Trading The S&P 500, Oil, & Gold Without Forecasts

Stock-Markets / Financial Markets 2010 Dec 29, 2010 - 03:18 PM GMTBy: J_W_Jones

The end of 2010 is rapidly approaching and the pundits and commentators continue to make their 2011 market predictions. I for one believe predicting future market moves is a futile endeavor where if you are right one year later you are viewed as a sage; if you are wrong nobody seems to remember or care.

The end of 2010 is rapidly approaching and the pundits and commentators continue to make their 2011 market predictions. I for one believe predicting future market moves is a futile endeavor where if you are right one year later you are viewed as a sage; if you are wrong nobody seems to remember or care.

In fact, I try not to read any predictions for fear that it might place a bias in my subconscious. I am a trader and thus have no need for emotions, bias, or opinions when trading. I try to stay away from the media and the pundits as often as possible.

With that being said, the managed money crowd will be finishing up their window dressing and the performance anxiety of 2010 will slowly shift to assessing their portfolio risk and making appropriate adjustments for the coming year. Based on current market sentiment it would make sense that most money managers are bullish as cash levels remain quite low when looking at mutual funds and institutional money managers' portfolios.

S&P 500

The S&P 500 is extremely overbought in almost every time frame and headline risk remains high. At current price levels I would not be interested in being long the S&P 500, in fact I would likely be taking some money off the table before 2011 rolls in.

I think opportunities are going to present themselves in 2011 for outstanding longer term entries into the equities market, however a disciplined approach will be required. Headline risks such as continued monetary and fiscal issues in the Eurozone, municipal budget concerns and potential defaults, potential for rising interest rates, inflation / deflation, and rising energy prices to name just few. Unfortunately some, if not all of the headline risks listed above will likely come to pass. Having fresh capital ready to deploy and developing a trading plan ahead of time for solid entry points will likely lead to a positive trading outcome in 2011.

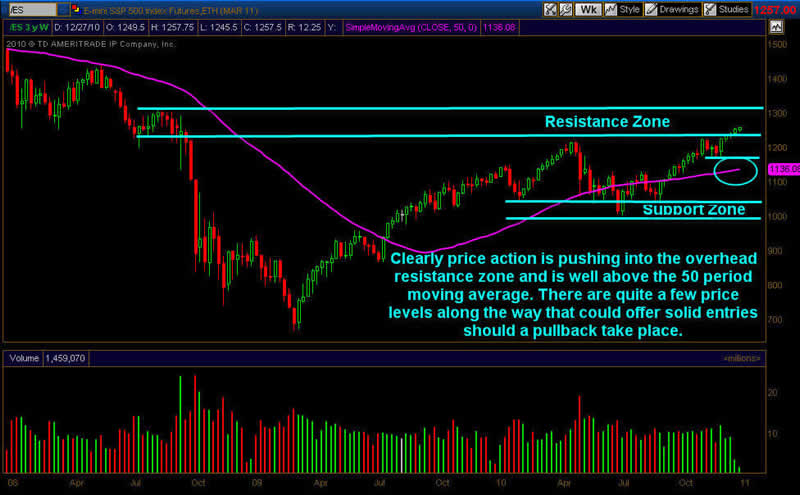

I believe there are going to be some outstanding trading setups in 2011 regardless of market conditions or economic factors, but in order to be prepared we need to have trading capital available and a trading plan prepared. The weekly chart below illustrates some key support levels on the S&P 500 e-mini contract.

At some point in the future, the S&P 500 is going to suffer from a correction and I intend to be prepared to take advantage of lower prices in my longer term investment accounts as well as in my short term option trading accounts. While I am generally a contrarian when sentiment and bullishness are this high, deep down I am hopeful that the economic recovery continues. However, I am not blind to believe that the worst is over and it is smooth sailing from here. There is nothing about financial markets that is ever easy, and when the directional bias is this strong I tend to step back and develop contrarian strategies just in case the crowd is wrong.

Oil

I try to stay away from opinions and focus on facts when conducting analysis regarding financial markets. However I am going to break my rule briefly to point out that in my humble opinion, the single largest threat to the U.S. domestic economy is not unemployment or housing, but energy. If energy prices continue rising, it causes nearly everything to rise in price in the United States as producers and manufacturers pass down rising fuel costs to the consumer. Essentially we have leveraged the ability to support our substantial population and tremendously high standard of living with the ability to use cheap and plentiful oil.

