A Bitter Coffee Divorce: Kraft v. Starbucks

Companies / Corporate News Dec 14, 2010 - 06:32 AM GMTBy: Dian_L_Chu

When a corporate partnership deal turns sour, it has every bit of the drama as a high profile Hollywood celebrity divorce. The verbal clashes between Starbucks (SBUX) and Kraft (KFT) have been escalating over the past month or so. Then, after a failed private resolution (Starbucks offered Kraft $750 million in August), on Monday Dec. 6, Kraft took the fight to court seeking an injunction to stop Starbucks from unwinding a 12-year partnership.

When a corporate partnership deal turns sour, it has every bit of the drama as a high profile Hollywood celebrity divorce. The verbal clashes between Starbucks (SBUX) and Kraft (KFT) have been escalating over the past month or so. Then, after a failed private resolution (Starbucks offered Kraft $750 million in August), on Monday Dec. 6, Kraft took the fight to court seeking an injunction to stop Starbucks from unwinding a 12-year partnership.

Kraft has distributed Starbucks bagged coffee, along with Starbucks’ Seattle’s Best coffee brand, in supermarkets and other retailers since 1998. Under the agreement, Kraft buys the coffee from Starbucks, sells it to stores, and then pays Starbucks a royalty fee.

$1.5 Billion of Irreconcilable Differences?

Now, Starbucks wants out of the pact claiming Kraft breached the partnership agreement and failed to aggressively promote its brands in stores.

Meanwhile, Kraft denies any breach, and said if Starbucks wants to back out unilaterally, it must pay Kraft the fair market value of the business plus a 35% premium, as per the partnership agreement. Though the final figure is yet to be determined by arbitration, some estimate it could cost Starbucks more than $1.5 billion in severance fees.

Premium Brands = Higher Growth & Margin

In the very crowded supermarket retail coffee space, premium brands are coveted because they offer faster growth and higher margin. Analysts have estimated the operating margin of Kraft’s Starbucks coffee business could be at 20% or more since it is a premium brand.

The recent sales data bear the message loud and clear. According to SymphonyIRI, among grocery coffee brands, while Folgers remains the top seller with a 28% market-dollar share, its unit sales fell by 2.1%. Kraft’s Maxwell House, the No. 2 ground coffee brand, with 16.7% share, grew by only 2.8%.

On the other hand, premium brands like Starbucks ground coffee, enjoyed a unit sale growth of 11.3% in the year ending Oct. 31, and ranks No. 4 with a market share of nearly 10%, while Dunkin' Donuts coffee brand grew by 14.8%. (Quite interestingly, Dunkin' Donuts coffee is distributed under a similar partnership arrangement between J.M. Smucker Co., (SJM), owner of Folgers and Millstone coffee brands, and Dunkin’ Donuts chain.)

Kraft – New Partner, Makeover or Divest

According to Kraft, Starbucks coffee retail distribution business has grown to $500 million in annual sales from $50 million 12 years ago. Credit Suisse estimates the yearly profit is about $128 million with a 50/50 split.

So, in the near term, the profit loss resulted from the separation is unlikely to cause much heartburn for Kraft-- the largest food company in the U.S. with $48 billion in annual revenue. In addition, Kraft might gain some consolation prize in the form of settlement fund due from Starbucks.

However, after taking back its own brand, and as part of its growth strategy, Starbucks will be aiming to expand its lineup of packaged coffees and food, pitting it against Kraft in the not so distant future. Furthermore, Starbucks has been one of Kraft Tassimo’s coffee suppliers, and JP Morgan estimates that 80% of Starbucks customers don’t have a single-cup brewer at home. With the breakup, it is a low risk proposition for Starbucks to form a partnership with Green Mountain Coffee Roasters (GMCR) single serving Keurig, a primary rival of Kraft’s Tassimo.

With the potential of facing Starbucks on multiple fronts, longer term, Kraft needs to either find another premium brand partner to bolster its existing lineup, or need a serious makeover of market differentiations in order to compete in the supermarket coffee isle. Otherwise, Kraft is probably better off divesting Maxwell House while it is still ahead.

