Four Ways to Monitor the U.S. Dollar and Risk Trade

Currencies / US Dollar Nov 30, 2010 - 11:41 AM GMTBy: Chris_Ciovacco

With European debt markets getting little relief thus far from the Ireland bailout, we need to keep a continued eye on the U.S. dollar. A weaker U.S. dollar tends to provide tailwinds for stocks, commodities, gold, and silver. Therefore, a longer-than-expected rally in the greenback may provide headwinds for these assets, with gold being the possible exception in the near-term.

With European debt markets getting little relief thus far from the Ireland bailout, we need to keep a continued eye on the U.S. dollar. A weaker U.S. dollar tends to provide tailwinds for stocks, commodities, gold, and silver. Therefore, a longer-than-expected rally in the greenback may provide headwinds for these assets, with gold being the possible exception in the near-term.

We outlined some concerns relative to a dollar rally and risk aversion on November 10th. With the Federal Reserve embarking on an aggressive money printing campaign (a.k.a. quantitative easing or QE), it seemed unlikely the dollar would muster the strength for a 7% rally, but that is exactly what has happened.

We will continue to have competing forces in the currency markets in the form of debt problems in Europe vs. Fed policy in the United States. Fundamental drivers related to a weaker dollar and higher assets prices are outlined on this QE resources page. To find the competing bullish forces related to the dollar, you need to look no further than Portugal, Spain, and Italy over the next few months.

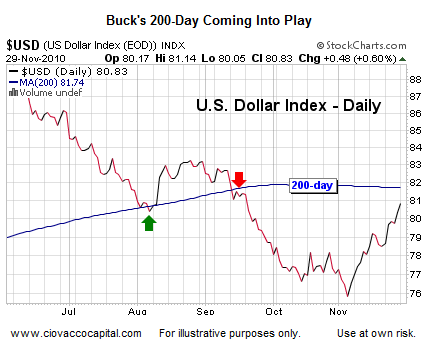

There are four relatively easy ways to track the progress of the dollar and risk aversion. The first is to monitor the dollar’s behavior near its 200-day moving average (shown below).

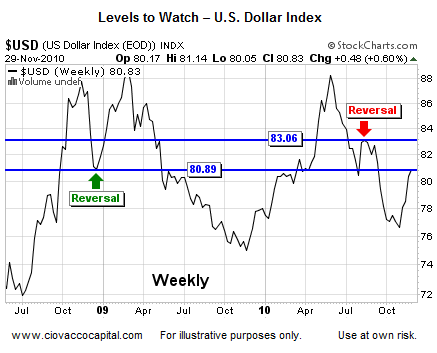

The second way to monitor the health of the dollar’s current rally is to evaluate the reaction of market participants as the U.S. Dollar Index trades between 80.89 and 83.06. These levels have coincided with significant trend reversals in the past (see arrows below). If the buck’s rally is to be short-lived, then the horizontal blue band shown below is a logical area for the bears to regain control.

The third way to keep an eye on the buck is to watch the 10-week moving average (MA). Notice in the chart below how significant rallies in the dollar were accompanied by a turn up in the 10-week MA (think blue line). The current turn would be more significant if it remains in place at the end of the week.

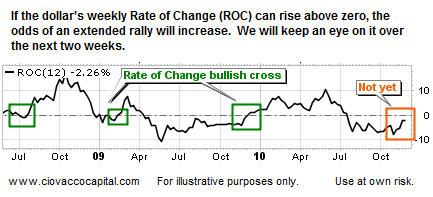

The fourth method to take the dollar’s temperature is to look for a zero cross of the Rate of Change (ROC) indicator on a weekly chart. Past rallies of any significance and duration have been accompanied by a bullish cross of the zero line in ROC. A cross has not taken place yet, which means some continued skepticism is warranted as to the sustainability of the dollar’s current rally.

For now, the bulls remain in control of the dollar and the bears remain in control of the euro. In terms of equities, Stock Market Levels to Watch, remains relevant in the face of continued weakness in risk assets.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.