U.S. Inflation Consumer Price Index Contains No Surprises

Economics / Inflation Dec 16, 2010 - 04:06 AM GMTBy: Asha_Bangalore

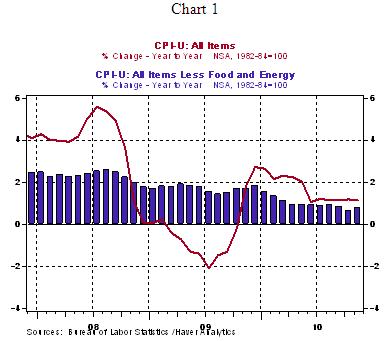

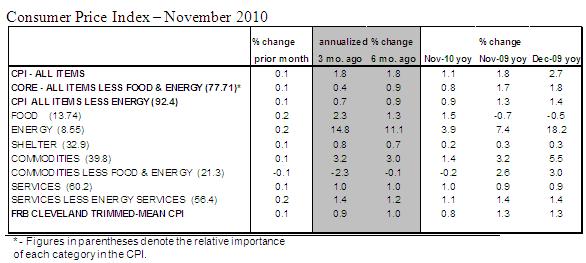

The Consumer Price Index (CPI) rose 0.1% in November following a 0.2% gain in the prior month. The CPI has risen 1.1% from a year ago compared with a 1.8% gain in the 12-month period ended November 2009. Energy prices increased only 0.2% in November vs. a 2.6% gain in October. The price index for natural gas (-5.7%) fell but gasoline prices (+0.7%) advanced for the fifth straight month, with November recording the smallest of these five monthly gains. The food price index moved up 0.2% in November after a 0.1% increase in the prior month. The important message is that the CPI continues to show a distinct decelerating trend (see Chart 1).

The Consumer Price Index (CPI) rose 0.1% in November following a 0.2% gain in the prior month. The CPI has risen 1.1% from a year ago compared with a 1.8% gain in the 12-month period ended November 2009. Energy prices increased only 0.2% in November vs. a 2.6% gain in October. The price index for natural gas (-5.7%) fell but gasoline prices (+0.7%) advanced for the fifth straight month, with November recording the smallest of these five monthly gains. The food price index moved up 0.2% in November after a 0.1% increase in the prior month. The important message is that the CPI continues to show a distinct decelerating trend (see Chart 1).

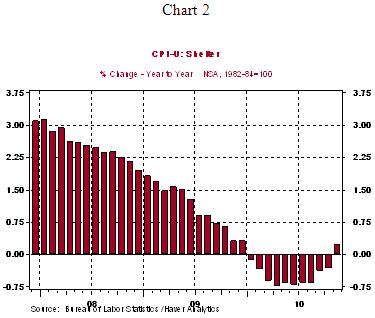

The core CPI, which excludes food and energy, also advanced 0.1% after holding steady in the August-October period. On a year-to-year basis, the core CPI rose 0.8% in November, with recent year-to-year changes in the core CPI hovering close to historical lows. As noted earlier, much like the all items CPI, the core CPI also shows a marked deceleration from a year ago (see Chart 2). These readings are below ranges consistent with price stability. The Fed's dual mandate of price stability and full employment is the major factor that motivated the second round of asset purchases, known as QE2.

Details of the report show lower prices for new (-0.4%) and used cars (-0.5%) and a decline in hotel prices (-1.2%) in November. Higher prices for apparel (+0.2% after three monthly declines), medical care (+0.1%), and shelter (+0.1%) more than offset these declines. On a year-to-year basis, shelter costs, the largest component of the core CPI, advanced 0.2% in November, the first gain since December 2009 (see Chart 2). Declines in owners' equivalent rent, the major sub-component of shelter, has held down the overall trend of shelter costs. In November, this index moved up 0.2% from a year ago and lifted overall shelter costs.

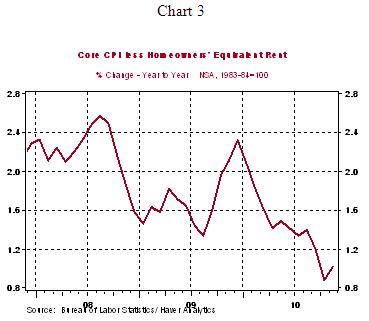

In addition, the year-to-year change in the core CPI excluding owners' equivalent rent also established a bottom in October (+0.8%) and rose 1.0% in November (see chart 3). Although a single month's reading is inadequate, charts 2 and 3 suggest that economic conditions are turning around to bring about a small increase in underlying core inflation, which is the Fed's current objective.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.