Starbucks Outgrows Kraft

Starbucks Outgrows Kraft As for Starbucks, one of the reasons it is ditching Kraft is that the company has found success bypassing Kraft in Via, a surprise entry in 2009 into the premium instant coffee. Via racked up $135 million in first-year sales with Starbucks handling the distribution itself while partnering with Acosta Sales & Marketing.

As a result, it is not surprising that Starbucks now intends to apply a similar model for its bagged coffees as well. The company already announced that it struck a deal with Acosta that will begin March 1, 2011.

Overall, it is a positive sign that Starbucks has outgrown Kraft to step up and take control of its retail brand marketing, particulary amid intensified competitions in the market place.

A Caffeinated Valuation

In its Q4 earnings call, Starbucks laid out its long-term EPS growth target of 15%-20% partly on growth in China (tripling to 1,500+ stores by 2015) and further expansion in the U.S. Long-term, margins are expected to approach 20% in the U.S. and mid-to-high teens internationally.

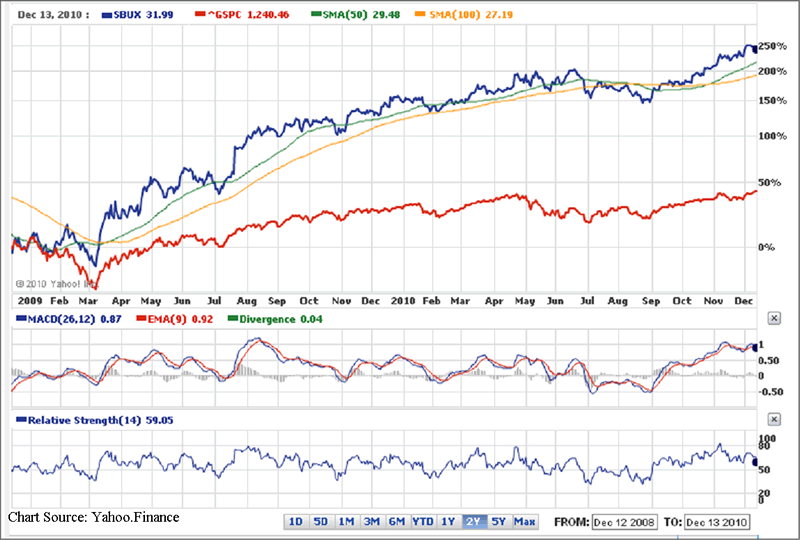

That probably explains its current valuation (P/E at 25.86, up 250% in the past two years, see chart) which suggests a high market expectation with a lot of the near-term opportunities already priced in.

Easy Setup for Underperform

However, I think Starbucks could easily underperform its targets based on the following factors:

- Unprecedented surge in commodity prices - Since Fed first hinted at QE2 about six month ago, sugar and coffee are already up by 80% and 50% respectively (coffee already hit a 13-year high). Starbucks management indicated in its Q4 earnings release that it now expects to “absorb roughly $0.08 to $0.10 in additional commodity costs for fiscal 2011, mostly related to higher coffee prices, although other commodities that we use such as cocoa and sugar are also on the rise.”

- A Weak U.S. consumer market - Surging commodity coffee prices have inevitably prompted Starbucks and its rivals like J.M. Smucker Co., to raise prices which could sap demand. Meanwhile, escalating inflation in energy and food, partly induced by QE2, most likely could also reallocate consumer spending away from daily “luxury items” like Starbucks coffee.

- Fierce competition at home & abroad – For instance, McDonald’s has priced its coffee drinks at exactly half of Starbucks’ in internatioanl regions like Taiwan, while implementing a similar pricing strategy in the U.S. KFC Taiwan also sells premium coffee espresso beverages. Emerging markets tend to be more “value-conscious” than the West, while some purse- watching consumers in the U.S. are willing to “trade down” from Starbucks. Dunkin’ Donuts coffee would serve as a prime example of premium coffee penetration by a fast food chain.

Better Investables Elsewhere

Moreover, from a technical perspective, Starbucks stock is in the overbought territory (see chart) and further upside would need to stem from above plan sales, which may be a challenge as discussed. Although the company does have good long term growth prospects, its current valuation suggests others--such as Yum! Brands, Inc. (YUM, P/E 21.82) and McDonald’s (MCD, P/E 17.03) --with an equal or better international growth story--would be more attractive investment choices right now.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.