China Says No More Cars, Down Goes the Auto Industry During 2011

Companies / China Stocks Dec 28, 2010 - 04:52 AM GMTBy: Dian_L_Chu

While the world is still unwrapping the surprise Christmas gift from China in the form of a interest rate hike of 25 basis points, this other piece of news with ample implication to the auto industry seems to have gone largely under the radar--The City of Beijing will limit the number of new license plates issued in 2011 to 240,000 to help control traffic congestion. Xinhua reported that car buyers in Beijing will have to draw lots before obtaining a vehicle license plate.

While the world is still unwrapping the surprise Christmas gift from China in the form of a interest rate hike of 25 basis points, this other piece of news with ample implication to the auto industry seems to have gone largely under the radar--The City of Beijing will limit the number of new license plates issued in 2011 to 240,000 to help control traffic congestion. Xinhua reported that car buyers in Beijing will have to draw lots before obtaining a vehicle license plate.

Beijing – An Auto Gold Mine

In 2009, Chinese government introduced tax incentives for cars with engine sizes of 1.6 liters or smaller. The move propelled China to the world’s biggest auto market that year, surpassing the United States. The trend has continued in the first 11 months of 2010--automakers in China shipped a total of 16.4 million vehicles, up 34% year-over-year.

Beijing is China's largest auto market and regarded by auto manufacturers as a gold mine. Statistics from the Beijing Municipal Commission of Transport show that the city's total number of automobiles stood at around 4.8 million, up almost 85% from 2005.

Carriage Before Horse

The problem is that the Chinese government is putting the carriage before the horse--encouraging consumers to buy cars without building enough roads and parking lots to support the auto boom. This problem is not unique to the city of Beijing, although it is the first resorting to this somewhat drastic measure to alleviate its horrendous traffic situation.

50% Drop in New Car Sales

With this new vehicle limit, China Automobile Dealers Association already came out with estimate that new car sales in Beijing are likely to decline 50% to around 400,000 next year.

Although this policy is only implemented in Beijing, it could have great influence over other large cities as Beijing is hardly the only city with poor urban planning suffering from the Great Traffic Jam, which could be a huge blow to the auto industry.

China – A Critical Auto Success Factor

China has been a major salvation to global automakers that are still struggling from a severe downturn in 2009 in the developed car markets. As such, position in China has become one of the most critical aspects of any auto company’s success. General Motor (GM), Volkswagen AG, Toyota Motor (TM), Ford Motor (F), and other industry heavy weights are all competing intensely for a bigger slice of the Chinese market (See China Car Market Chart).

Although China auto market is expected to slow down in the coming years (see Predicted Sales Chart) partly because the tax incentives that help drive the auto sales are set to expire on Dec. 31, 2010, the world’s top auto companies still have high hopes for China.

Great Auto Growth Sans Roads & Parking?

Bloomberg reported that world’s largest automakers-GM, Volkswagen, Toyota, and Nissan all expect sales in China to grow anywhere from 10% to 17% in 2011. While most auto companies commented that it is too soon to talk about the effect this measure will have on car sales, there’s no getting around the fact that without sufficient roads and parking spaces, any great growth potential (See Predicted Sales Chart) in China is basically meaningless.

Infrastructure Gap For The Next Decade

As discussed in my previous analysis, China has inadequate logistic infrastructure to meet the needs of its mass population and heavy industrial business, partly reflecting poor planning by the local and central officials. As much as the country has been racing to build and upgrade its transportation system, this new restriction speaks volume that the deficiency most likely will persist in the next decade or so.

Raw-Material Heavy Cost Structure

Conceivably, the new vehicle cap, the also new 4% increase on fuel prices, and the latest interest rate hike to rein in escalating inflation and asset bubbles would constitute a triple whammy to the already severely recession-hit auto sector. Furthermore, since the automaker cost structure is heavy on the raw material, the global inflation pressure would hit input costs more so than other sectors.

Then, you also have companies already made resource commitments based on the prior robust China growth forecasts. For example, Ford will open 66 new dealerships in China by the end of the year, bringing its total to 100 new dealers in the country in 2010 and its total number of outlets to 340. Daimler AG also plans to invest €3 billion by 2015 to expand its production facilities in China.

Beware of the “Bullwhip Effect”

This suggests automaker stocks and/or ETFs, mutual funds with Chinese auto exposure, including but not limited to the aforementioned companies, could be subject to significant revaluation based on new tightening measures coming out of China, which could only intensify and likely extend beyond 2011. And this could also have a “Bullwhip Effect” up and down the entire auto supply chain.

Auto Sector Could Be A Short

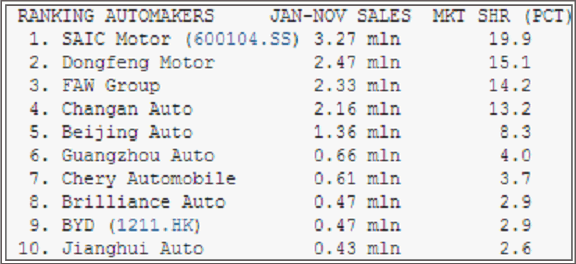

Shares of Chinese (see China Car Maker Ranking Table) and German automakers like SAIC Motor Corp. (600104:SS), China’s largest automaker, Hyundai Motor Co., South Korea’s biggest carmaker, BMW, Volkswagen AG, are already seeing selling pressure after city of Beijing decision to impose the limit. Further selloff could be expected as fund managers and traders start doing some serious portfolio VaR shuffling after the start of the New Year.

Compared to its peer group, GM is probably the most vulnerable, as China has become the largest single market for GM since the first half of 2010, surpassing the home market. So, it looks like American taxpayers would need to wait a bit longer for GM to pay off the taxpayer-funded bailout.

Nevertheless, look on the bright side--it is fortunate that GM’s IPO took place before these negative announcements came out, so GM was able to plow $1.8 billion of the IPO money back to the U.S. Treasury Dept.

Disclosure: No Postions

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.