Some of the reasons that oil prices could rise have fundamental and technical foundations. From a fundamental standpoint, supply appears to be declining and will continue to decline going forward unless some oil fields that are currently unknown are discovered and make available immense supplies of oil. Additionally, the basic principles of supply and demand are present as emerging market countries are needing more and more energy to keep their economies growing and to satisfy the concurrent rising standard of living. Countries like China, India, and Brazil are only going to see their need for energy increase and other countries in the world need to recognize that demand is rising and supply is falling.

While the argument among economists rages on regarding inflation versus deflation, if inflation were to rise suddenly this would also be bullish for energy. Most investors may not have considered that oil prices are over $90/barrel and the economy is relatively sluggish. Where would prices be if the economy were to boom in 2011?

From a technical standpoint, the Great Recession pushed oil down from the all time highs in 2008. Many economists believed that the rise in oil prices is what really caused the market to crater in early 2009. If we view a weekly chart of oil, it would appear that we are continuing to trend higher and that in the longer term this trend will likely persist.

I would be shocked if oil prices do not reach at least $100/barrel in 2011. Some analysts are saying that it could reach $115-$120 by the summer and could probe all time highs as early as 2012. The fundamental and technical analysis is mutually supportive and in the longer term I think rising energy prices is not only a near certainty, but also a major threat to the global recovery.

Gold

The recent pullback offered a nice entry around the $133/share on GLD. In full disclosure, I purchased GLD around 133.25 and sold a slew of naked puts on silver and gold which I have closed for solid gains. Argument surrounds gold and silver as economists bicker over whether we are going to see hyperinflation or deflation in 2011. I for one do not know or claim to know. What I do know is that gold appears to be nearing a final wave of buying which could push it to all time highs.

However, I do believe without question that the volatility in the price of gold is likely to increase dramatically. Large price swings are likely in 2011 as headline risks will drastically impact the price of gold and silver and cause volatility to increase. While this is somewhat speculative, the various headline risks in Europe and in the United States will have a significant impact on precious metals prices.

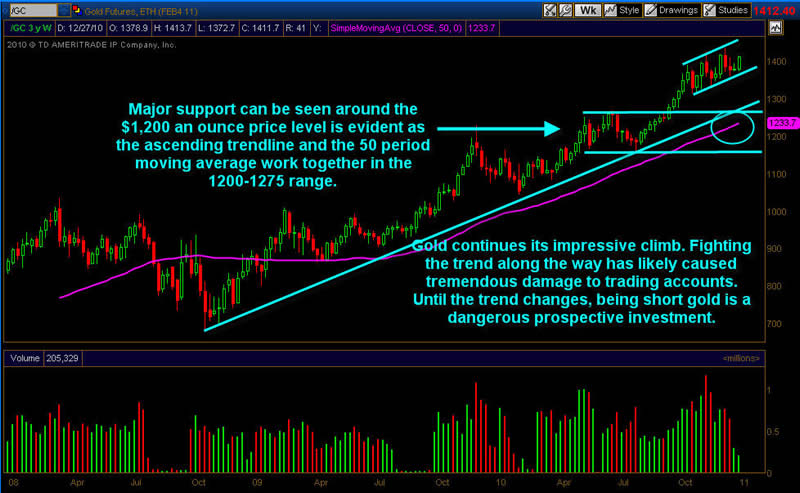

Gold continues to trend higher and fighting the trend makes little sense and could be a great way to lose precious trading capital. I will continue to play the rising trend until it fails which at some point in the future is inevitable. Neither gold, nor any other asset can continue rising forever. A pullback at some point is not only likely, but would be healthy. Obviously gold remains in a bullish uptrend as illustrated by the weekly chart below:

I do believe that gold is a solid hedge against currency risk and higher inflation based on recent price action, but I am not willing to buy into the world is ending philosophy that many gold bugs envision.

I do not believe that the entire financial construct will fail and that a barter system will be created with gold becoming currency. Through a variety of emails from all over the world I have been presented with all kinds of analysis and data that all fiat currencies fail, that gold is a store of value, and that gold will protect investors from currency manipulation and inflation. While all of these things may be true, I am unwilling to abandon hope for peace, prosperity, and a better future.

Conclusion

I am optimistic about the domestic and global economy in the long term. I believe that great opportunities for long term investment will be offered in 2011 and I intend to take advantage of the price action. I am an options trader at heart, but in the end I am an eternal optimist. Being pessimistic is not only depressing, but it offers very little in the form of solutions. Consequently an absolute pessimistic forward looking view serves to only create biases that are not conducive to success in financial markets. Let's forget about predictions and pundits and focus on what really matters – price action.

If you would like to continue learning about the hidden potential options trading can provide please join my FREE Newsletter: www.OptionsTradingSignals.com

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.