Gold Price Supported in 2011 by Concerns About Currencies and Government Bonds

Commodities / Gold and Silver 2010 Dec 17, 2010 - 09:19 AM GMTBy: GoldCore

Gold's recent correction continued yesterday but it has risen today as the dollar has fallen. Gold is up in most currencies this morning except in euro terms as the euro has seen a relief rally on the outcome of the EU agreement to create a post-1913 crisis tool. Fundamental disagreements remain though and the agreement may not be enough to stop the debt crisis from deepening with many analysts pinpointing the first quarter of 2011 as a high risk period.

Gold's recent correction continued yesterday but it has risen today as the dollar has fallen. Gold is up in most currencies this morning except in euro terms as the euro has seen a relief rally on the outcome of the EU agreement to create a post-1913 crisis tool. Fundamental disagreements remain though and the agreement may not be enough to stop the debt crisis from deepening with many analysts pinpointing the first quarter of 2011 as a high risk period.

Gold is currently trading at $1,371.78/oz, €1,030.20/oz and £878.47/oz.

Portugal and Spain's fiscal situations remain precarious and yields on Spanish debt are rising again over concerns of Spain's credit quality. Moody's slashed Ireland's credit rating by five notches to Baa1 from Aa2 this morning. They warned that further downgrades could follow if Ireland was unable to stabilise its debt situation. Ireland's 10 year bond yield has risen from 8% to 8.35% in recent days on these concerns.

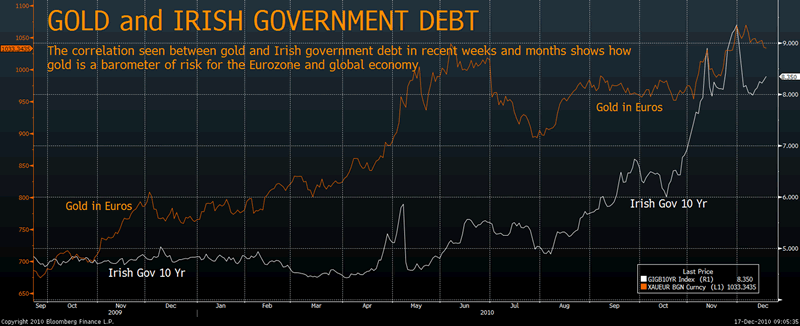

Gold's rising value has been correlated with the yields on peripheral Eurozone government debt which have risen in tandem. This is clearly seen in looking at gold's performance in dollars and especially euros in the last year versus Irish government debt (see chart above).

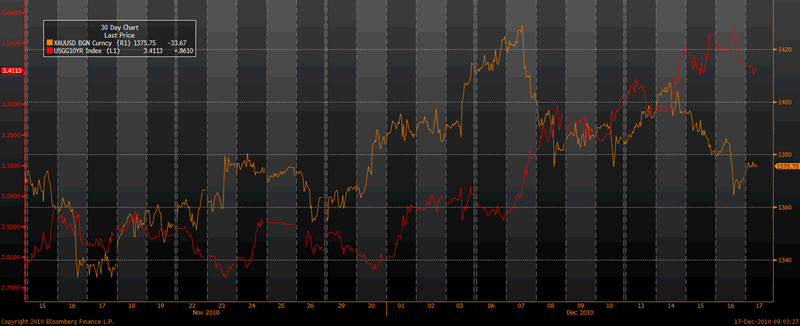

Gold in USD and US Government 10 Year – 30 Day (Daily)

Gold's historic correlation with rising interest rates as clearly seen in the 1970s and 1980s may be being reasserted again. This can be seen in the recent and growing correlation between the 10 year US government bond and gold and their performance in the last month (see chart above).

Some investors are becoming wary of loaning capital to governments for long periods and many are deciding to hedge exposure to government debt and currency volatility and debasement by an allocation to gold. Similarly, many savers concerned about the solvency of banks and about the safety of paper currencies are diversifying into gold.

This trend is not going to go away anytime soon and looks set to continue well into 2011.

SILVER

Silver is currently trading $28.81/oz, €21.65/oz and £18.46/oz.

PLATINUM GROUP METALS

Platinum is currently trading at $1,693.50, palladium at $736.00/oz and rhodium at $2,225/oz.

NEWS

(Reuters) - Some Irish seen turning to gold, shunning banks Disgusted by how the banks have wrecked the economy and worried their savings are no longer secure, some Irish people are buying gold and diamonds or storing their money in safes until the crisis blows over. Ireland's government has guaranteed deposits but anxiety about what the future holds, particularly after Dublin was forced to seek a bailout from the EU and the IMF last month, has some savers seeking alternatives to the banks.

"There has been an increase in demand, sustained over a period of months. There's been a slight increase in the last month. We get that every single day. From mom and pop investors to high net worth individuals," Mark O'Byrne, executive director of bullion dealer GoldCore, told Reuters. O'Byrne said the firm always advised its customers not to turn their savings exclusively into gold.

"Gold is a classic hedge against the rest of your portfolio and you should put 5-10 percent," he said, adding that more companies were diversifying their cash holdings into gold than before. "We had a few (corporate deposits) per year before, now we have a few per week," he said. (see full article on our News page).

(Bloomberg) -- Gold may decline as some investors sell the metal before the end of the year to take advantage of a 10th consecutive annual gain, a survey found. Twelve of 24 traders, investors and analysts surveyed by Bloomberg (including GoldCore), or 50 percent, said the metal will fall next week. Eight predicted higher prices and four were neutral. Gold futures for February delivery were down 1.3 percent for this week at $1,366.40 an ounce at 10:45 a.m. yesterday on the Comex in New York.

(Bloomberg) -- Gold demand from India, the largest buyer, was the highest since Dec. 8 with gold at $1,371 an ounce, UBS AG said in a report. Demand picked up at prices below $1,380 an ounce, UBS analyst Edel Tully wrote in the report e-mailed today.

(Bloomberg) -- Iridium for immediate delivery climbed 0.7 percent to $770 an ounce by 2:41 p.m. in London, the highest price since at least 2001, according to Johnson Matthey Plc data on Bloomberg.

(Financial Times) -- Bosch warns material prices could hit growth

A sharp increase in raw material prices will slow down Europe's economic growth next year and could put smaller supplier companies in financial trouble, the head of Bosch has warned.

(Financial Times) -- Basel reveals liquidity gap for biggest banks

The world's biggest banks have a combined €1,730bn ($2,287bn) gap in liquid investments that they must fill within four years, according to the Basel Committee on Banking Supervision, the international banking watchdog. Under the Basel III rule book, finalised by the committee on Thursday, 91 of the world's biggest banks - tested in an impact assessment - also have a €577bn capital shortfall compared with the new 7 per cent headline number for equity tier one capital, a measure of financial strength.

(Financial Times) -- US delays vote on commodity trade

US federal regulators unexpectedly postponed a long-awaited vote to introduce sweeping limits on commodity speculation amid internal discord about the timing of the rules. The new rules from the Commodity Futures Trading Commission would have capped the number of contracts that investors could hold in 28 raw materials including oil, gold, copper and corn.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.