Can Fiat Paper Currency Bring Prosperity?

Currencies / Fiat Currency Dec 10, 2010 - 03:46 AM GMTBy: Mike_Hewitt

A short description of money and historical examples where forms of which were not a good store of value ended in economic disaster.

A short description of money and historical examples where forms of which were not a good store of value ended in economic disaster.

JULIA: Welcome to tonight's show. I'm Julia Sanders. We have with us Mr. Thomas Hughes. It's great to have you here with us tonight.

THOMAS: Thank you Julia. Pleasure to be here.

JULIA: OK. So, today we are going to discuss money.

THOMAS: Yes, it is a very interesting subject. Originally, there were only commodities and people exchanged them according to their wants and needs with one another. At its most basic level, money is a medium of exchange. Something that is desirable to use as money, is also a good store of value and can serve as a unit of account.

JULIA: So what has been used as money?

THOMAS: All over the world, different commodities emerged to play a role, as an acceptable medium of exchange. Cowry shells, wampum, and tobacco, have been used. The word salary actually derives its meaning from the Latin word 'salarium' which means salt.

JULIA: Interesting piece of trivia.

THOMAS: Yes, salt was used in pre-coinage Mediterranean societies. On a small group of South Pacific islands, large stones were used as money.

JULIA: They used rocks as money?

THOMAS: Yes, on the Yap Islands a type of limestone was used. These stones were very rare and were quarried on Palau, some 250 miles to the southwest. New stones were acquired at great peril, perhaps even loss of life. They were valued most highly by the islanders. Here is a picture.

The stone money of the Yap Islands.

JULIA: And what happened?

THOMAS: An enterprising Irish-American was shipwrecked there in 1874. He learned of the unique economy of the island. Sensing a profitable business opportunity he returned a year later, aboard a vessel carrying limestone. He exchanged these stones for goods produced by the islanders.

JULIA: That sounds funny.

THOMAS: Well, perhaps a humorous tale to us today. But to the people of the Yap islands, their economy was destroyed. The stones became so numerous that they lost all their value. The people discovered that they had much less in terms of goods than they previously enjoyed, as they had traded these things away for the stones. They were in effect poorer, although they had much more money than they ever had before. Perhaps there is a lesson in this. Today we trade pieces of paper, a material abundant like the limestone rocks of the Yap islands.

JULIA: So are you suggesting that we may find ourselves amongst piles of paper, and no goods?

THOMAS: That is a possibility, and one not completely unknown to the history books. This highlights why it is desirable for money to also be a store of value. As the people of the Yap islands found out, rocks are a terrible store of value. And to be honest, paper isn't much better.

JULIA: I remember reading about hyperinflation in Germany. A wheelbarrow of money required to buy a loaf of bread. People filling up their wood stoves with paper money.

A German woman feeding a stove with currency notes, which burn longer than the amount of firewood they can buy.

THOMAS: Weimer Germany in the early 1920's, is perhaps the most well-known example of hyperinflation. China was the first country to use paper money. That occurred in the early 9th century. When Marco Polo returned to Europe in 1295, he detailed how the Chinese emperor created paper money through a very official process. His claims of paper being used as money were met with ridicule and disbelief by his fellow Europeans. Unknown to Marco Polo, China was being ravaged by hyperinflation after he left. So what Marco Polo saw, as being the immense wealth of China, was merely an inflationary boom caused by money creation. China stopped using paper money in the middle of the 15th century and did not return until the arrival of the Europeans in the 19th century. As it turned out, China once again experienced hyperinflation with paper money in the late 1940's.

JULIA: Any others?

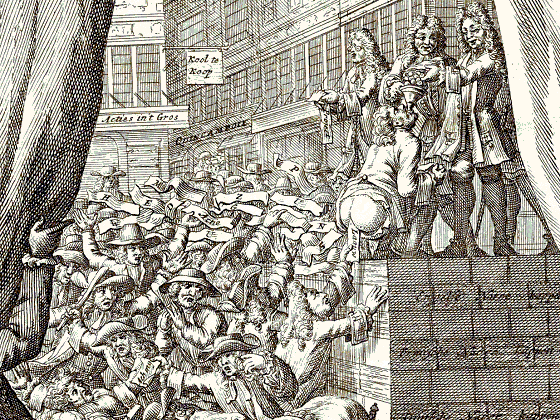

THOMAS: Many. The United States experienced two hyperinflationary episodes - the continental money during the War of Independence, and the Confederation paper during the U.S. Civil War. France experienced terrible hyperinflation during the French Revolution. France also experienced economic turmoil in the early 1720's, when John Law proposed printing paper notes as a means to alleviate France's debt. Law proposed stimulating industry by replacing gold with paper credit, and then planned to increase the supply of credit through low-interest rate loans. To reduce the national debt he proposed replacing it with shares in economic ventures - this policy directly contributed to the disastrous Mississippi Company bubble. That scheme fell apart in 1722, when the public en masse attempted to redeem their paper notes into gold. There was simply not enough gold to honour all redemptions.

Changing gold into paper money. Taken from the Arlequin Actionist (1720)

In the end, shares of the Mississippi Company were deemed worthless. This wiped out the wealth of many.

JULIA: This sounds a bit like today. The U.S. Federal Reserve has taken bad debt unto its balance sheet, and are they not printing money to purchase U.S. Treasuries so interest rates stay low?

THOMAS: As Mark Twain once said, "history doesn't repeat itself, but it often rhymes."

JULIA: Interesting. Thank-you for your explanation. We will now take a short commercial break.

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of www.DollarDaze.org , a website pertaining to commentary on the instability of the global fiat monetary system and investment strategies on mining companies.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.