Energy Sector Outlook Positive for Investors

Commodities / Crude Oil Nov 14, 2010 - 06:50 AM GMTBy: Joseph_Dancy

Trends in the energy sector remain positive. We think current conditions and trends have created one of the best investment environments for us in years:

Trends in the energy sector remain positive. We think current conditions and trends have created one of the best investment environments for us in years:

EIA Demand Forecast - Last month the International Energy Agency (IEA) raised its 2010 global oil demand forecast upward, to 86.9 million barrels per day from 86.6 million barrels per day. This will be an increase of 2.0 million barrels per day over year earlier levels.

In 2011 crude oil demand is expected to increase by a further 1.3 million barrels per day to roughly 88.2 million barrels per day – a record level of consumption (chart courtesy Financial Times). We expect the IEA to raise their demand forecast upward again before year end reflecting a growing global economy.

In 2011 crude oil demand is expected to increase by a further 1.3 million barrels per day to roughly 88.2 million barrels per day – a record level of consumption (chart courtesy Financial Times). We expect the IEA to raise their demand forecast upward again before year end reflecting a growing global economy.

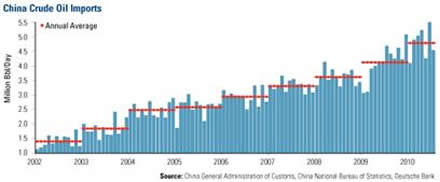

The executive director of the IEA, Nobuo Tanaka, noted that China has become the world's largest energy user, overtaking the United States. He told an industry conference that "half of the oil demand increase comes from China. Nobody knows when it (will) slow down." China saw a record 35 percent increase in September crude oil imports from the year earlier period.

Net Energy Returns - The Economist had an excellent discussion last month about energy economics and net energy recovery from exploration activities. They note a key long term investment concept should be the trend of the amount of energy returned from the energy invested in the exploration effort. For example, in the 1930’s it took about one barrel of oil energy to drill a well that would deliver 100 barrels of production. By the 1970’s that had dropped to around 3 barrels of energy to drill a well that would deliver 100 barrels of production.

Currently it appears we need 5 or 6 barrels of energy input to deliver 100 barrels of production. Going forward some analysts forecast the ratio to continue to increase – reducing the net energy returns for investors. Because this ratio is declining, and energy use continues to grow with the global economy, the resources needed to develop these energy sources will have to increase—probably substantially so.

One analyst forecasts that energy expenditures will require a fourfold interest in capital outlays in the next decade. Of course technology may make recovery more efficient, cutting the energy intensity of development, but the analyst also predicts in a decade we may need closer to 20 barrels of energy input to deliver 100 barrels of production. Substantially higher prices will be needed to support this level of capital expenditure.

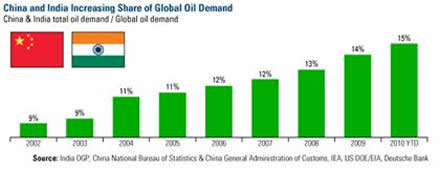

China Demand - Frank Holmes of U.S. Global Investors noted the bullish trends developing in Asia: “After falling during the first half of 2009, global oil demand rose 2.25 million barrels per day during the first six months of 2010. The oil demand story continues to be driven by emerging markets, especially China and India.”

China Demand - Frank Holmes of U.S. Global Investors noted the bullish trends developing in Asia: “After falling during the first half of 2009, global oil demand rose 2.25 million barrels per day during the first six months of 2010. The oil demand story continues to be driven by emerging markets, especially China and India.”

“This week’s chart from Deutsche Bank shows China and India’s share of global oil demand has increased 67 percent since 2002. This year, Chindia’s combined total accounts for 15 percent of global demand” (charts courtesy U.S. Global Investors website).

Credit Suisse expects oil demand to grow 9.3 percent in China, 4 percent in Latin America and 4.4 percent in the Middle East in 2010. In contrast, it expects oil demand to contract by nearly 2 percent in Western Europe and manage only meager growth in North America The Financial Times last month noted that there was “no let-up in accelerating car sales” in China. Economic growth in China slowed to 9.6% - but still is very robust. China’s car market has expanded 30% annually for the last decade—but the country only has 30 vehicles per 1,000 people compared to 206 in Russia and 559 in Italy. So the market is no-where near saturated.

U.S. consultant J.D. Power noted last week China car sales had surpassed expectations and raised their forecast for 2010 to 18 million units—well above U.S. sales levels which are expected to reach 11.5 million units. China’s expanding demand for energy, agricultural products, and commodities should put a floor under these prices—and should create substantial investment opportunities.

U.S. consultant J.D. Power noted last week China car sales had surpassed expectations and raised their forecast for 2010 to 18 million units—well above U.S. sales levels which are expected to reach 11.5 million units. China’s expanding demand for energy, agricultural products, and commodities should put a floor under these prices—and should create substantial investment opportunities.

Analyst Forecasts - The Financial Times had an article last week that noted Goldman Sachs does not think $100 a barrel oil is “as unlikely as it sounds.” Goldman predicts oil will break into triple digits by the end of 2011. The forecast is based on higher than expected global demand, inventory declines, and a reduction in global spare productive capacity.

Economist Jeff Rubin had the following comments on the recent forecasts for triple digit oil prices in the next year or two:

. . . the first thing you identify in an economic recovery, even the most anemic one, is that the economy starts burning more oil. The next thing is that oil prices start rising rapidly. Already they’re at more than double the levels of the last recession’s lows, and that’s with most major oil-consuming economies (including the world’s largest oil guzzler, the U.S.) still operating well below their pre-recession levels.

Movements in oil prices have never been linear in the past, and there’s no reason to expect them to be so in the future. The interaction between genuine market forces and financial speculation is a fact of life in virtually all commodity markets.

Ali Naimi, the oil minister of Saudi Arabia, late last month noted that a trading range for oil between $70 and $90 would be a ‘comfortable zone’ for producers and consumers, an increase from the $70 to $80 range he has mentioned repeatedly over the last two years. Saudi Arabia is the world’s largest producer and exporter of crude oil, so the comment was treated bullishly by investors.

Mergers & Acquisitions - The deal making continued in the energy sector last month, with Chesapeake Production selling an interest in their Texas Eagle Ford shale prospect to a Chinese energy firm for $2.2 billion. The Eagle Ford shale is a South Texas formation that has significant potential for both natural gas, natural gas liquids, and crude oil production. LSGI holding GeoResources recently acquired an interest in the Eagle Ford play, and Crimson Exploration also has drilling locations in the oil leg of the play. Consulting firm Tudor Pickering Holt refers to the Eagle Ford play as “hot”.

Due to the extreme undervaluation of natural gas exploration and production companies, LSGI portfolio holding Quicksilver Resources (KWK) received a letter from the Darden family regarding taking the company private. The Darden family has a large interest in the firm already. We invested in Quicksilver when it was a microcap at $1.41 a share on a split adjusted basis in September, 2000—it now sells for roughly $15 a share.

Separately natural gas producer Exco Resources CEO also offered to take the natural-gas producer private, valuing the Dallas company at $4.4 billion. The offer was at a 38% premium to the closing price last week. The company has operations in the Haynesville (Texas), Permian Basin (Texas) and Marcellus Shale (Pennsylvania), and illustrates how undervalued some of these firms have become.

The merger and acquisition activity is at levels that will assist in supporting stock prices of companies in the sector. For value investors opportunities exist for substantial capital gains in our opinion.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2010 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.