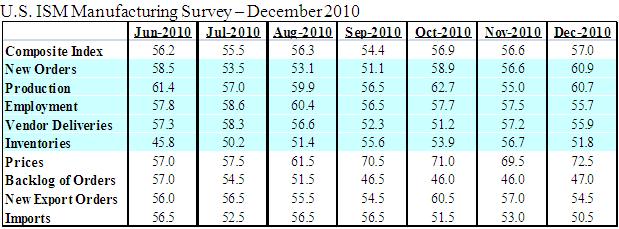

The U.S. manufacturing sector closed the year on a strong footing and kicked off 2011 with bullish news on the first trading. The ISM manufacturing composite index moved up to 57.0 in December vs. 56.6 in November, the highest reading since May 2010. The sharp increases in indexes tracking new orders (60.9 vs. 56. 6 in November) and production (60.7 vs. 55 in November) accounted for the higher composite index in December. Indexes measuring employment, vendor deliveries, inventories, exports and imports declined in December but are holding above 50.0. Readings above 50 denote an expansion while those below 50.0 are indicative of a contraction.

The U.S. manufacturing sector closed the year on a strong footing and kicked off 2011 with bullish news on the first trading. The ISM manufacturing composite index moved up to 57.0 in December vs. 56.6 in November, the highest reading since May 2010. The sharp increases in indexes tracking new orders (60.9 vs. 56. 6 in November) and production (60.7 vs. 55 in November) accounted for the higher composite index in December. Indexes measuring employment, vendor deliveries, inventories, exports and imports declined in December but are holding above 50.0. Readings above 50 denote an expansion while those below 50.0 are indicative of a contraction.

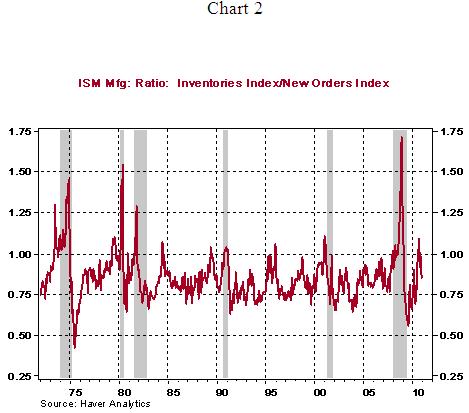

The ratio of inventories-new orders fell in December after advancing in four out of the five months ended November, which suggests that the increase in new orders is related to improving demand conditions and not inventory building (see Chart 2).

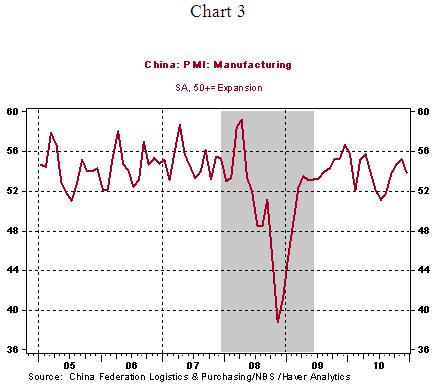

Overseas, the factory sector in China appears to have settled at a lower pace of activity in December. The purchasing managers' index (PMI) of China dropped to 53.9 in December from 55.3 in November. China's recent hike of interest rates and the latest PMI suggest that a slower growth trajectory in the near term should not be surprising. Factory activity improved in India during December (56.7) but at a slower pace compared with November (58.4). Furthermore, within Asia, the PMI of Japan contracted for the fourth straight month. The Eurozone PMI advanced in December to 57.1 from 55.3 in November, with Germany and France leading the way.

U.S. Construction Outlays Advance in November

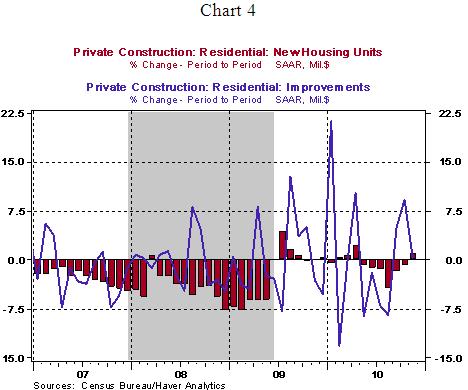

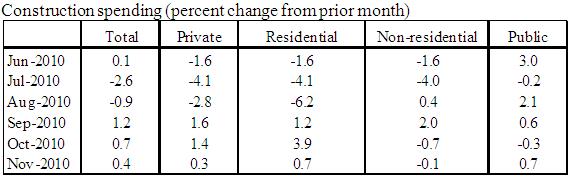

Total construction spending rose 0.4% in November, marking the third consecutive monthly gain. Residential construction outlays increased 0.7% in November, with new construction (+0.9%) and improvements (+0.4%) accounting for the overall increase. The increase in outlays for construction of new homes is the first monthly gain since April 2010. Non-residential construction spending edged down in November. The message from these numbers is that the construction sector is yet to show a meaningful recovery and posting only sporadic and small gains since the recession ended.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.