The Best ETF for Your Portfolio

Companies / Renewable Energy Dec 05, 2010 - 04:54 AM GMTBy: Jared_Levy

As a kid, some of my fondest winter memories were driving through the different neighborhoods in and around Philadelphia where I grew up admiring all of the ornate holiday light displays. Of course, being a geek at an early age, I always wondered what their electric bills looked like and how rich someone had to be to essentially fire up 10,000 small lamps every night for six to 12 hours.

As a kid, some of my fondest winter memories were driving through the different neighborhoods in and around Philadelphia where I grew up admiring all of the ornate holiday light displays. Of course, being a geek at an early age, I always wondered what their electric bills looked like and how rich someone had to be to essentially fire up 10,000 small lamps every night for six to 12 hours.

Changes In The Energy Grid System

Energy production (and usage) has come a long way since the early '80s and so has the way you can get it into your home and more importantly how the average Joe can invest in it. Most Americans don't realize that much of our national energy grid system is actually not really national at all, it's a fragmented, aging hodgepodge of local and regional networks that needs a major overhaul to bring it into the 21st century.

At the moment, the cost of electricity is lower than it was at this time last year for most consumers. The average price per kilowatt hour is 11.53 cents versus 11.58 cents last year as of the end of August, according to the DOE. So if your electric company allows it, and you're not in a current price lock, this may be a good time to lock in your rate as higher oil and natural gas price will generally translate into higher electric costs.

But this article isn't about your saving a couple dollars on your electric bill; it's about the big changes that are happening to our electric grid and usage and, more specifically, the vast changes being thrust upon us by the automotive industry and the government.

Find out how you could cash in on European natural gas.

Changes Are Coming!

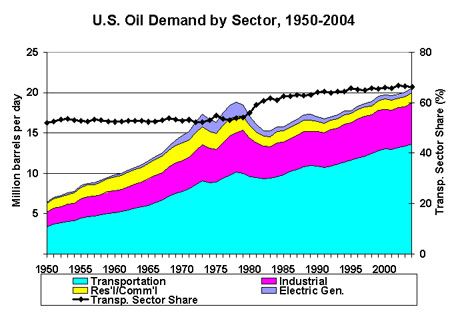

It's all about efficiency, using green technologies and mostly about getting America weaned off of our addiction to crude oil. Of all the oil used in the U.S., more than two-thirds of the crude oil we consume is used for transportation; that's about 13,750,000 barrels per DAY. According to a 2007 DOT study, there were over 254.4 million registered vehicles in the U.S. at that time, which has been growing along with the population. That's a lot of fossil fuel burners.

Uncle Sam Wants a Hybrid Car

President Obama and many other folks in and out of Washington are pushing for more energy-efficient vehicles; this means that hybrids and full electric vehicles like the Chevy Volt are sure to be finding their way into your garage sooner than later.

Alessandro Volta's battery is really coming back into vogue these days.

The National Highway Safety Commission forecasts that nearly 20% of all automobiles in the U.S. will be running on some sort of a hybrid mechanism by 2015. According to several sources, the U.S. government has committed $2 billion in spending for advanced batteries production and nearly $25 billion for programs to promote carmakers to retool their factories for the production of more fuel-efficient vehicles. The pressure is on!

How Do You Invest in This Green Technology Movement?

Electric cars and our entire energy grid will need to get "smarter" and more robust. While many investors are looking at the automakers themselves, I think the real play lies in the energy that will drive them. The U.S. will need major infrastructure additions and improvements. There are many players in the game and at this point in time, it's quite difficult to know who will be the biggest winner in the end. The best way to play it is to stay diversified.

First Trust NASDAQ has created an ETF that contains many of the companies that should stand to benefit from a major infrastructure overhaul. I would bet that many of you have never heard of many of the companies that are actually held, which may be a good thing. It's often too late once your investment is front and center on CNBC. Because of demand for their products or services, some of these companies may see either dramatic increases in revenue or some may simply be acquired by larger companies looking to get in on the action and/or eliminate competition. The fund's ticker symbol is appropriately named "GRID" and can be bought by the share from your broker or trading platform.

As we move from a petroleum-dominated society to more "green" sources like electricity, the need for more intelligent delivery as well as "fuel" stations for our cars should drive demand for infrastructure.

Alternative energy sources like solar, wind, water, coal, natural gas and nuclear energy all produce electricity; the companies that can improve and profit from the way we use it, live with it and drive with it should prosper in the coming years.

I am not saying that this will happen overnight,

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source : http://www.taipanpublishinggroup.com/...

By Jared Levy

http://www.taipanpublishinggroup.com/

Jared Levy is Co-Editor of Smart Investing Daily, a free e-letter dedicated to guiding investors through the world of finance in order to make smart investing decisions. His passion is teaching the public how to successfully trade and invest while keeping risk low.

Jared has spent the past 15 years of his career in the finance and options industry, working as a retail money manager, a floor specialist for Fortune 1000 companies, and most recently a senior derivatives strategist. He was one of the Philadelphia Stock Exchange's youngest-ever members to become a market maker on three major U.S. exchanges.

He has been featured in several industry publications and won an Emmy for his daily video "Trader Cast." Jared serves as a CNBC Fast Money contributor and has appeared on Bloomberg, Fox Business, CNN Radio, Wall Street Journal radio and is regularly quoted by Reuters, The Wall Street Journal and Yahoo! Finance, among other publications.

Copyright © 2010, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.